Is Inflation Delaying Your Retirement?

Written by:

Henry Hoang, CFP®

Zoe Network Advisor

Is Inflation Delaying Your Retirement?

Written by:

Henry Hoang, CFP®

Zoe Network Advisor

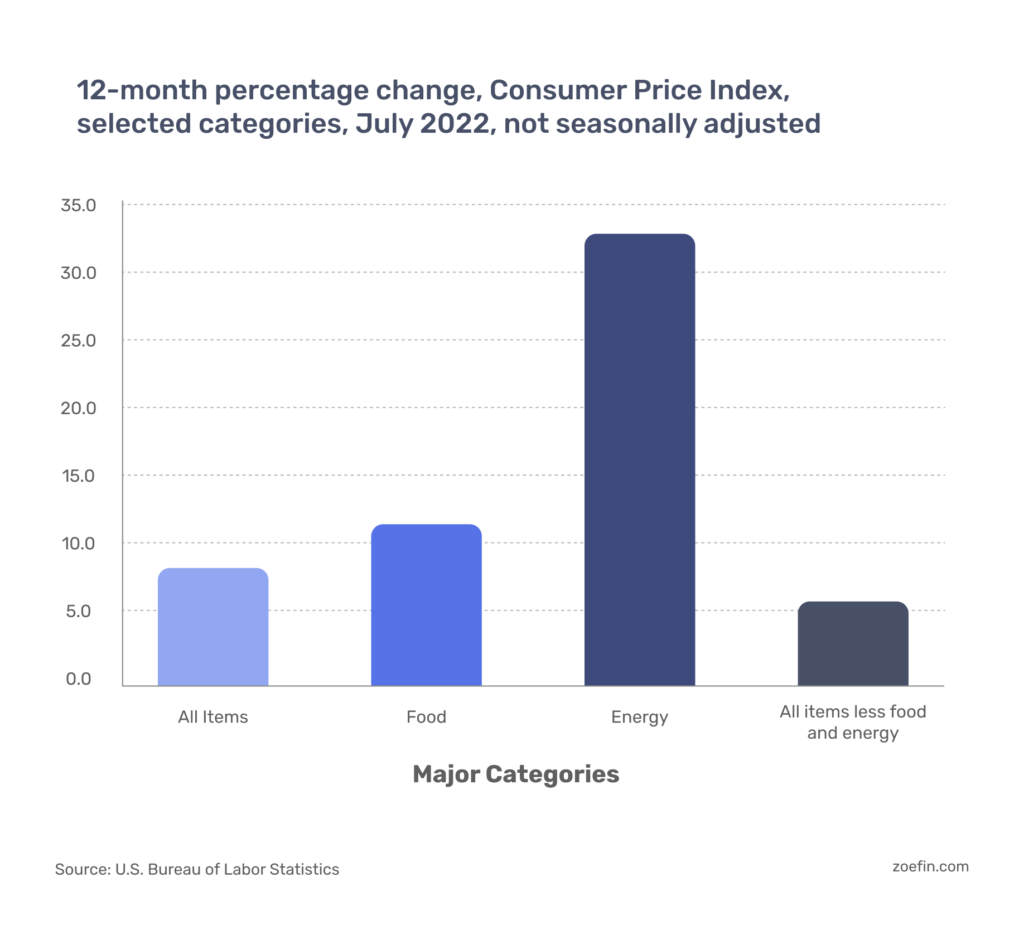

Inflation has become a serious concern worldwide, as many feel diminished purchasing power and skyrocketing costs of day-to-day necessities. Unsurprisingly, due to economic concerns, many of those retiring soon are worried about inflation affecting their retirement plan.

3 Tips to Ensure You Can Retire on Time Without Running Out of Money

Inflation has become a serious concern worldwide, as many feel diminished purchasing power and skyrocketing costs of day-to-day necessities. The resulting uncertainty is an enemy for investments and retirement. Thus, it is unsurprising that many of those retiring soon are worried about delaying their retirement due to inflation.

If you’re a retiree who is now facing an unexpected retirement delay, these are 3 tips to ensure you can still retire on time without running out of money.

The Secret Ingredient: Preparation

Whether retiring now or in the near future, are you prepared? There are various approaches to determining if you are prepared for retirement. Some may use a rule of thumb of a 3% to 4% withdrawal rate from their investment portfolio. For example, a 4% withdrawal rate from a $1 million dollar portfolio means you can reasonably assume that you can withdraw $40,000 each year for retirement. Unfortunately, this simple approach is not sufficient to ensure a successful retirement.

A solid retirement plan takes into account additional variables beyond your withdrawal rate. The best method to determine if you are ready to retire would be a thorough retirement analysis, which should include the following:

- Accurate data on your expected income and expenses during retirement.

- Realistic and reasonable assumptions for inflation and tax rates, as well as expected returns specific to your investment portfolio.

- Tests a series of what-if scenarios, called a Monte Carlo analysis, to determine the resiliency of your plan (i.e., periods of high inflation, low stock market returns, higher tax rates).

If your conclusion is that you are sufficiently prepared for retirement, here are 3 key tips to ensure you don’t outlive your retirement nest egg.

Create your Income Plan in Advance

Going into retirement blindly without a prepared income plan is a recipe for disaster. You must know which accounts you plan to draw money from each year. If you have multiple IRA or 401k accounts laying around, consolidating your accounts may help you organize and simplify your retirement planning.

There is No Such Thing as Too Much Guidance

First, you will need to review your current and expected expenses to create a monthly budget for your retirement. Determine which expenses are fixed and which expenses are variable. Next, you will total up all of your expected income sources (i.e., social security, pension, rental, annuity income).

Now you can easily calculate if you have an income gap to solve for. For example, if your expected monthly expenses total $6,000 and your income sources amount to $5,000, you will have a monthly income gap of $1,000.

This will inform you of the best decumulation strategy to use. Not everyone’s approach looks the same, and there are many strategies to consider. Here are some common strategies used to generate income:

- Incorporating dividend-paying stocks into your portfolio.

- Using a bond laddering strategy.

- Annuities to generate a guaranteed income stream over your lifetime.

There is no such thing as a one-size fits all approach. It is important to consider factors such as your life expectancy, withdrawal rate, and risk profile to create an income plan that gives you the highest probability of success and a happy retirement.

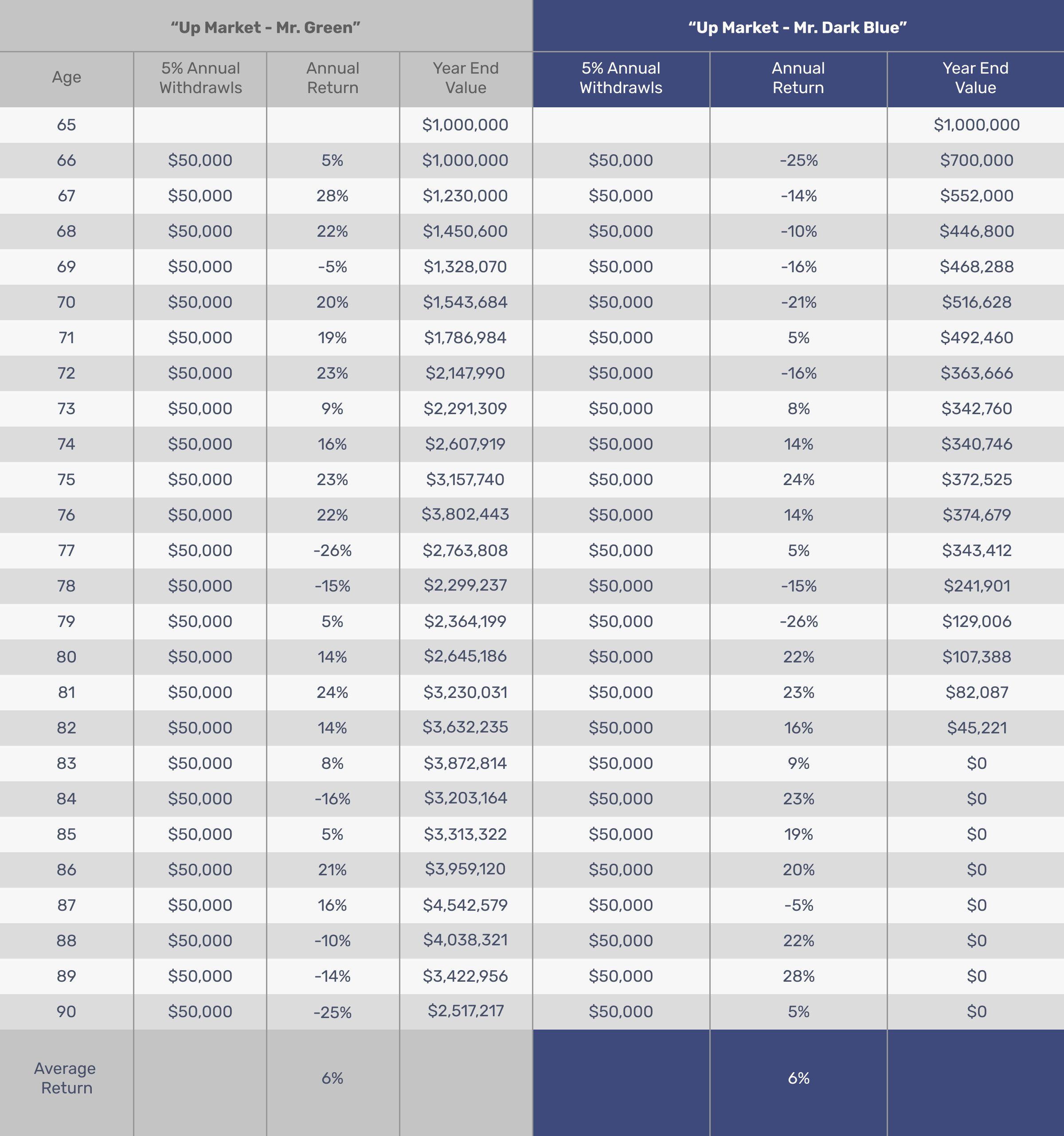

Manage Sequence of Returns Risk

One of the greatest risks to your retirement portfolio is being unprepared for a bear market in your early retirement years. A sequence of risks on returns for your retirement nest egg is retiring into a down market where you withdraw money from a depreciating portfolio.

A possible solution? You can have two portfolios that would have the exact same average rate of return but a different order of returns that will lead to completely different outcomes in retirement. One portfolio might fully cover retirement with a surplus, while a second portfolio may run out of money early.

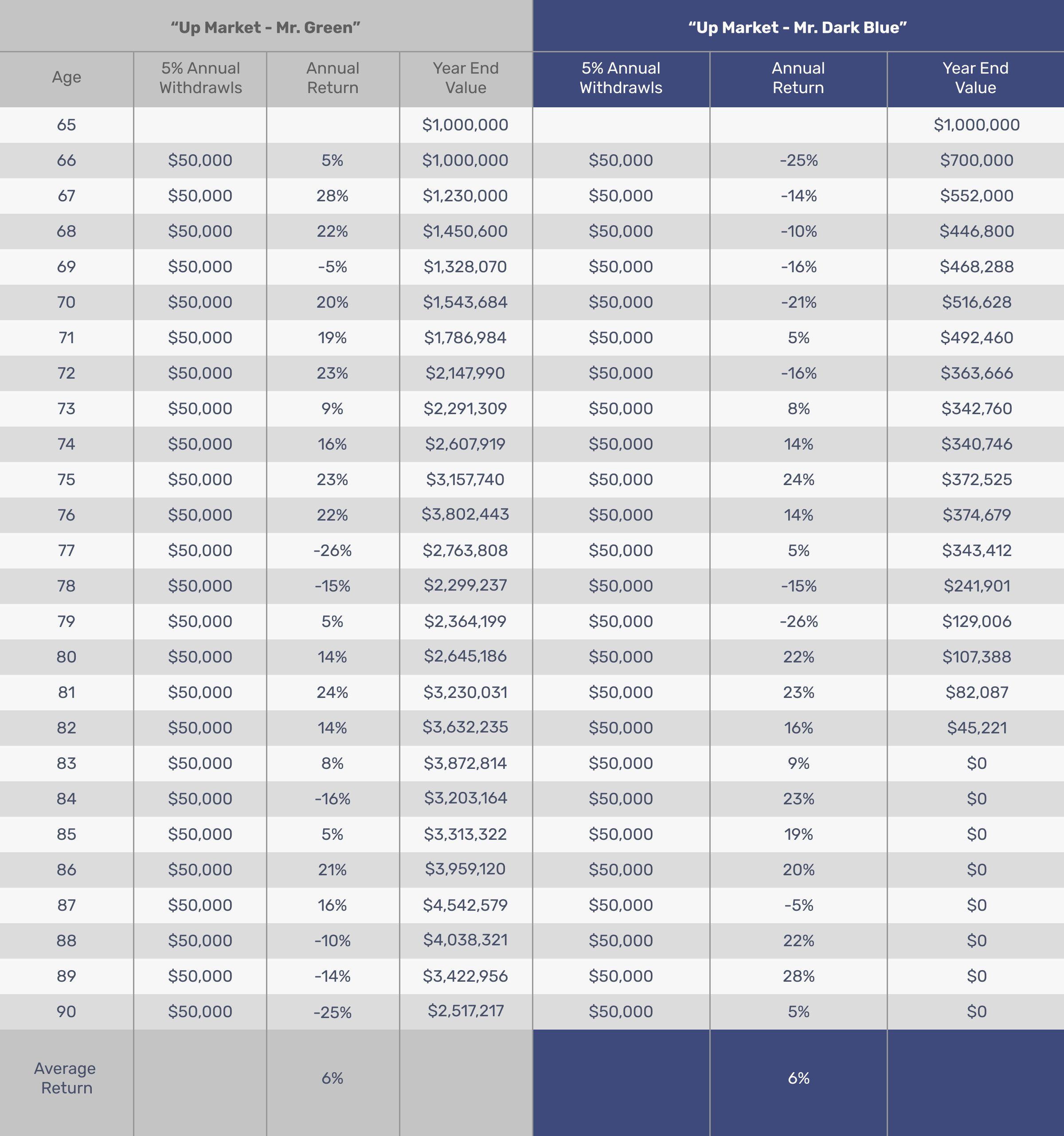

Here is an example of 2 portfolios where the annual returns are in reverse order:

To manage the sequence of returns risk, you need to have a portion of your portfolio that is not subject to market risk. This means having a part of your portfolio that is not invested in stocks. Your goal is to have some of your principal protected so that in a down year in the stock market, you can withdraw money from parts of your portfolio that have not depreciated. By not selling stocks after a down year, you are giving your portfolio a significantly higher probability of rebinding back to a healthy level.

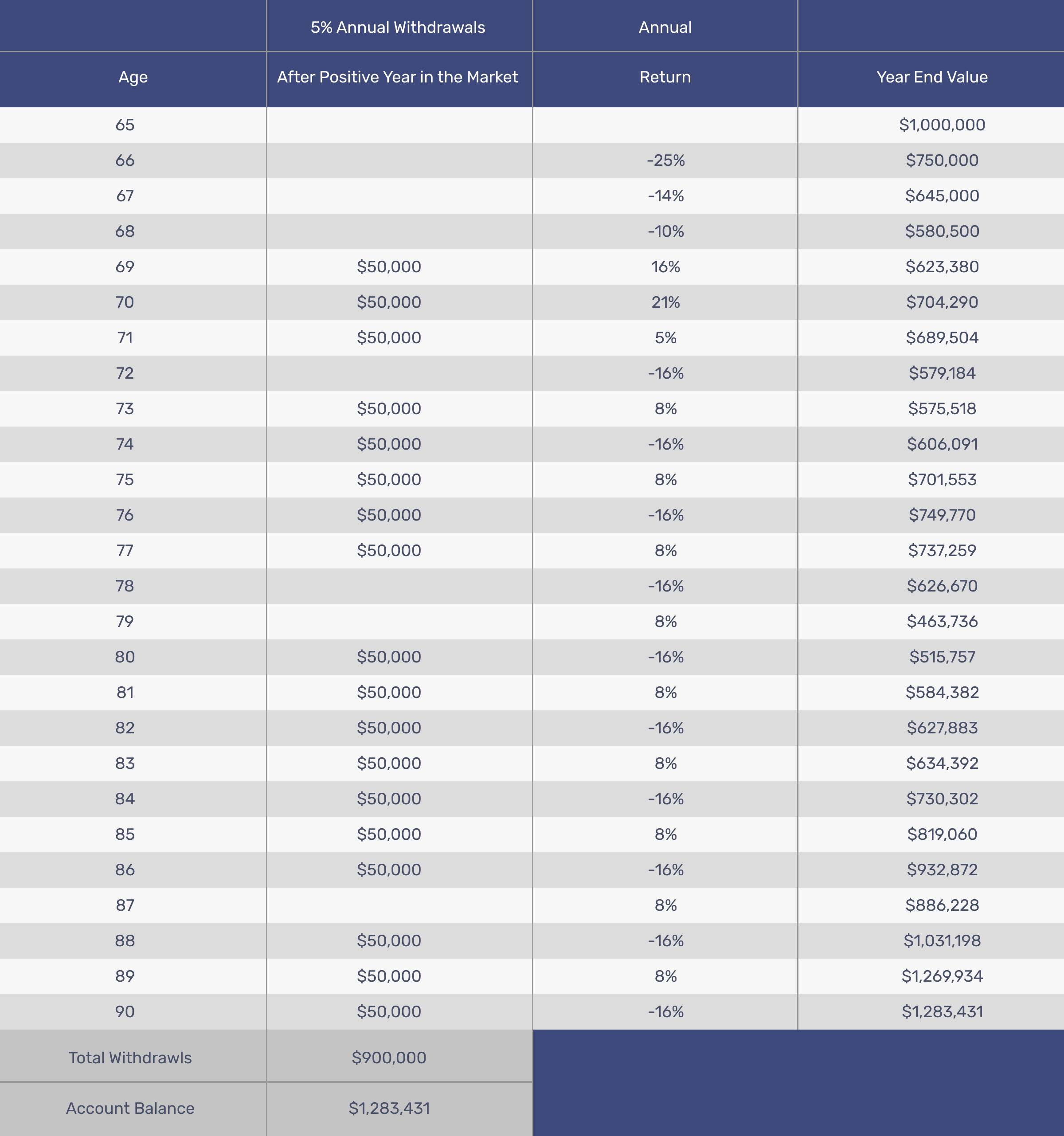

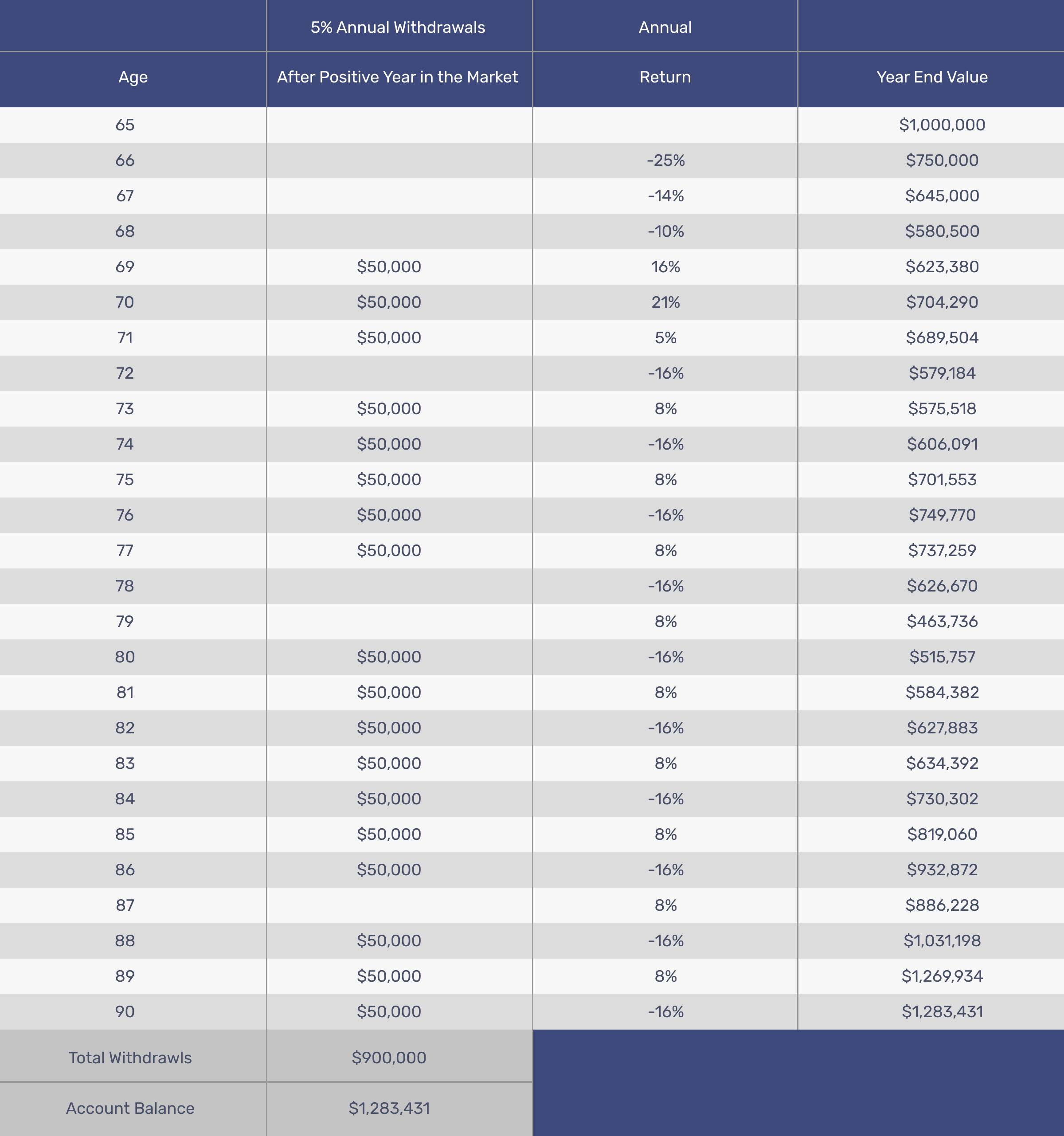

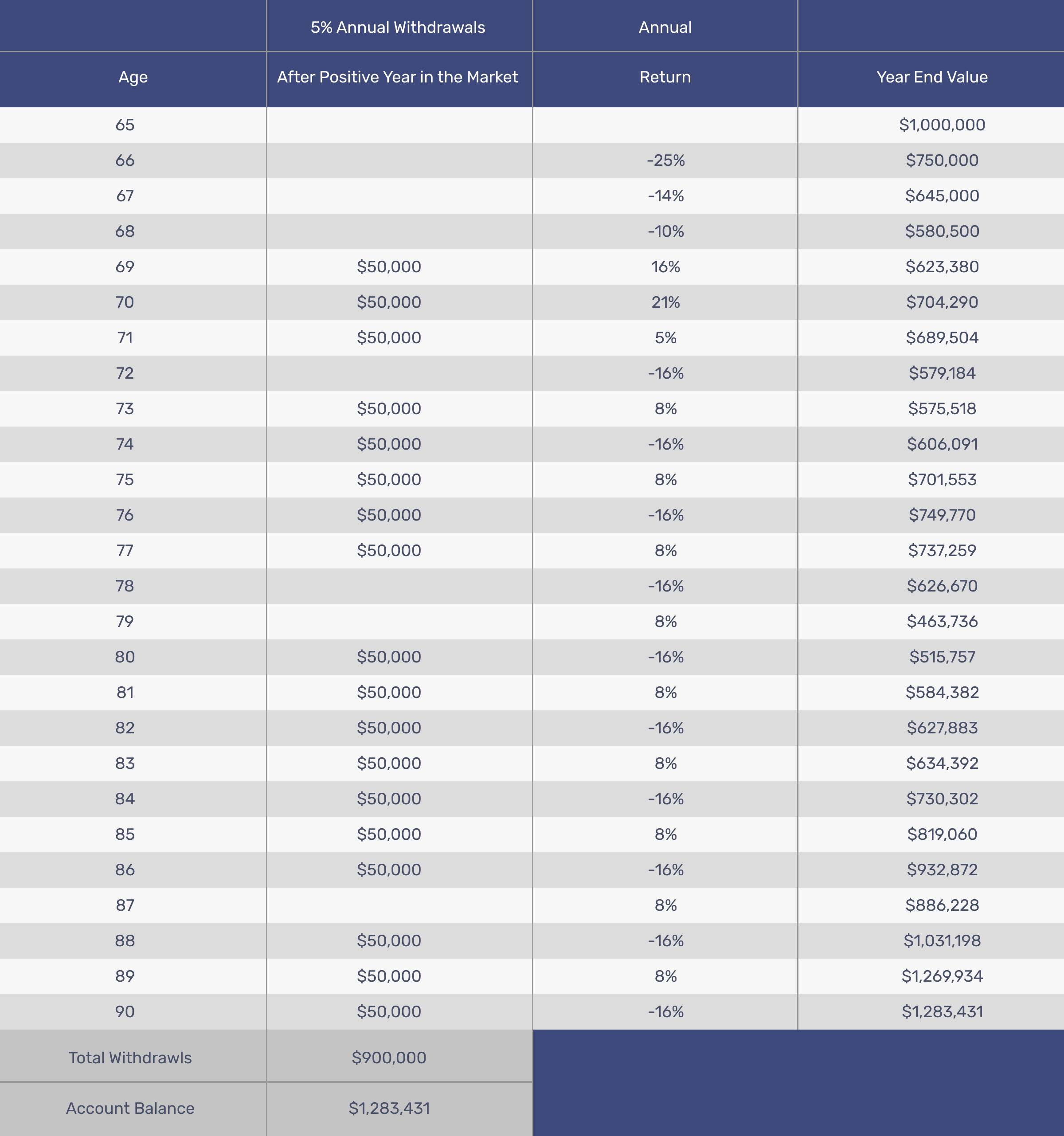

If Mr. Dark Blue in the example above had a retirement plan that allowed him to avoid taking withdrawals from his stock portfolio after a down year, his retirement years would look completely different:

With a sound withdrawal strategy, you will know in advance where you will draw money from during bull, bear, and flat markets. During a volatile year in the market, like the one we are currently experiencing (early fall of 2022), successfully managing the sequence of returns risk may be the difference between a happy retirement and having to get back into the workforce.

Optimize your Growth Bucket

With a thoughtful retirement plan that provides a clear income strategy and anticipates an immediate market correction, now it’s time to focus on growing your remaining nest egg.

Your growth bucket is here to help you outpace inflation over the long term. If we look back from 1928 through 2021, the stock market averaged an annual return of 10.07%, while the average annual inflation rate was 3.19%. In other words, the stock market has historically outpaced inflation by a multiple of over three. Although this doesn’t mean we can expect the same results in the future, history has demonstrated that the stock market has proven quite resilient while providing meaningful growth over the long term.

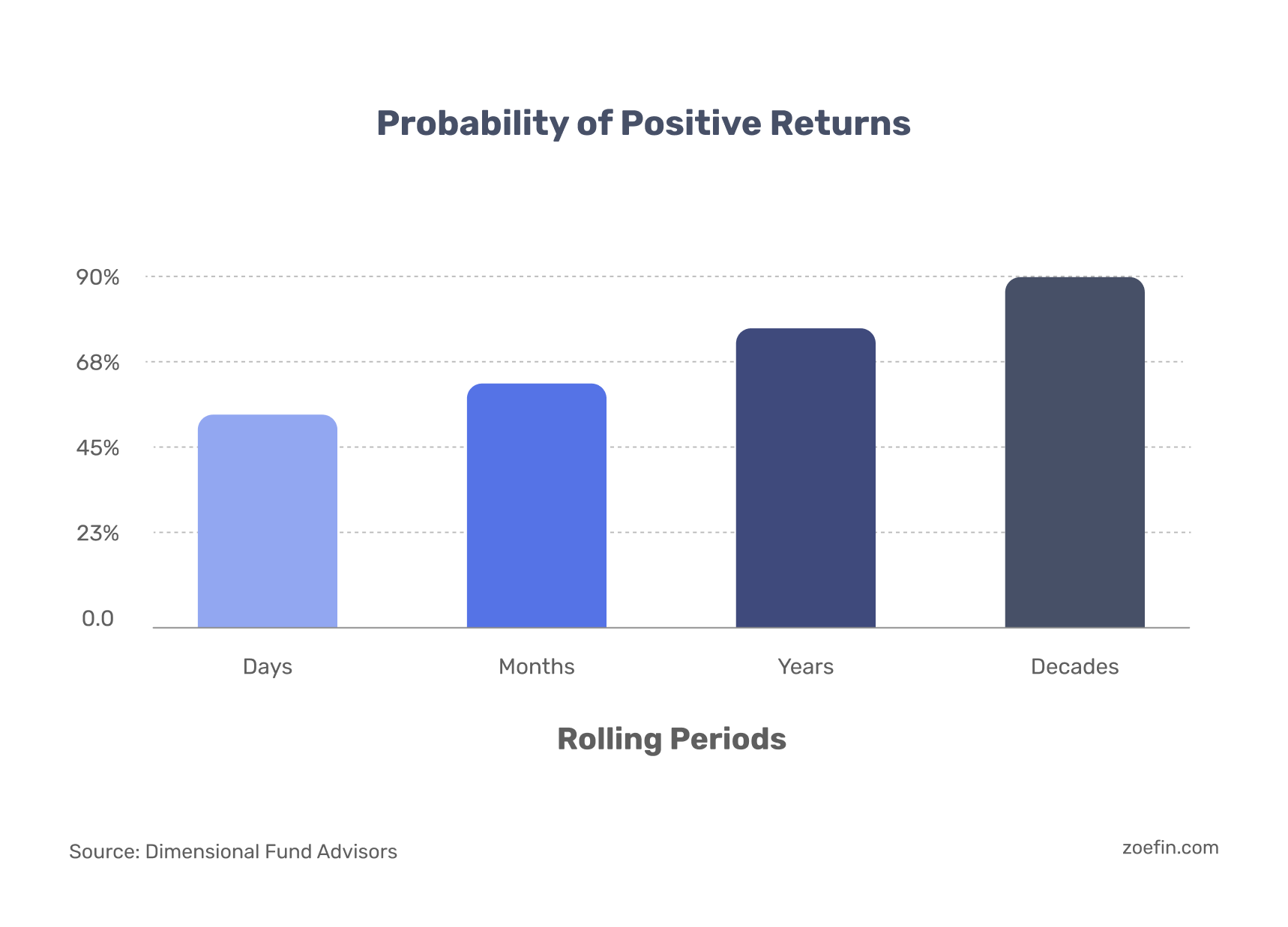

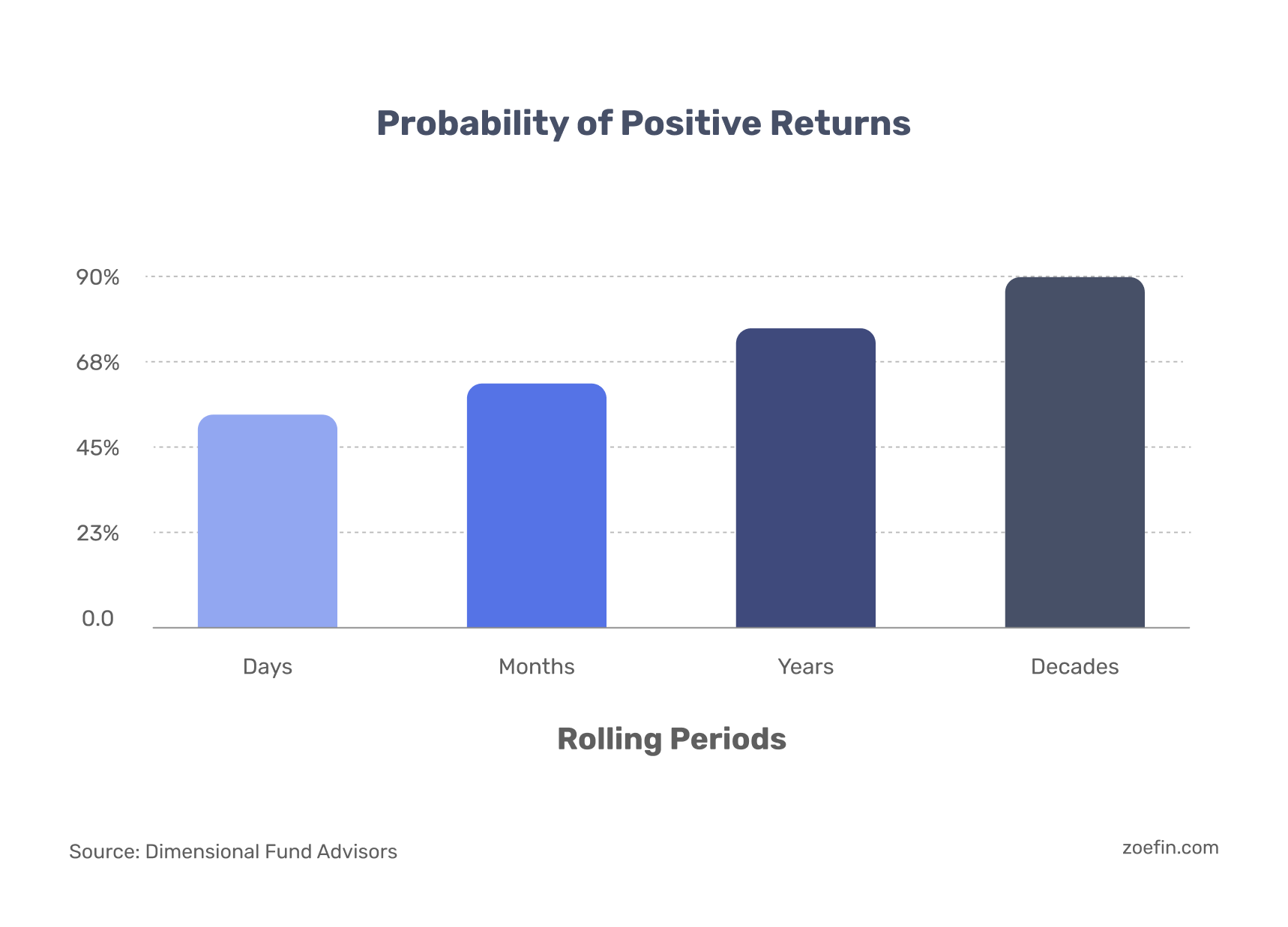

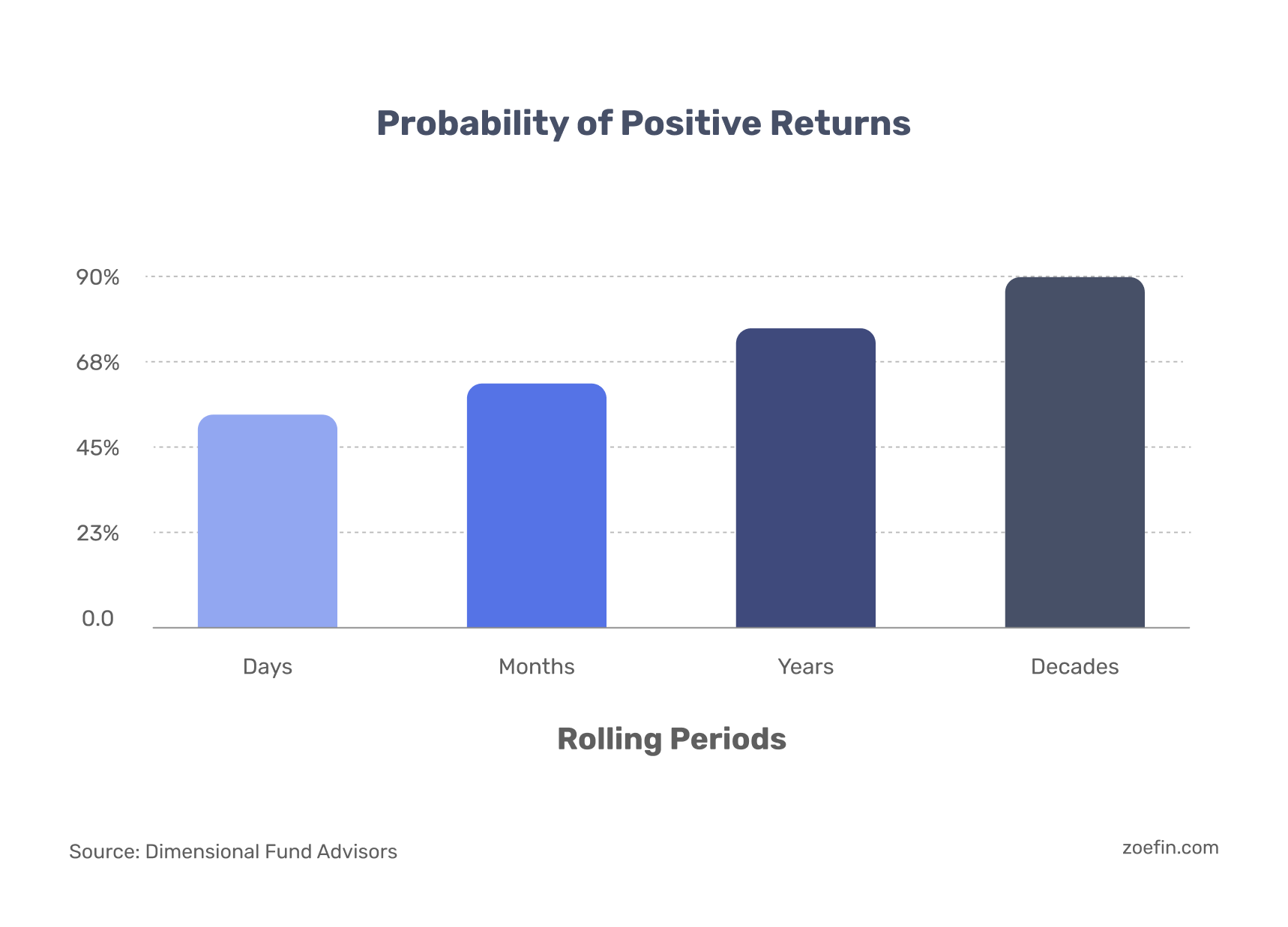

Keeping a healthy long-term perspective is critical to your investment success over time. With a clear income and retirement plan in place, staying disciplined during uncertain times is much easier. While stock market returns can be volatile in the short term, longer holding periods significantly increase your chances of a successful retirement.

Empower Your Retirement

Managing risk responsibly is the key to healthy and sustainable growth over the long term. Concentration can help you build wealth, but diversification will help you protect your hard-earned wealth. You can use investment analysis software or work with a vetted and certified Financial Planner to assess the risk characteristics of your portfolio. The analysis will help you determine if your portfolio is aligned with your investment goals and risk profile.

No Crystal Ball, No Retirement Problems

Nobody has a crystal ball to know exactly what the future holds. But by planning in advance, you will have peace of mind knowing you are prepared to execute your plan intelligently as the future unfolds. With a clear income plan, a portfolio that is prepared for an immediate bear market, and a long-term strategy to grow your nest egg, you are now positioned well to enjoy your retirement with the peace of mind you deserve. Financial advice can also be a hard pill to swallow, and having support from a financial advisor is a key strategy for a successful retirement plan.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners