How to Withdraw Retirement Funds: A Tailored Guide

Reading Time: 5 minutes

Discover how to establish a realistic retirement income with the proper frameworks. A solid plan will not only help you understand how to withdraw retirement funds, it will also save you from worrying about your finances during your golden years.

How To Withdraw Retirement Funds

What are the strategies available to withdraw retirement funds? Start by thinking about the different retirement withdrawal strategies and which one is best for you. You might have already looked at reducing your portfolio volatility as you near retirement. But it is important to reassess your risk tolerance as withdrawals begin, too. You don’t want your plans to change suddenly because of how the market is behaving when you retire. The following are some of the most common frameworks retirees use when looking to understand retirement income strategies: the bucket system, target risk portfolios, and target date funds.

Where do you envision spending your golden years? Depending on your stage of retirement planning, you may be dreaming about daily walks on the sand or finally living in your favorite city. For many Americans, retiring overseas remains an attainable goal. In fact, there are currently around 700,000 American retirees abroad, according to data from the Social Security Administration (SSA).

Living abroad can be appealing to those who don’t believe their retirement funds will be enough to live comfortably in the US. Lower costs of living and better weather have led more soon-to-be retirees to consider retiring abroad. That said, Social Security is for many an important source of retirement income that may not always be accessible if retiring abroad. Americans that retire abroad can only receive social security benefits if they are determined to be eligible.

Withdraw Retirement Funds: Income Strategies

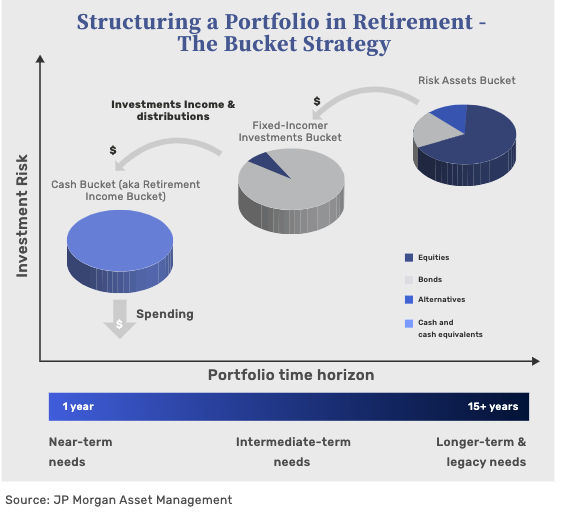

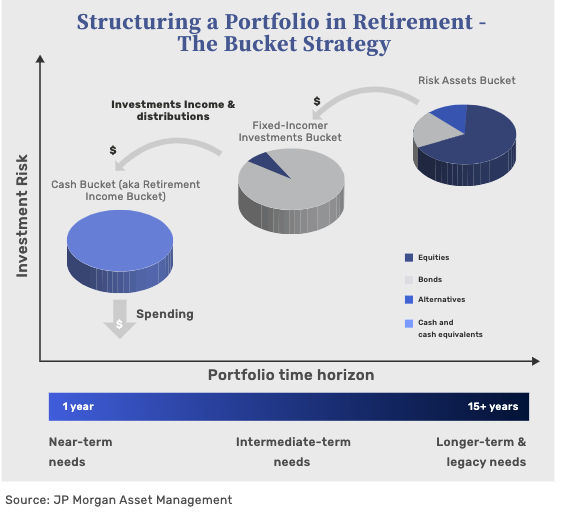

1. The Bucket System Framework

Do you understand how to withdraw retirement funds? This strategy separates your investments into “buckets.” You should start by setting up the cash or direct retirement income bucket. This is where you allocate funds for immediate use and where you withdraw from. These will most likely be for living expenses for the next year or two, as well as an emergency fund. Because it offers on-hand cash, it doesn’t have expected returns.

Once you’ve made sure you have the funds to meet these expenses, you fill the other two buckets. The next one should be a fixed-income investments bucket. These should be around 90% bonds, such as corporate and municipal bonds, and 10 percent equities. This bucket is for the money you’ll need in the next 10 years, so you don’t want it to be as risky. Even if it doesn’t grow much, you can be calm knowing you will have a certain income during this time.

The last one should be a risk assets bucket that allocates the rest of your long-term savings for riskier growth-focused investments. These are assets you won’t need for a while so you can afford to be risky with them. In case the market isn’t favorable, your portfolio has the time to recover. Riskier investments include stocks and real estate.

Depending on your specific needs and the current market conditions, you can rebalance the risk assets and the fixed-income buckets. This is done by increasing or decreasing how much you allocate to each bucket, via a risk tolerance assessment. Be aware that moving money from bucket to bucket can trigger tax bills. The advantage is that you have cash on hand and don’t need to tap into other accounts in case of an emergency

2. Target Risk Portfolios Framework

A target risk portfolio works as one holistic personalized portfolio so you don’t have to separate your funds. Target risk portfolios incorporate your risk tolerance and capacity when investing your funds. That means that a target risk portfolio will require constant monitoring of your risk tolerance and investments. They will inherently change over time as you look for safer investments the closer you get to retirement.

3. Target Date Funds Framework

For many retirees, target date funds are a great option as they put your investments on “autopilot”. Target date funds invest and build your portfolio in a single retirement fund. As your target retirement date approaches, the portfolio starts to reduce risk. The catch is, target date funds are not all created equally.

They have different associated fees, a variety of risk allocations, and they don’t take into account any other assets you might have outside the fund. Check the fees before you decide on a certain fund. Fidelity’s 2040 Target Date Fund charges 0. 75% while Vanguard’s charges 0.14% yearly, although they both have a similar return profile. They’re particularly time-sensitive, so your choice of fund will affect your returns and how easy it will be for you.

You should also be aware of the different risk allocations available to you. The mix of bonds, stocks, and cash varies throughout. The composition of your target date fund can differ by the provider, despite having the same target date of retirement. The following table looks at the percentage of stocks that are in each of these Target Date Funds by the time you hit 65.

Withdrawal Principles

You will also benefit from understanding how much and from which accounts you can withdraw so you aren’t worrying about outliving your money. Just like choosing a framework, it is about something that works for you, not against you. You might choose to follow the 4 percent rule, or go for dynamic withdrawals, which give you room for adjustment. Keep in mind, not all accounts work the same. You might have to make some changes to maximize the benefit from your required minimum distributions (RMDs), social security, and pensions.

The 4% Rule of Thumb

The 4% retirement withdrawal rule calls for you to restrict your withdrawals to no more than 4% of your portfolio any given year.

safe if you hope to keep a steady income throughout retirement and the same expenses. So if you have $600,000 in savings, you would not withdraw more than $24,000 per year. It is not a one-size-fits-all solution, though.

It isn’t guiding you in efficiently using your money to support your lifestyle. It may seem like a standard, but it’s only there as a guideline. Having a strong retiring withdrawal strategy alongside a retirement income plan will guide you far better than a rule of thumb. Because it will work with you in maximizing your income to your specific situation.

Withdrawal Sequence Principles: Not All Accounts are Created Equal

This means that withdrawing from your accounts will depend on the type of account. We recommend following the withdrawal sequence principle, which is intended to align with your Required Minimum Distributions (RMDs). This sequence applies to most accounts and is there for you to reap the benefits.

Start by withdrawing from taxable accounts, such as brokerage accounts. You tap into these first so you can pay the capital gains upfront. Then, you withdraw from traditional retirement accounts, such as IRAs and 401ks. Your assets will enjoy compounding without paying dividends or income tax.

Your last withdrawals should be from Roth IRAs/401ks. You want your funds to grow as much as possible for as long as possible since you paid taxes on them upfront. For qualified medical expenses, you can tap into your Health Savings Accounts (HSAs). You want to have one of these, bearing in mind the considerable cost of healthcare in retirement.

Required Minimum Distributions (RMDs) Strategy

RMDs are the minimum amounts you must withdraw annually, starting the year you turn 72. They can trigger unwanted taxes or capital gains. Even if you don’t need the money, you are required by law to withdraw it from these accounts. You can bypass income tax on your required withdrawal by donating directly to a qualifying charity if you can do without those funds.

If you have a Roth 401k, you will be subject to taxes when withdrawing your RMDs. However, move your assets to a Roth IRA and you will no longer have to complete an RMD. Similarly, you might be able to take advantage of a “Backdoor Roth” if you are in the early stages of retirement. You can rollover from an IRA into a Roth IRA. Even though you will be taxed on the transfer, your investments will grow tax-free.

Social Security and Pensions

As of 2020, nearly 90 percent of Americans over 65 receive Social Security benefits. And for 50 percent, these are half of their income. Pension plans, established in 1935 as a method of providing retirement income, are the retirement plan retirees in the US rely on. Social security and pensions are the base money retirees can expect as an income that is not withdrawn from investments.

You are eligible for Social Security benefits as soon as you turn a certain age, between 62 and 67. The exact age, known as your full retirement age, will depend on the year you were born. Your eligibility depends on the number of years you work, and the amounts you receive depend on when you start cashing in. Keep in mind that with Medicare, the earlier you apply, the lower the cost.

You can dip into your benefits before reaching full retirement age, but your overall benefit amount will be reduced. On the other hand, you can increase your monthly amount if you delay them. This will make you eligible for delayed retirement credits that will stop once you turn 70. Whatever you decide, it will depend on your situation. Make sure to have a framework and strategy in place that factors in your benefits.

Enjoy and Preserve in Retirement

Retirement is the point in your life when you don’t have to work for an income. For most people, that coincides with reaching a senior age. Whatever your age, your retirement years are known as the golden years. You get to make the most of all your hard work and spend them how you want. A thoughtful strategy with the right income framework is the perfect recipe for a stress-free retirement. Understanding how to withdraw retirement funds is step one. If you aren’t sure about what is best for you, a financial advisor can guide you in the right direction.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners