Stock or Bonds? What is the best way to invest?

Reading Time: 8 minutes

Investing is about what’s best for you and your future goals, so digging into how each can reap financial growth is paramount.

Trying to decide the best way to invest? Often, investors are stuck debating between stocks versus bonds. Before you invest in a stock or a bond, you’ll want to understand the basics of each. Above all, investing is about what’s best for you and your future goals, so digging into how each can reap financial growth is paramount.

Why Invest In Stocks Or Bonds?

Stocks and bonds are the most popular financial assets. As an investor, you could purchase stock, meaning you hand over cash for a share in the company. Or, you could purchase a bond, thus you loan them cash, receive interest for a certain period of time, and are then repaid. Almost every financial plan includes some kind of investment in one or the other, or both. The three main reasons for their popularity is their liquidity, tax, and diversification benefits.

Liquidity Benefits Of Stocks And Bonds

Say you own an investment real estate property that you want to sell. It could take an indefinite amount of time before you see that money in your bank account. On the other hand, if you wanted to sell a bond or a stock, the money from your sale would be in your bank account within three days. The liquidity benefits of stocks and bonds are a key reason investors choose these as an essential part of their investment portfolio.

Tax Benefits Of Stocks And Bonds

Stocks and bonds also have tax benefits. You can invest in them through retirement accounts, such as an employer-sponsored 401(k), 403(b), or an Independent Retirement Account (IRA).

Diversification Benefits Of Stocks And Bonds

Lastly, there are diversification benefits. If you have $500k in savings and you invest in an investment property, you literally have all your eggs in one basket.

If the investment doesn’t pan out, all your savings suffer. On the other hand, if you invest that $500k into an index ETF (that mirrors the 500 largest public companies in the United States), you will smooth out individual company risk as you gain exposure to the whole market.

What Are Stocks?

When you own a stock, you own a piece of the company. This is also referred to as a share in the company or equity.

How Do I Make Money By Buying A Stock?

- Stocks offer dividends meaning regular or varying payouts to shareholders.

- If the stock price increases above what you paid, you could sell your stock and make a profit.

Each offers you the chance (never guaranteed) of growing your initial investment. But, stocks come with significant risks as well.

Top 2 Risks of Investing in Stock

- Stock prices can swing around wildly, as their entire value is based on the potential profits of the company, which are often difficult to predict. So, just as stock prices can go up, they can come down.

- If the company goes bankrupt, shareholders are last in line to get whatever is left of the company (debt is paid first).

Stocks are shares in a company that offer the investor a number of possible return opportunities, but they also carry a high level of risk.

How Do You Know Which Stock to Invest In?

Stocks vary from shares in new small-capitalization companies to those in big, well-established, large-capitalization companies, like Apple or Microsoft. While most stocks have this structure, the financial information that goes into the stock price is broad and complex. That’s why individual stock investing requires significant research and due diligence.

In fact, it is so difficult to be a great “stock picker” that nearly no one is able to beat the market consistently. As a result, it is often easier and more cost-effective to invest through low-cost Exchange Traded Funds (ETFs) or index mutual funds. These vehicles contain several different stocks, often across many sectors (and sometimes countries), and thus, you end up “owning” the market itself.

What are Bonds?

Bonds, in contrast, are debts that a company or a government has taken out. When you buy a bond, you’re essentially lending the company money in return for regular interest payments.

To simplify things, let’s get the terminology out of the way:

- Principal: original loan amount

- i.e. the value of your investment.

- Maturity date: the date on which the principal is repaid.

- Coupon: the interest that you receive as an investor.

How Do I Make Money By Buying a Bond?

- Interest income: regular coupon payouts to bondholders.

- Capital gains: if the bond price increases above what you paid, you could sell your bond and make a profit.

Example: If you invest $1000 in a bond that “matures” in 10-years, that pays you 5% interest, you will receive a $50 coupon every year (usually divided into four quarterly payments of $12.50) and after 10-years you’ll receive your original $1000 back. In this case, your return is in the form of interest income. But, if after 5 years interest rates fall and your bond is priced at $1,100, you may decide to sell it to lock in the $100 gain. You would have earned less interest income but you would also have gained value (capital gain).

While no bond is completely safe, their prices are generally more stable than stocks. Since the coupon you receive is agreed upon at the outset, there are no surprises (whereas with stocks the price can fluctuate daily). If the company goes bankrupt, bonds and other debts are the first to be paid from the company’s remaining assets.

What is the Best Bond to Invest In?

All bonds have a credit rating, which is a formal evaluation of how likely the company is to pay back the bond. Normally, as with all investments, the better the credit rating, the lower the coupon (interest rate) as the investment is less risky.

In contrast to a traditional loan, the company does not need to and usually cannot pay back any of the original bond principal until the maturity date. Because of this, bond trading is generally less “liquid” than stock trading. It could be more difficult to sell a bond or get your money back before the maturity date, whereas a stock you can sell at any time.

Either way, we don’t recommend you sit there and read through a menu of bonds to purchase. The more liquid and economical way to invest in bonds is through a well-diversified, low-cost mutual fund, or ETFs.

Bonds versus Stocks: Which is Best for Me?

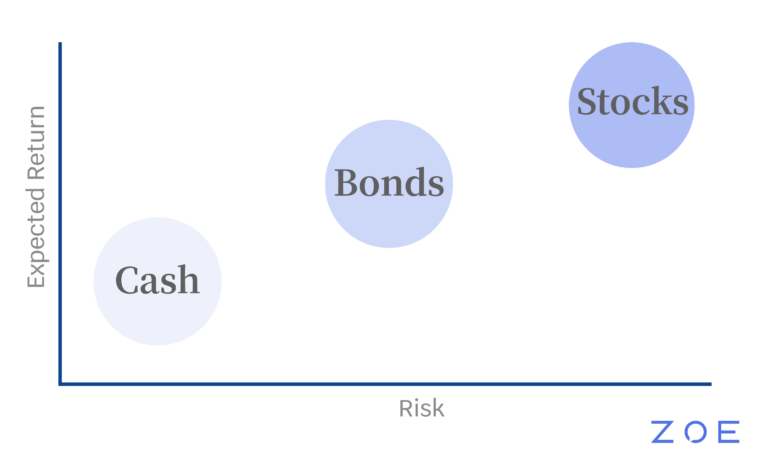

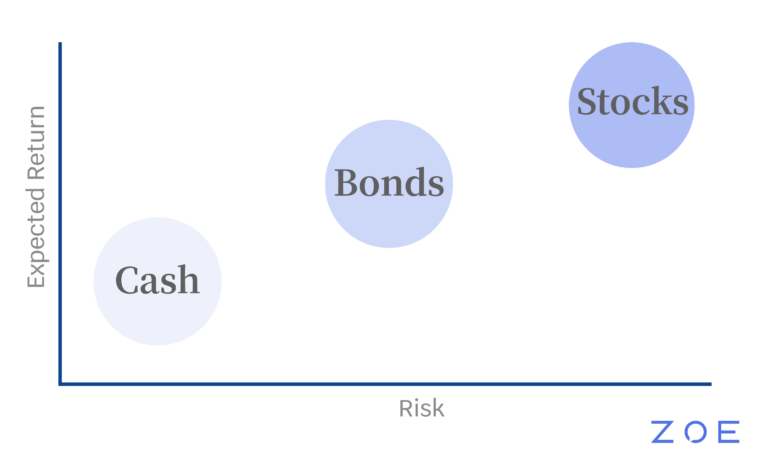

Investing in stocks, whether individually in each stock or through investment vehicles like mutual funds and ETFs, is inherently riskier than bonds. On the other hand, because of the higher risk, you’re also expected to receive a higher return than if you were to own a bond. Naturally, this depends on the market’s volatility.

The chart below represents an oversimplification of risk and return for bonds and stocks. Naturally, there are cases where a bond can be riskier than stock or have a higher expected return, but generally speaking the more risk you take, the higher your expected return. Cash is included as it is an investable asset that happens to have the lowest risk and often the lowest expected return.

The Best Investment Strategy: One Unique to Your Financial Situation

As a young person with an IRA or 401k or a parent creating a college savings plan, you have a longer investment horizon, so you may be more willing to take on risk and buy stocks.

Stocks can go up and down wildly, but a balanced and diversified stock investment strategy has a strong chance of providing greater returns than bonds over an extended timeframe.

In contrast, if you’re about to retire or currently retired, you may not want the risk associated with stocks when you are going to be relying on your investment funds very soon. In this case, bonds may be more useful as they will generate returns that are both more consistent and more reliable than stocks. There are also certain tax benefits associated with bond income; you can learn more about them in our holistic guide to retirement, The Road to Retirement.

Having said that, you can always mix both stocks and bonds in your investment portfolio. The decision to do so depends on your investment horizon, risk tolerance, and financial goals. A great starting point is to know where you stand today. A fiduciary financial advisor or financial planner help you clarify if stocks or bonds, or both are best for you.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners