What Active Investing Should Really Mean For Your Portfolio

What Active Investing Should Really Mean For Your Portfolio

Most investors consider “active” investing to be stock picking with the goal to outperform the broader market. But in reality, an active investing framework can provide a rigorous, objective, and holistic approach to investing.

61% of Americans invest in order to achieve their goals. Be it retirement, travel, starting a business, supporting others, or simply earning higher returns – the ultimate goal of investing is to make more money or preserve the value of your money. Nevertheless, achieving that goal is where it gets a little tricky.

Active and passive investing are two investing strategies. They have different goals and lead to different outcomes, and it’s important to understand which one fits your unique needs and makes your money work in the markets.

What Does Active Actually Mean?

Differences Between Active and Passive Investing

Most investors consider “active” investing to be stock picking with the goal to outperform the broader market (i.e. S&P 500 Index). The investor (or the financial advisor on behalf of the investor) buys or sells individual stocks based on specific factors, hoping to pick more winners than losers.

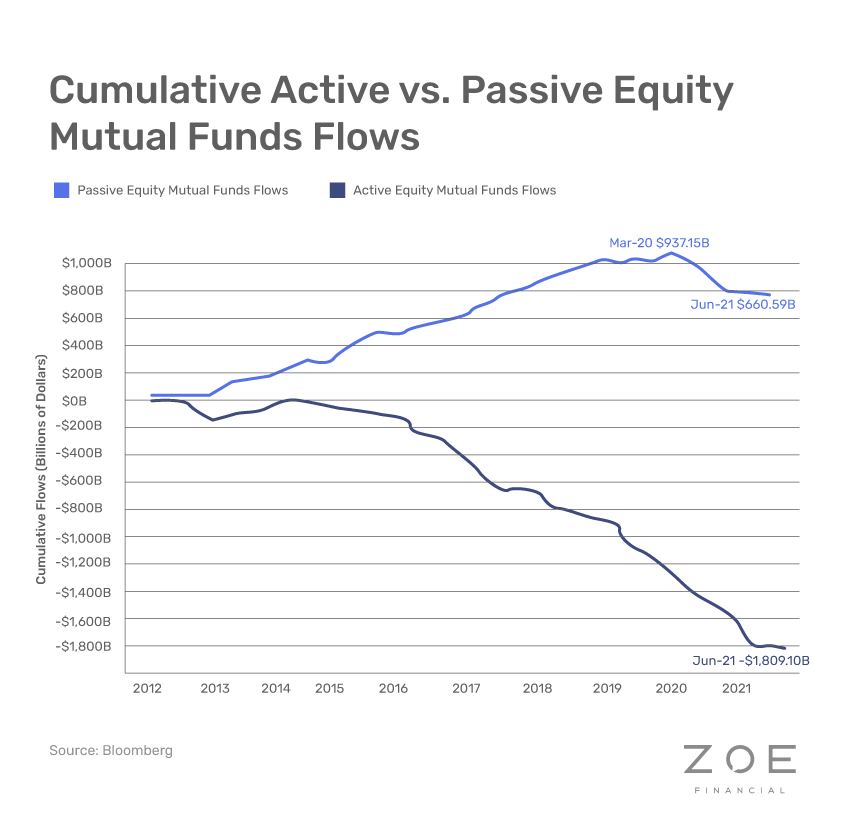

“Passive” investing has a buy-and-hold approach with the goals of generating long-term market returns. With passive investing, you buy investments in a benchmark index with the goal of accepting benchmark returns while reducing trading expenses and improving tax efficiencies. The trend over the last decade is investors buying passive mutual funds and ETFs while selling active strategies.

Historically, there is a lot of debate on the “active” vs. “passive” investing topic and whether there’s an actual value-add to pursuing active investing.

Consistent with the advisors in our network, we believe that it’s time to shift the conversation from an “active” style of investing to a long-term, disciplined wealth creation strategy.

Before we dig deeper and evaluate whether or not your portfolio is active (and what that actually means), it’s crucial to first point out that the way people invest has changed over time. Let’s take a tour through the evolution of investing to better understand how we ended up in today’s investing landscape.

Times Have Changed

Prior to World War II, individual investors mostly owned individual stocks.

In the 1950s, mutual funds started to gain traction as they brought down the cost of ownership and thus democratized investing to a broader set of investors. Mutual funds had their biggest inflection point though after the introduction of the 401k through the Employee Retirement Income Security Act (ERISA) in 1974. The bull market of the 1980s and 1990s further contributed to the adoption of mutual funds (both index and active funds).

Exchange-Traded Funds (ETFs) were introduced in the 1990s and provided an improved way of investing. They tracked indexes at a lower cost and a more tax-efficient way while trading on stock exchanges as regular stocks do!

Not only did ETFs provide broader access to domestic stocks, but they also provided access to international stocks, commodities, and currencies that were previously not easily accessible to individuals. According to a report from the Investment Company Institute, after the ‘08 Global Financial Crisis, ETFs gained further adoption and grew from $531B to approximately $5.45T from 2008 to 2020.

With the backdrop of commission-free stock trading, a new way of owning stocks has emerged: Direct Indexing. Direct Indexing allows for truly personalized and customized portfolios without having to “pool” different people’s money. In other words, it is the equivalent of building your own unique ETF.

The evolution of investment vehicles has also transformed the role of the financial advisor.

Understanding Wealth Creation Today

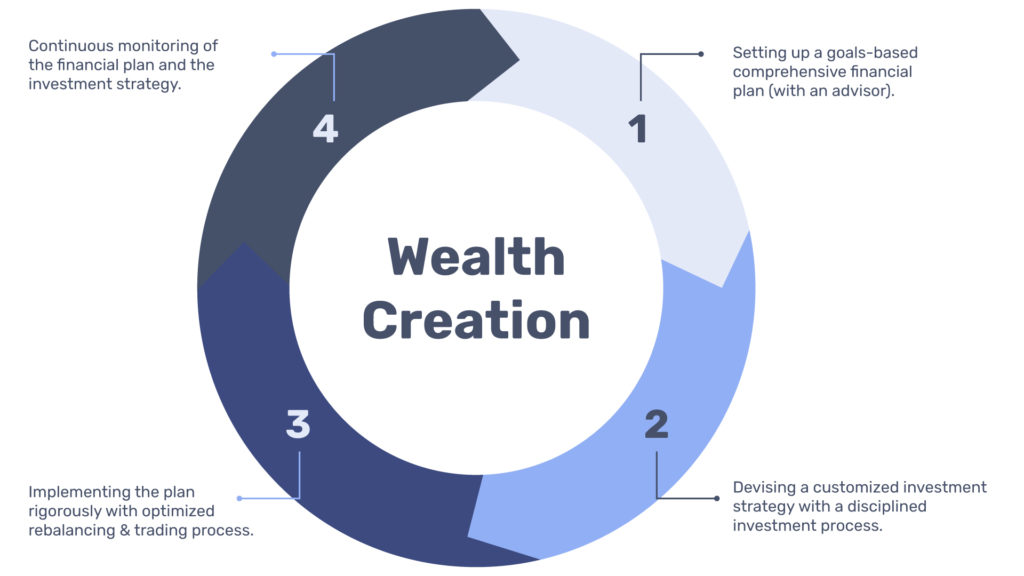

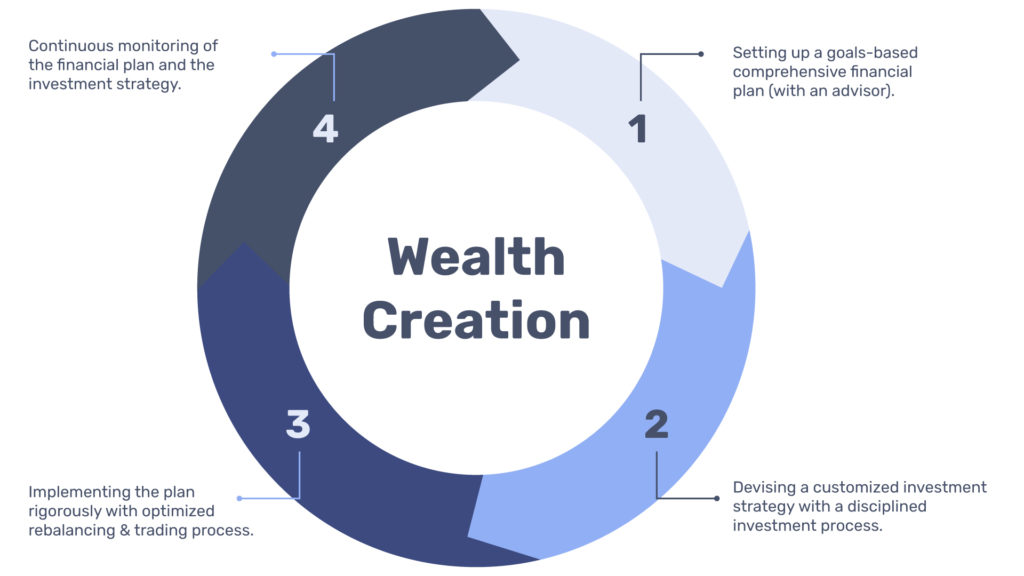

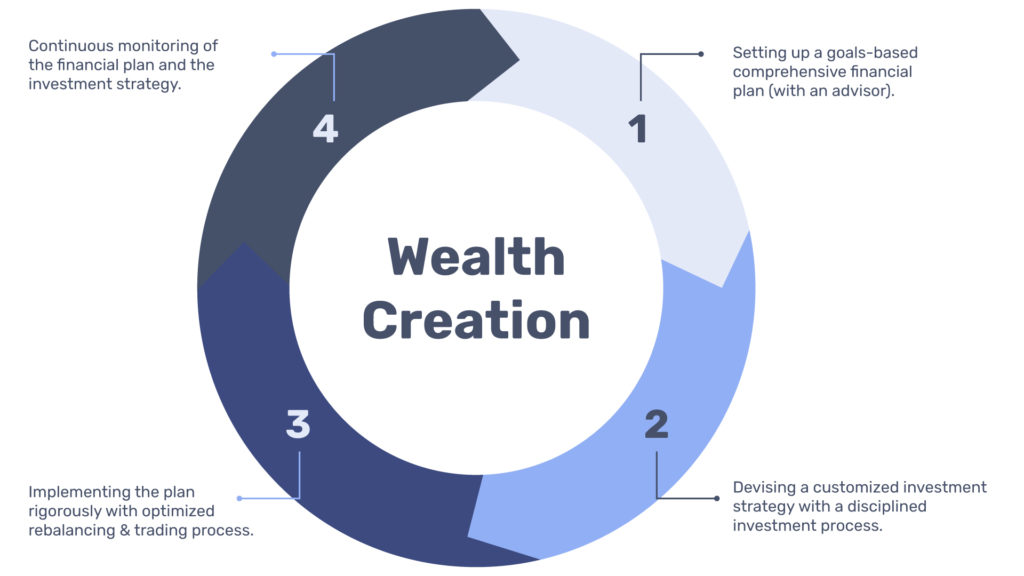

Instead of an active investment management style, we believe in an active framework that provides a rigorous, objective, and holistic approach to investing.

There are several investment frameworks that can help you achieve your financial goals. The key is to have a framework and the discipline to stick to it.

So how are advisors working with an “active” framework? Most of the action will happen behind the scenes. Here is an example of the activities an advisor would do:

- Create a list of investable Asset Classes.

- Develop a Strategic Asset Allocation using historical and forward-looking expectations of the asset classes.

- Select appropriate Asset Allocation consistent with your preferences (risk, goals, time horizon).

- Choose the investment styles (passive/hybrid/active) along with the investment vehicles (some of the widely used ones are below):

- ETFs

- Mutual Funds

- Individual Stocks

- Follow a disciplined and tolerance-based approach to rebalance accounts & minimize drift between you and your target portfolio.

- Regularly monitor portfolios to ensure you stay on track to achieve your goals.

- Check-in with your advisor on a regular basis to ensure your situation has not changed enough to merit an adjustment to the set goals and investment strategy.

6 Ways the “Active Framework” can Provide Value

Hint… it’s not about beating the market:

- A goal-based approach leads to a higher client engagement and a greater likelihood of sticking to the plan with fluctuating markets.

- Selecting the right asset allocation could have a huge impact on overall progress for your goals… According to research, 90%+ of portfolio returns could be attributed to asset allocation.

- The disciplined process of choosing/developing the investment strategy helps maximize the risk-reward potential while minimizing the overall costs.

- Regular portfolio rebalancing helps with minimizing portfolio drift (the difference between the current and target portfolio) while keeping emotions out of the day-to-day portfolio management.

- Advisors should be keeping you motivated and accountable for staying on track especially during market swings.

- In short, life is fluid and ever-changing… And your financial plan should be too!

The Bottom Line

Active investing is not a get-rich-quick scheme. Although most people may think of it as a stock-picking strategy that outperforms the market, we believe in using it as a framework, rather than an investment management style.

Selecting the right asset allocation can provide a huge impact on the progress of your financial goals, and this is one of the many ways an active framework can provide value to your investment strategy.

Building wealth while navigating through the challenges in life is a marathon and not a sprint. If you manage to build a consistent process that you can follow and keep up with, you will be able to drive more outcomes.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners