Opening the Backdoor for a Roth

Opening the Backdoor for a Roth

We all know that backdoor Roth conversions can be a powerful technique for a client’s long-term retirement goals. Excellent advisors have the ability to articulate this benefit clearly, execute the required steps efficiently, and replicate this process consistently.

This process may sound easy in theory. But in reality, getting through the backdoor may be more challenging than clients realize. Here are some tips for approaching backdoor Roth conversions as an all-star advisor.

Locked Out Of The Front Door?

When they begin the withdrawal phase of life, most people have a mixture of pre-tax, tax-free, and taxable assets. As a wealth planner, you play a pivotal role in guiding clients toward the best withdrawal strategy. But first, you should start by educating them about the best savings strategy to build with.

While Roth IRAs have unique benefits compared to other accounts, they are subject to income limitations. If your client’s modified adjusted gross income (MAGI) is over $144,000 (single) or $214,000 (married filing jointly) in 2022, then they are not able to contribute to a Roth IRA directly.

If your client is over these limits, back door Roth conversions can be an excellent opportunity for you to add value as their advisor.

Try Picking The Lock On The Back Door…

To access a Roth IRA through the back door, people make nondeductible contributions to an IRA and then quickly move it to a Roth IRA. How quickly depends on how efficiently you can accomplish all the steps required.

However, while efficiency is critical, the key will always be to ensure your client feels comfortable going through the process. A best practice is to confirm that they know what is going on. You can use a checklist to help clients keep track of what has been done and what comes next:

⬜ Open a traditional IRA.

⬜ Put $6,000 into it (or $7,000 if you’re over 50).

⬜ Open a Roth IRA.

⬜ Transfer cash from the Traditional IRA to the Roth.

⬜ Invest the cash in the Roth IRA.

⬜ Do not forget to remind them to file Form 8606 with their tax return.

Unlocking this door will be the most beneficial for clients who:

- Can consistently contribute.

- Have a longer time frame.

- Have high taxable income, now and in the future.

- Expect tax rates to increase over time.

- Live in high-income-tax states.

- Aspire to leave a legacy.

Since the door relocks every year, backdoor Roth contributions become beneficial upon repetition. If clients have a positive experience the first time, they are more likely to do it again next year. As their wealth advisor, you can follow up once everything has been completed and set the expectations for the following year.

How To Know If The Back Door Is The Best Choice

If clients can’t handle all the steps or don’t understand the value of the strategy, there is no point in it. If you want to set them up for success, try showing them the importance of Roth Conversions visually.

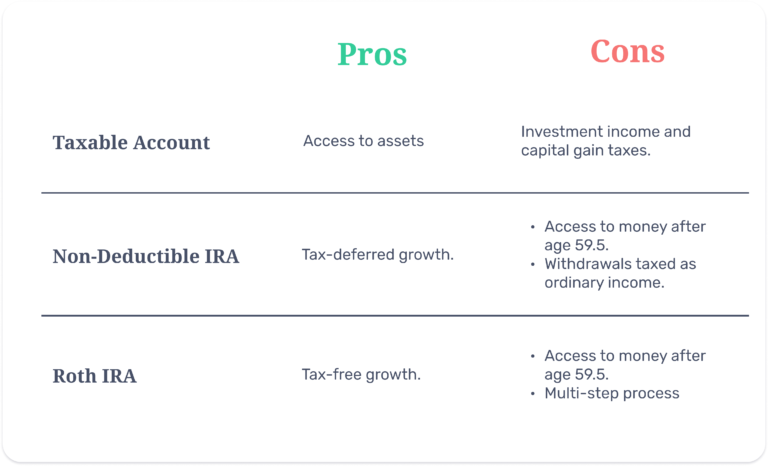

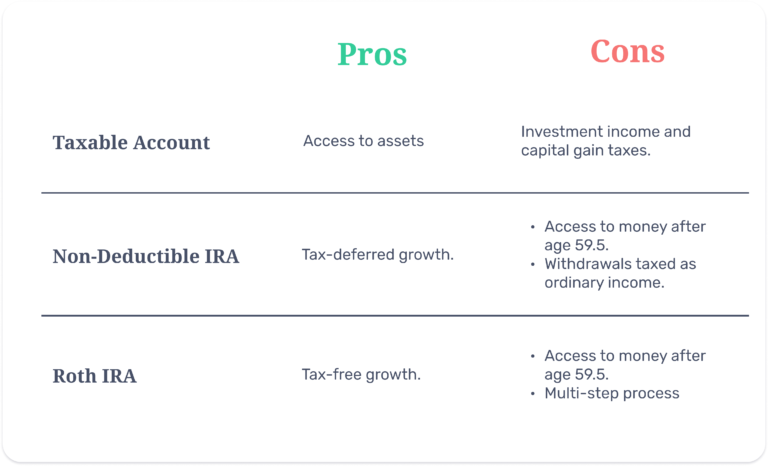

You can do this by comparing a nondeductible IRA vs. a taxable account vs. a Roth. First, discuss how the account grows. Then, show the yearly tax drag on a taxable account and compare it to the same investments in an IRA. Given that neither nondeductible IRAs nor Roth IRAs have immediate tax savings, illustrate the difference in the after-tax value of their assets. Finally, show them how the after-tax value for the nondeductible IRA is reduced by ordinary income while the taxable account is reduced by capital gains tax. Also, explain how the Roth remains at the same value.

If you illustrate this concept correctly, they will realize that a backdoor Roth conversion allows them to avoid ongoing investment taxes each year and taxes upon withdrawal.

Make Sure Not To Set Off Your Alarm System!

There are two (unfortunate) common pitfalls with backdoor Roth contributions. As a great wealth advisor, you must keep them in mind and know how to avoid them.

1. Existing IRA dollars

Ensure that your client does not have any other rollover or traditional IRA money, especially if these accounts are held outside of your firm. This instance would trigger the IRS’ Pro-Rata Rule, which determines the amount of conversion that is subject (or not) to taxes.

Suppose you attempt to convert after-tax traditional IRA contributions to a Roth IRA, but there are existing pre-tax dollars. In that case, your client will be subject to taxation on a prorated basis.

As a tip, keep in mind that inherited IRAs do not count as preexisting pre-tax assets.

2. IRA Gains Pre-Roth

If your client has any gains on the IRA that they convert, it is not a true tax-free conversion. This could happen either because they did not convert the assets fast enough and they earned interest or because they invested the assets before the transfer.

A best practice is to leave the assets uninvested in the Traditional IRA and convert them once the contribution settles.

Open the Door

Once you identify which of your clients is the right fit, backdoor Roth IRAs allow you to add tremendous value and help your clients invest tax-free.

However, the key to making Roth IRAs a powerful way to grow wealth is consistency. That said, make sure to guide your clients through the process clearly and keep them accountable each year following.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.