US Presidential Elections: Understanding The Impact on Your Finances

Reading Time: 7 minutes

Do US Presidential elections actually have an impact on investor behavior? Do markets do better in democratic or republican regimes? Do Congressional Election Outcomes affect market returns? Is there an ideal investment strategy during an election season? Should I go to cash during this Presidential election season?

With elections right around the corner, feeling skittish about how it could impact your wallet is to be expected. Potential heightened market volatility can make for sleepless nights. While it’s true that the US Presidential Elections can have meaningful impacts on policy, laws, and foreign relations – the last 90 years history can help us derive if the US Presidential election will have an impact on your investments.

While we don’t have a time machine to transport us to November 5th, we can evaluate how markets have done during a certain political party’s mandate and even if there is an ideal investment strategy during a US Presidential election season.

Top 5 Investment Impacts of US Presidential Elections

1. Do Elections Have an Impact on Investor Behavior?

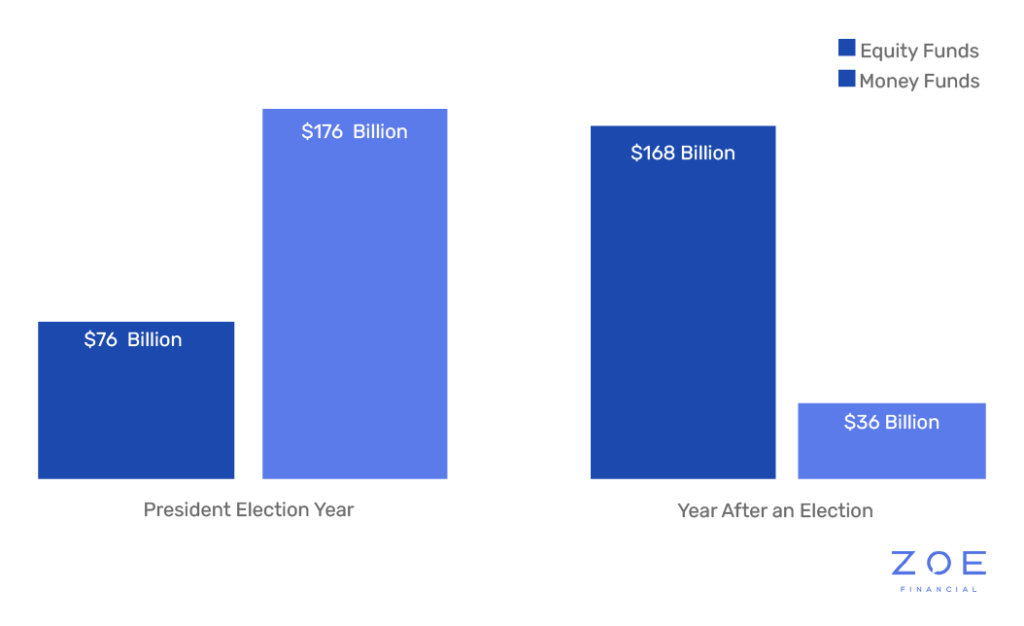

Feeling nervous during an election season? You are not alone. Studies show investors often become more conservative with their investments during election years. While this may be caused by the rampant increase in political commentary you’re seeing all over the place, one thing is evident: when people get nervous, money flowing into safe-heaven money markets increase.

Source: Morningstar. Includes mutual funds and ETFs.

Values based on USD. Equity funds include U.S. and international equity funds. 2020 data is year-to-date through 7/31/20.

As one of the lowest risk investments, investors may rely more heavily on money market funds to give them a sense of control during a time when most things feel out of their control. Morningstar’s chart reveals that, since 1992, investors have moved their assets into money market funds at a far higher rate in times leading up to an election. Equity funds, on the other hand, show the highest inflows during the year following a US Presidential Election. The desire to minimize risk is reasonable from a behavioral standpoint.

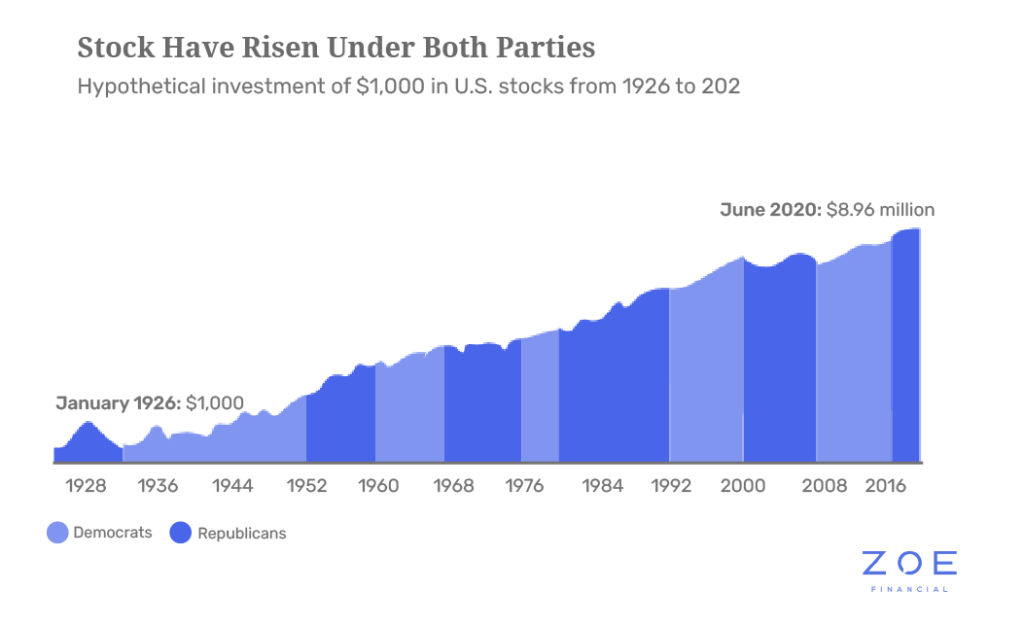

2. Do Markets Perform Better Under Democractic or Republican Leadership?

Often, investors ask: “In general, do markets perform better under democractic or republican leadership?”. Our own political opinions and biases often lead us to believe that there must be a definitive difference in how the stock market reacts based on a particular political party.

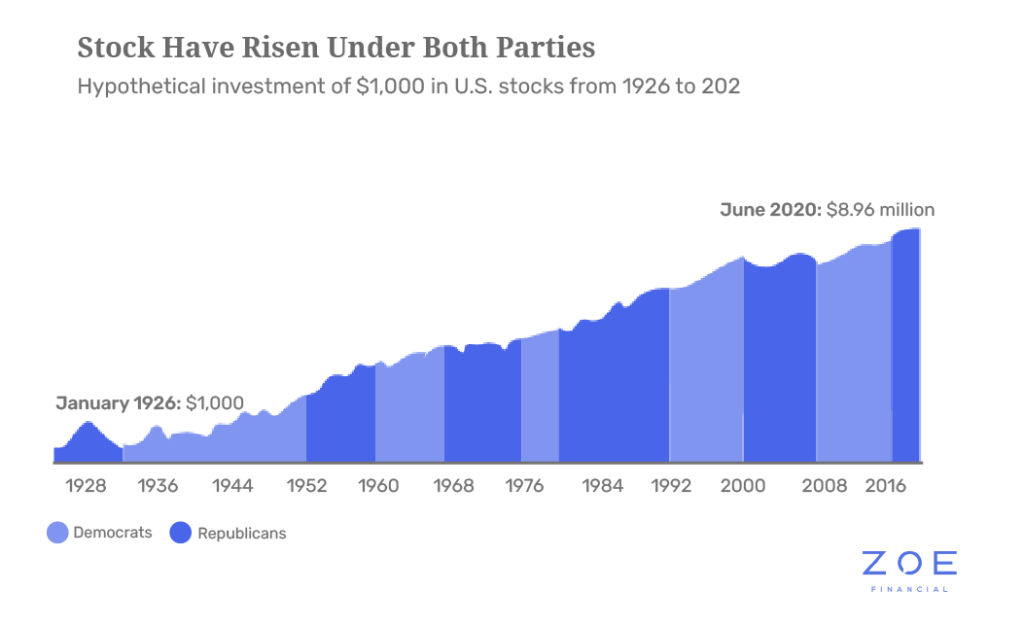

Source: Morningstar as of 6/30/20. Stock market represented by the S&P 500 Index from 1/1/70 to 6/30/20 and IA SBBI U.S. large cap stocks index from 1/1/26 to 1/1/70.

Past performance does not guarantee or indicate future results. Index performance is for illustrative purpose only. You cannot invest directly in the index.

It turns out there is no difference what party is in power. In fact, we may give Presidents a little too much credit. Democrat or Republican, over the long term, as the above chart shows, stocks have trended higher regardless of which party wins the US Presidential Election. After all, the market are driven by the private sector which accounts for more than 90% of the economy.

3. Do Congressional Election Outcomes Affect Market Returns?

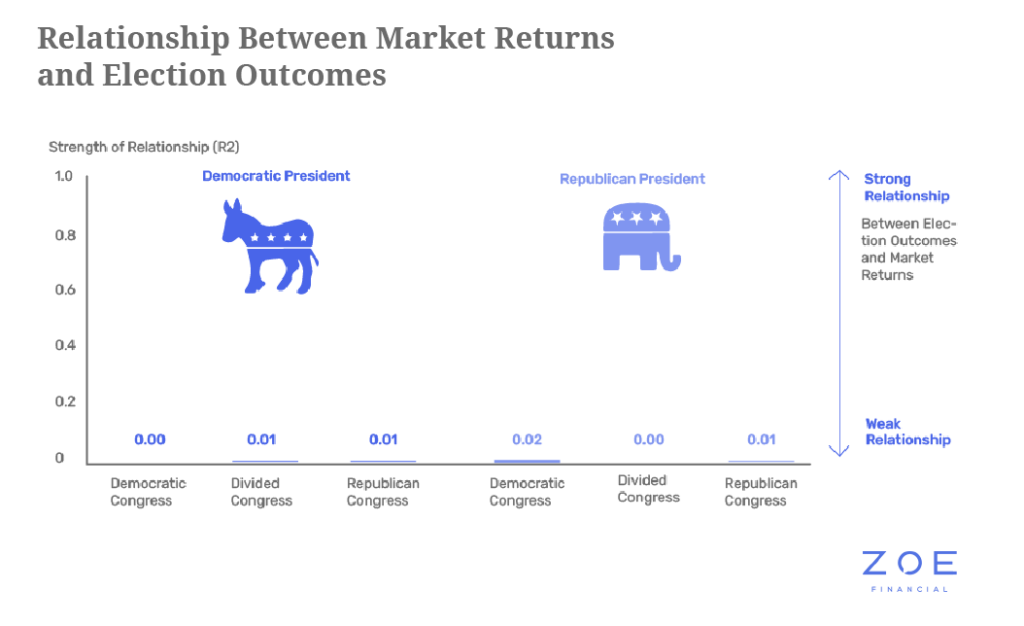

One of the biggest causes for concern for investors during this particular election cycle is the probability of a single party sweeping Congress. Yes, policy may change if there is a new political party running the Capitol building. However, there is no strong relationship between market returns and the political makeup of the US Congress.

Source: Bloomberg and GSAM.

Some say gridlock, or an equal split between parties, is best. However, the above chart shows it may depend on the structure of Congress. As indicated, the relationship between election outcomes and market returns is essentially zero.. Regardless of if President Trump is re-elected or Joe Biden wins, in the short term (3 to 6 years out) it turns out that there is no relationship in comparison to how the market will react.

4. Is There an Ideal Investment Strategy During an Election Season?

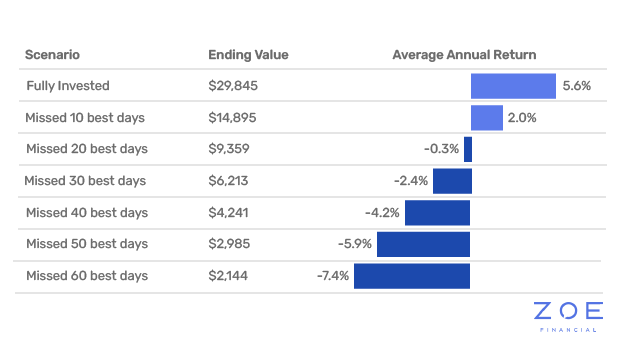

As we’ve written in the past, the best thing you can do with your investmentss, regardless of if it is an election year or not, is to stick to your plan and ride out uncertain events. JPMorgan Asset Management’s 2020 Retirement Guide shows that if you missed the top 10 days in the market from 2000-2019, your returns were cut by half.

The study also shows that six of the 10 best days in the market happened within two weeks of the 10 worst. Time in the market beats timing the market.

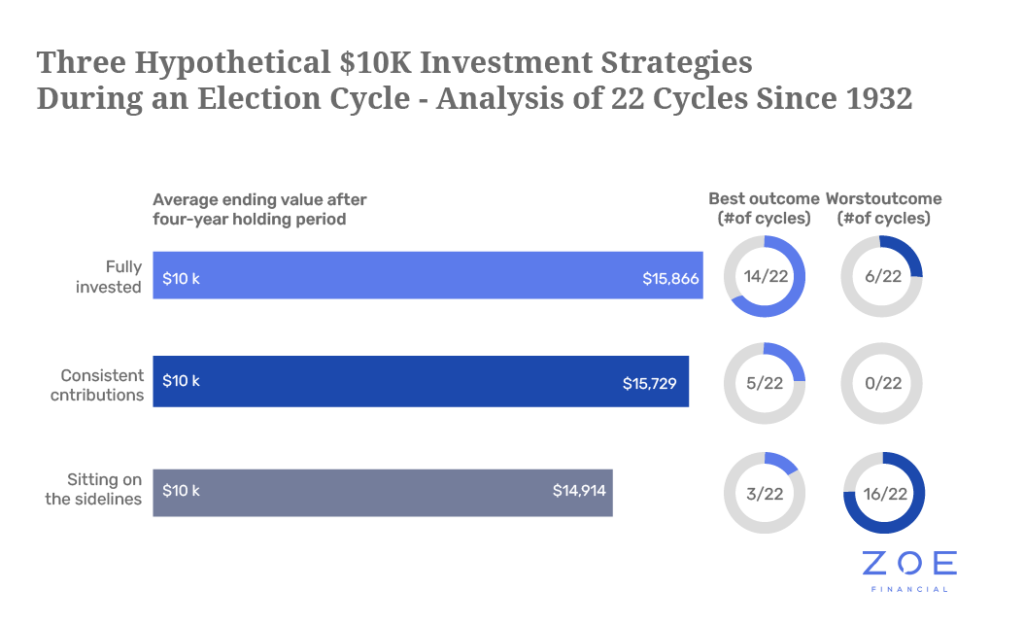

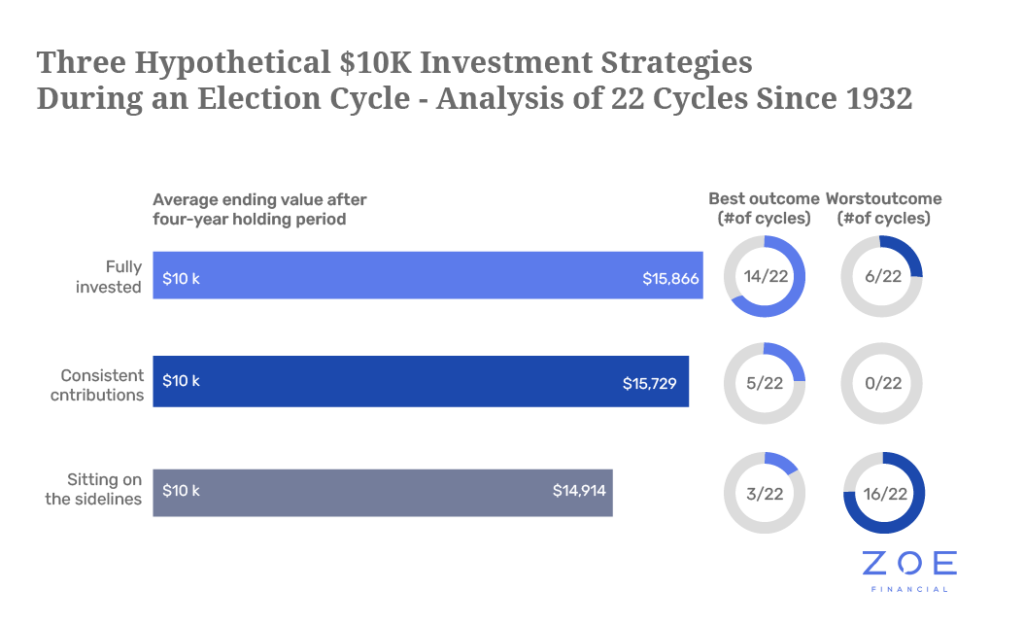

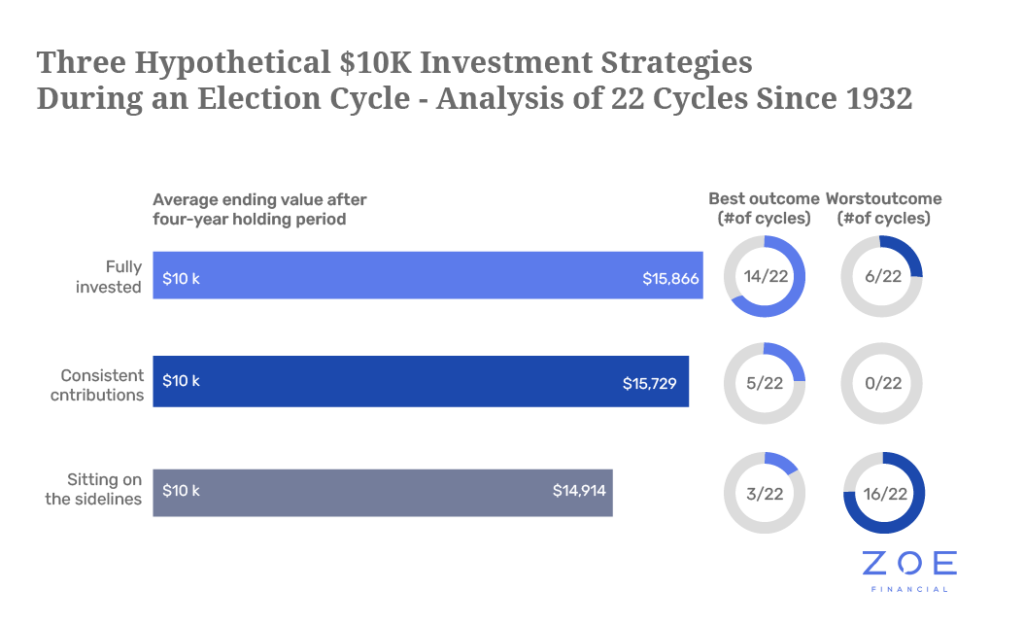

A similar study looked specifically at investment strategies during election cycles, and as per below chart, the findings are not much different.

Sources: Capital group

For those fully invested, the average ending value after a four-year holding period shows the highest return: $15,866. For those who made consistent contributions, the average ending value was $15,729. Unfortunately, those who missed out are those who opted for a “sitting on the sidelines” investment strategy.

Those who allowed election predictions to influence their investment decisions were disproportionately negatively affected by not sticking to a long-term investment strategy.

5. Should I Go to Cash During this Election Season?

No. Moving your investments to cash as a result of the US Presidential Election is an investment strategy that historically has not worked well

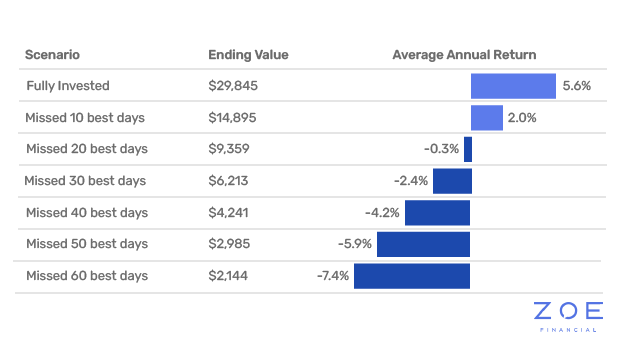

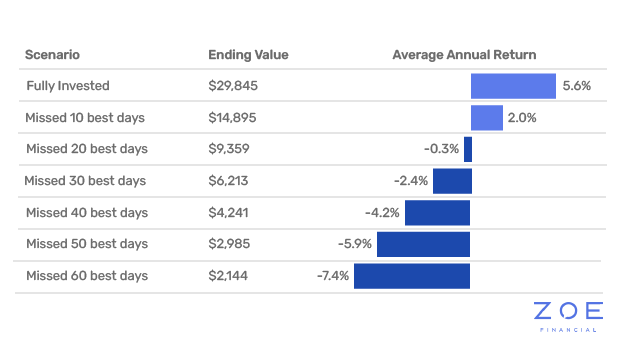

Source: JP Morgan

As evidenced in the above JP Morgan chart, getting out of the market to avoid a certain party or candidate in office could have severely detracted from an investor’s long-term returns.

How To: Weather Financial Uncertainty During the 2020 US Presidential Elections

Above all, there is no need to panic about how the US Presidential Elections could impact your investments and portfolio. Historical data shows the markets have historically risen regardless of the political party in office. An investment strategy that focuses on timing a potential electoral victor, on the other hand, could reap havoc on your investments. When you’re invested, you don’t have to make any decision; but when you sell, you now have to make two decisions. If you do “get out” at the right time, you must then figure out the best time to get back in — potentially leaving you without the benefits of having stayed invested in the first place!

Working with an interest-aligned wealth advisor to build your plan can help ensure a successful financial future for you and your family. Regardless of the election’s results, you will have someone to guide you through it and make sure your actionable investment decisions such as rebalancing and tax harvesting instead of predicting market movements.

While policy may shift, there is still plenty that you can control ahead of any potential political changes. Be it tax code or healthcare spending, don’t sit on the sidelines as an investor out of fear of how a policy change may affect you. For example, if you’re concerned about the tax situation, don’t wait until new policies are enacted. Instead, work with your wealth advisor to review and optimize your tax strategy. In terms of changes to health care, speak with a trusted advisor who understands health insurance options, such as HSAs, and plan accordingly. Above all, look to understand your options and create a game plan.

If there is one thing that’s been made clear by 2020, it is that anything could happen. While it may be tempting to wait it out in anticipation of November 3, you should still take a long-term approach to your financial goals. Don’t put your financial future in the hands of an unpredictable election.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners