Has Inflation Led to a Sugar High?

Reading Time: 3 minutes

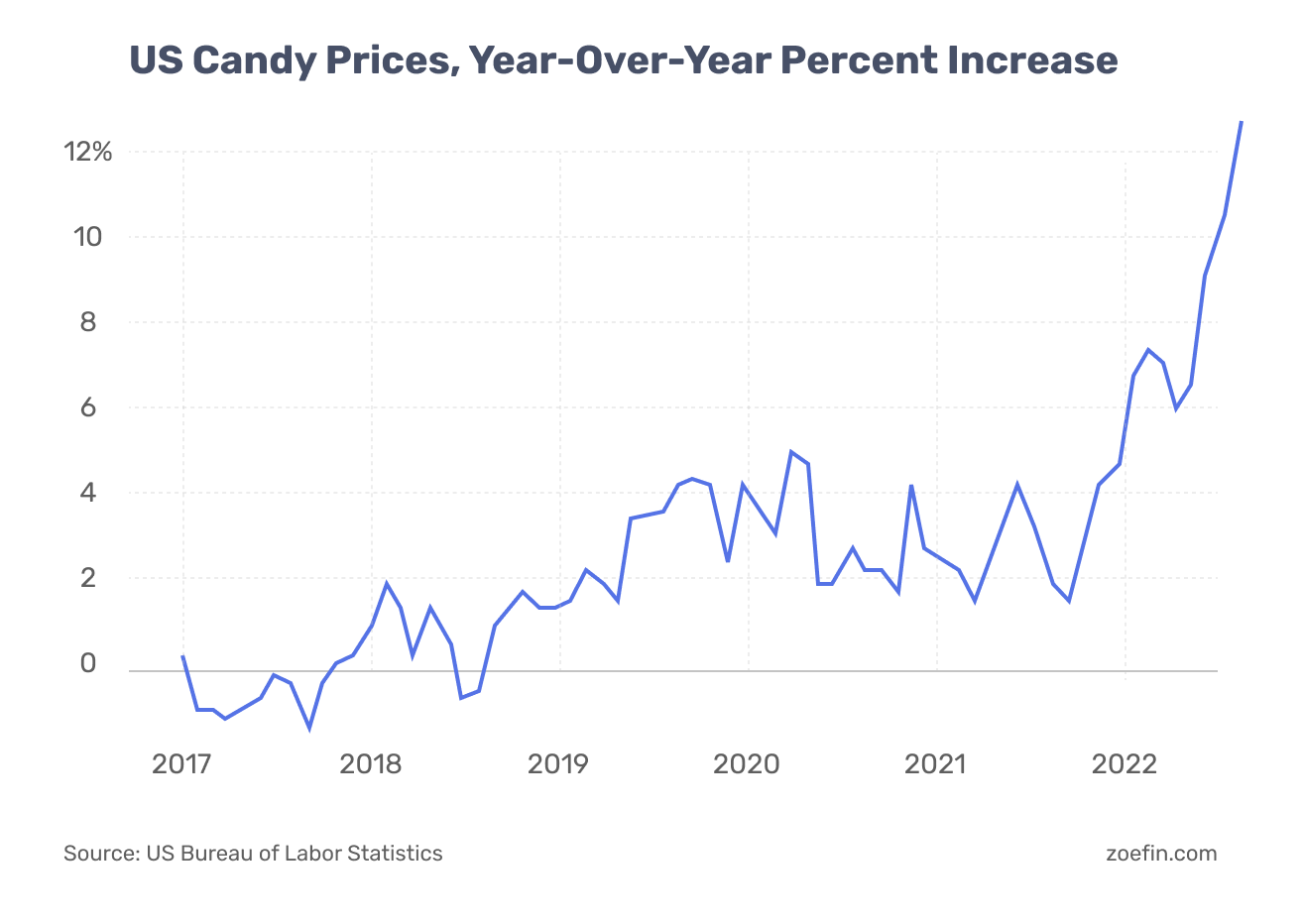

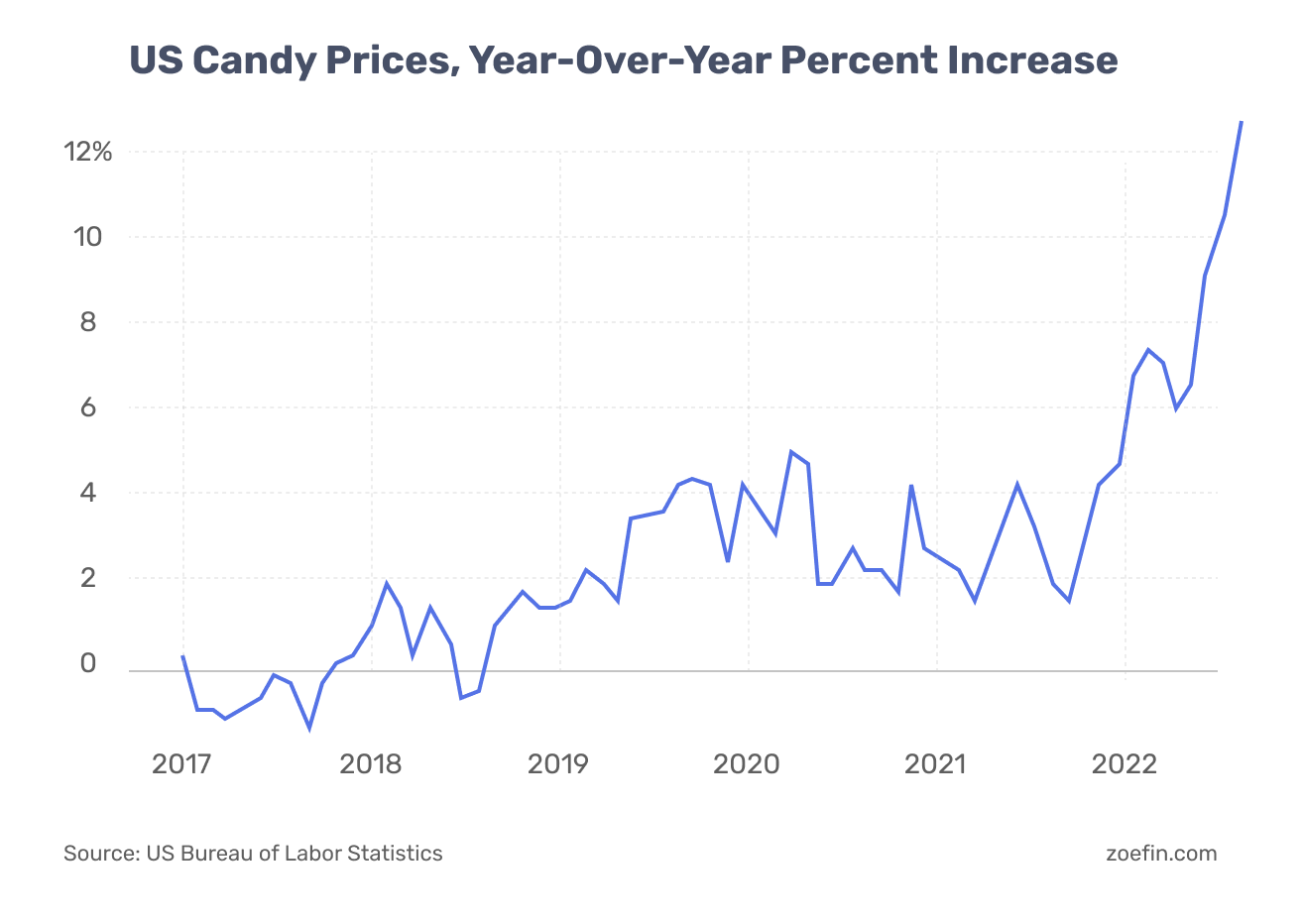

Inflation has remained high this year at approximately 8.2%, and we have seen an increase in the costs of commodities. According to the US Bureau of Labor Statistics, the price of candy is 13% higher than it was just one year ago.

After a parade of costumes, everyone waits for the sun to set and the doorbells to start ringing… time to trick-or-treat! Whether you take your children or grandchildren to the house down the street that gives out full-sized chocolate bars or to the more traditional candy corn givers, you’re likely expecting the kids to bring home enough Halloween candy for the rest of the year. All sugar highs are welcome during this Halloween… or are they?

Inflation is Getting in the Way of Trick or Treating

Inflation has remained high this year at approximately 8.2%, with costs increasing across a range of commodities. Candy prices however, have risen at an even ghastlier rate. According to the US Bureau of Labor Statistics, the price of candy is 13% higher than it was one year ago. This is even higher than the CPI for food which is at 11.2%.

Sugar is more expensive for a number of reasons. Sugar cane crops have been battered by droughts, delays in the supply chain process of chocolate resulting from the war in Ukraine, and the continued effects of the pandemic have increased costs for suppliers and manufacturers.

While candy is produced year-round, companies see spikes in demand during sweet tooth holidays such as Halloween. Companies must therefore prioritize whether to meet the demand for Halloween and risk profit loss year-round or not meet the demand for Halloween items and use their resources for regular year-round products. For example, Hersheys’ CEO Michele Buck claimed their current strategy is centered around “everyday on-shelf availability.” So if you haven’t seen the purple and orange-wrapped Hershey packs lately, you know why.

Whether you are buying Switzerland’s DeLafée chocolates to celebrate the sugar-high holiday with your partner or distributing Hershey bars during trick-or-treating, prices are up.

Is Trick or Treating Cancelled?

That headline was spooky. Trick or treating is not canceled. No one would think of stealing children’s happiness that way, but households will have greater candy expenses than anticipated. To be precise, S&P Global has announced the expected household spending on Halloween candy is approximately $3.2 billion.

What Can We Expect for the Remaining 2022 Holidays?

According to Deloitte, the rise in candy prices might also indicate slower holiday shopping this year. Moreover, if you have seen sales signs that have made you double-check your calendar to confirm it’s still October, you are witnessing retailer strategies. Many companies are responding to demand and launching promotions. Doing so allows them to give consumers a chance to distribute their budgeted expenses. According to the National Retail Federation (NRF), the latest consumer survey expressed that 44% of holiday shoppers prefer buying holiday gifts earlier during October as they fear the effects of inflation.

This Year’s Halloween: Trick > Treat

Inflation might have made Halloween’s weight lean more toward the tricks than the treats, but at least now you know holiday shopping can and should be spread out throughout the upcoming two months. Avoid the spookiness of this season from extending and think about the presents you want to buy. Holiday promotions may be waiting for you!

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners