The Tell-All Series: Do I Need a Wealth Advisor?

Reading Time: 6 minutes

Hiring a wealth advisor is an important life decision. But the first question that may arise is whether or not you fit the description of someone who needs a wealth advisor.

Zoe outlined several profiles, each with different wealth situations and needs. These examples are not meant to be recommendations or to cover every scenario under the sun, but rather to serve as a starting point on your journey of financial awareness.

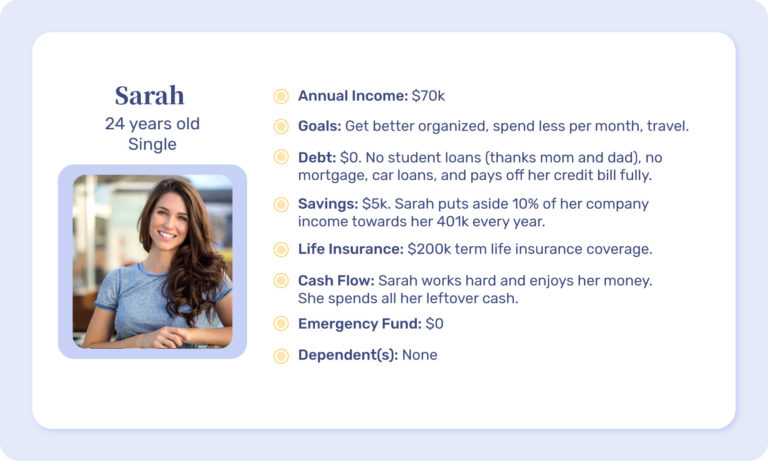

Does Sarah need a wealth advisor? Probably not.

Sarah is young, has no debt, no dependents or partners and she is saving every month. Instead of spending the $1,000 she might spend on an advisor, she should contribute this amount directly towards building an emergency fund. To prepare for the future, she could read our guides to educate herself as her life stage starts to change.

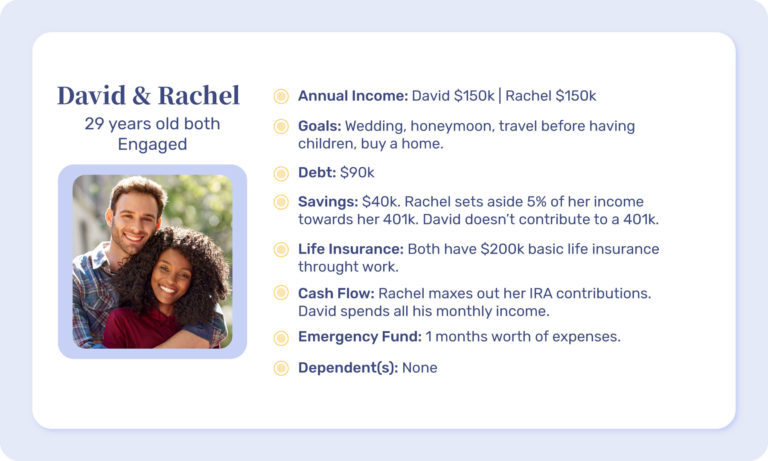

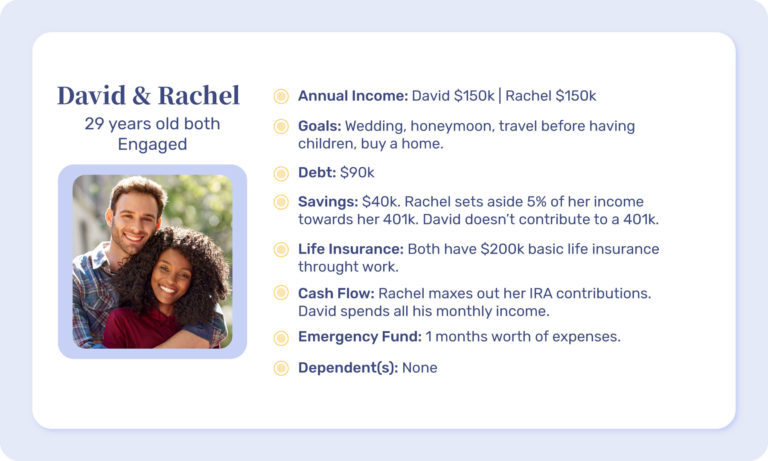

Do David and Rachel need a wealth advisor? Probably…

After they marry, their individual wealth merges, and considering the number one cause of stress in relationships is money, a great wealth advisor can help set some good financial habits as a couple from the start.

At this stage, there is probably no need to hire an advisor that manages their investments, as most of their savings are in their current 401k plans. Hiring an advisor on a retainer is probably best in their case since their investable assets are below $50,000.

The advisor’s expertise should include holistic wealth planning for young couples, consolidation of student loan debt, and counsel on short-term goals such as buying a house and building a more robust emergency fund.

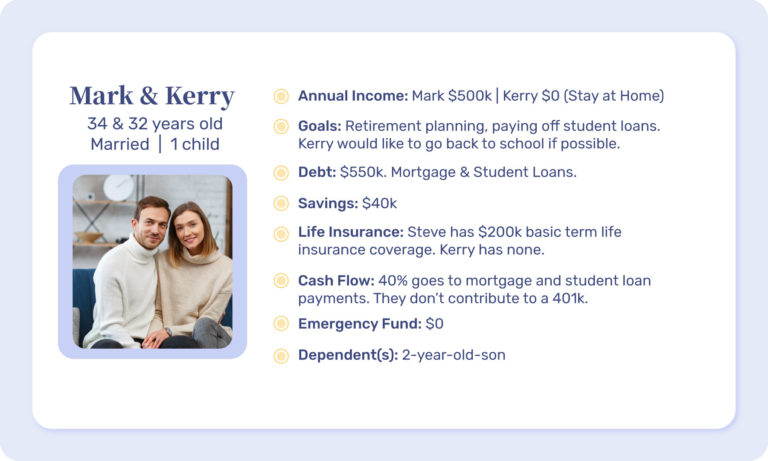

Do Mark and Kerry need a wealth advisor? Yes, they could definitely use one!

Mark and Kerry could use a great advisor that can help them with their budgeting and debt consolidation. They are in dire need of saving towards an emergency fund before they even get started on student loan repayments or retirement planning. Considering that they have a young child, the advisor can also help them find the appropriate coverage of their term life insurance.

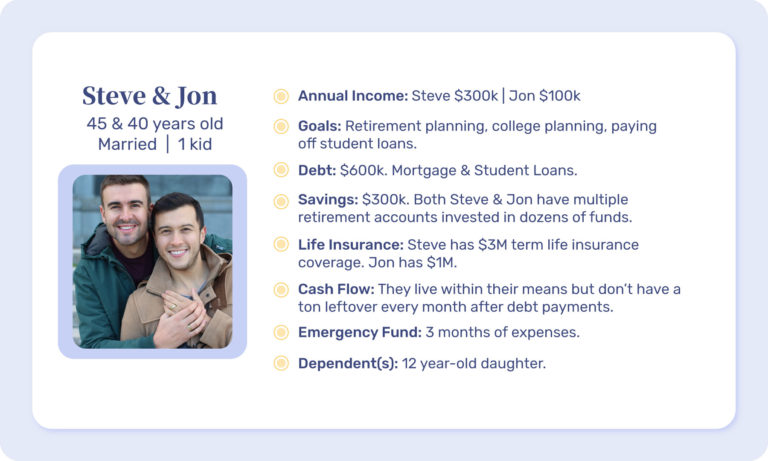

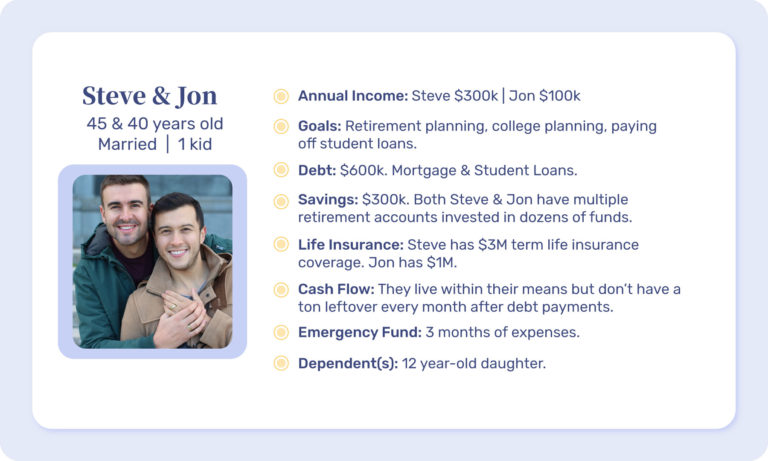

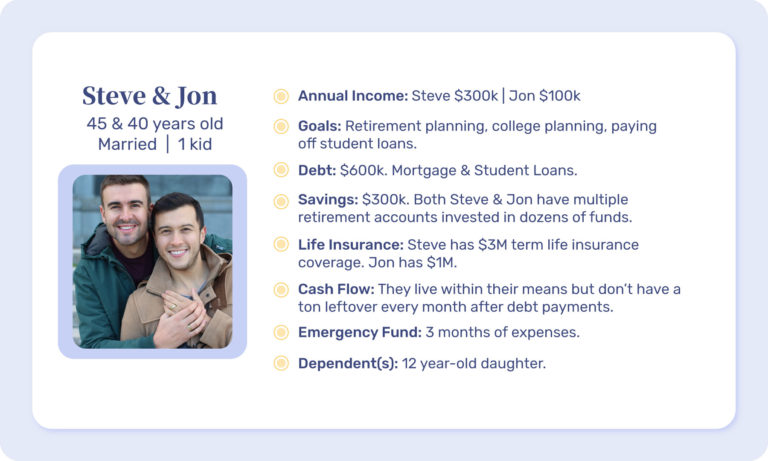

Do Steve and Jon need a wealth advisor? Yes, for investment advice

Steve and Jon have their monthly expenses well under control, but they could use a wealth advisor that has strong experience in retirement planning and investments. A great advisor can improve their haphazard portfolio by incorporating their personal risk tolerance and goals to construct a portfolio with realistic return expectations. He or she can also examine the investment fees and investment taxes that they are currently paying to ensure they are being cost and tax-efficient. Lastly, a great advisor can educate Steve & Jon on the importance of setting up a Power of Attorney and a Will and can connect them with the right Estate Advisor to do so.

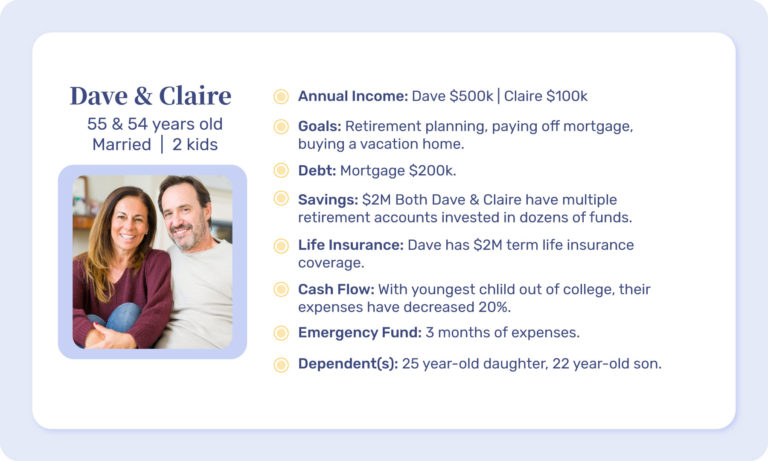

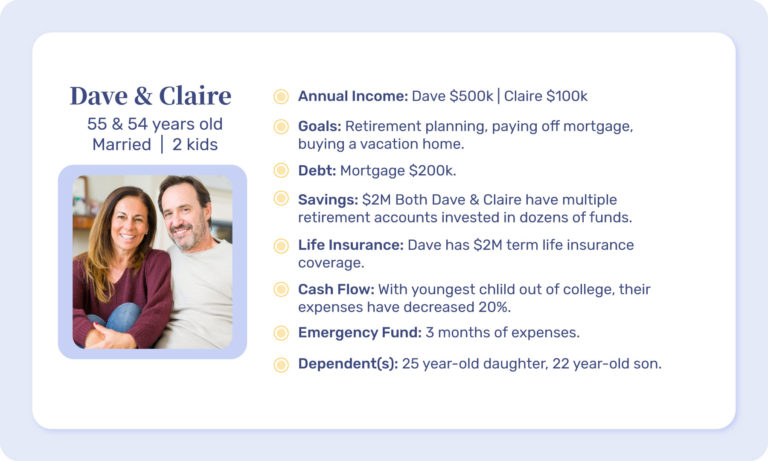

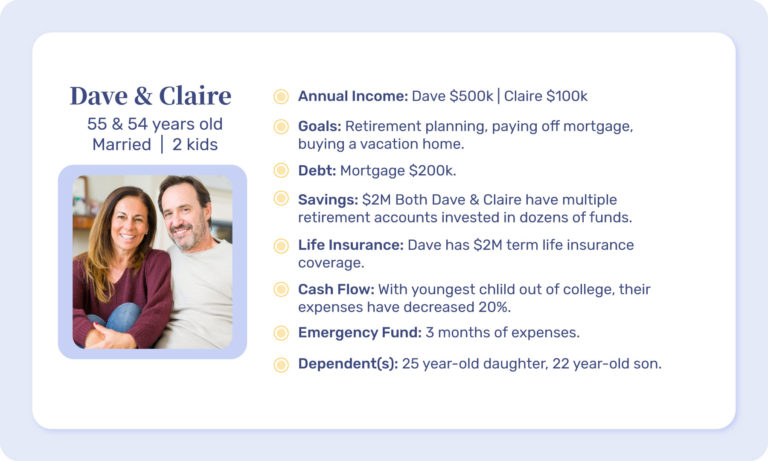

Do Dave and Claire need a Wealth Advisor? Yes!

Dave and Claire should look for an advisor that has strong experience in retirement planning and investments. A great advisor can help them take a more strategic approach to their investment portfolio by analyzing their risk tolerance and adjusting the risk/return profile of their portfolio. He or she can help them set realistic expectations of the income they will receive when they retire in 10-12 years. The advisor can also educate them on the importance of, and the steps involved in, setting up a proper estate plan.

How To Know When You Need Wealth Advice

Perhaps you can relate to one of our profiles, perhaps not. The point, however, is that no matter what life stage you are in, you can always use some help to improve your situation. But that does not mean that everyone should hire a wealth advisor!

When your wealth is more valuable than your time, which tends to be when you are younger and have less income, it might make more sense to educate yourself on how to develop good saving habits, rather than doling out money to hire an expert. As your income rises and your life becomes more complicated (in a good way) with marriage, children, homeownership, etc., time becomes a scarce resource and it might make more sense to outsource the task of the household CFO by hiring someone to help you.

If you enjoyed this post, check out How To Interview a Financial Advisor.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners