Zoe’s Tell-All: 2023 Tax Season

If you’re a golfer, you know a lot goes into the brilliant game. Getting the perfect score is not about who hits the ball the hardest but rather a mix of strength, the quality of the clubs, swing, direction, and strategy. Similarly, filing taxes includes many steps and details everyone needs to know about. However, once you get into the best practices, you can plan ahead and maximize your tools in preparation for every tax season.

If you’re a golfer, you know a lot goes into the brilliant game. Getting the perfect score is not about who hits the ball the hardest but rather a mix of strength, the quality of the clubs, swing, direction, and strategy.

From an outsider’s perspective, this sport might be pretty straightforward. However, when you start playing, you know it’s anything but simple. This is because there are so many small components you need to be aware of, such as the positioning of your arms and feet, having the right posture, making sure your eyes are always on the ball, knowing which golf club to use, the variations of your swing, and the list goes on.

Similarly, filing taxes includes many steps and details everyone needs to know about. However, once you get into the best practices, you can plan ahead and maximize your tools in preparation for every tax season.

Tax planning can be overwhelming, but it doesn’t have to be. This blog will review critical organizational tips, tax season deadlines, and a few tax strategies to maximize the reduction in your tax bracket.

Tee Time – Planning Ahead

Maximize The Tools Available to You

Planning ahead is essential for successful tax filing. Gathering all your documents and receipts before filling out any form is necessary housekeeping to ensure that everything gets noticed during the tax-paying process. In addition, it’s critical to get into the habit of organizing your income documents throughout the year so they can be easily located.

The internet can facilitate your tax filing process. TurboTax is a good example. This software guides you step by step and prepares you for income tax returns. First, however, you should learn how to maximize deductions and credits. Don’t stay at the basics; overlooking tax strategies can be costly.

Talk to An Expert So That You Can Enjoy The Game.

If you’re overwhelmed by the complexities of tax filing, consider talking to a financial advisor that can support you. A financial advisor can help you analyze your financial situation, maximize all your deductions, and provide personalized advice on managing taxes going forward.

A financial advisor is like a golf coach. You don’t need to bring your coach with you in order to play in the most luxurious golf courses. But, enjoying your time there and getting close to a perfect score is highly influenced by how much you practice and who helps you improve your swing.

Getting to The Course Late is Unacceptable – Important Dates

Keeping score in golf includes:

- Thinking about the par.

- Counting your strokes for each hole.

- Calculating the running total.

- Recording scores.

- Tracking the difference.

- Considering each player’s handicap.

This is an extensive but critical list. Tracking taxes is just as important as keeping records in golf. Successful tax planning includes making sure you’re aware of these dates.

Important Deadlines

These dates include previous deadlines that started on January 23rd.

- January 23 – Tax season began. Start filing your taxes and apply for credits, such as earned income and child tax credits.

- January 31 – You should have received your W-2 and 1099 forms by now.

- February 15 – If you were exempt from filing taxes, you should also file for a W-4 before February 15th to claim an exemption for 2023. This is also the deadline for other 1099 forms. Check-in with the IRS to make sure you know what applies to you.

- April 3 – First required minimum distribution (RMD) for those who turned 72.

- April 18 – Federal tax-filing deadline and the last day to request a tax extension. April 18th is also the HSA and IRA contribution deadline.

Keep documents organized and handy to make your tax filing successful.

Your Handicap: Know Your Tax Bracket and What That Means

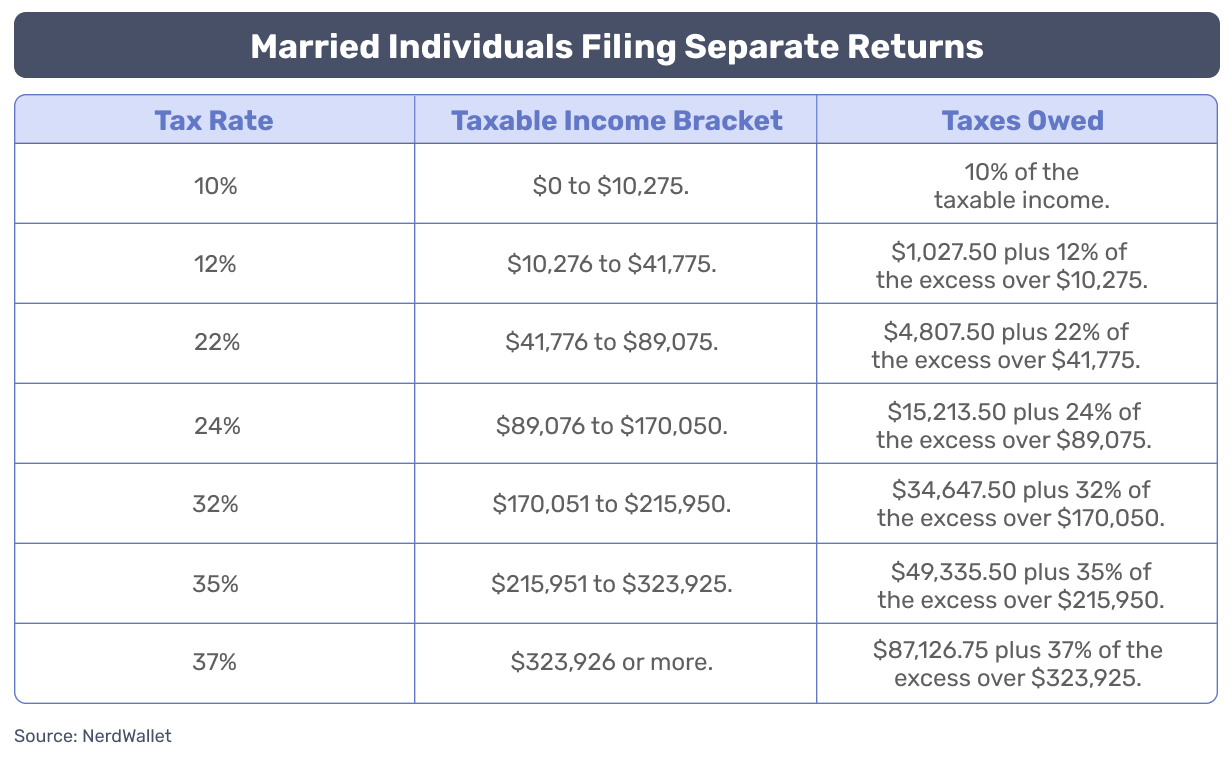

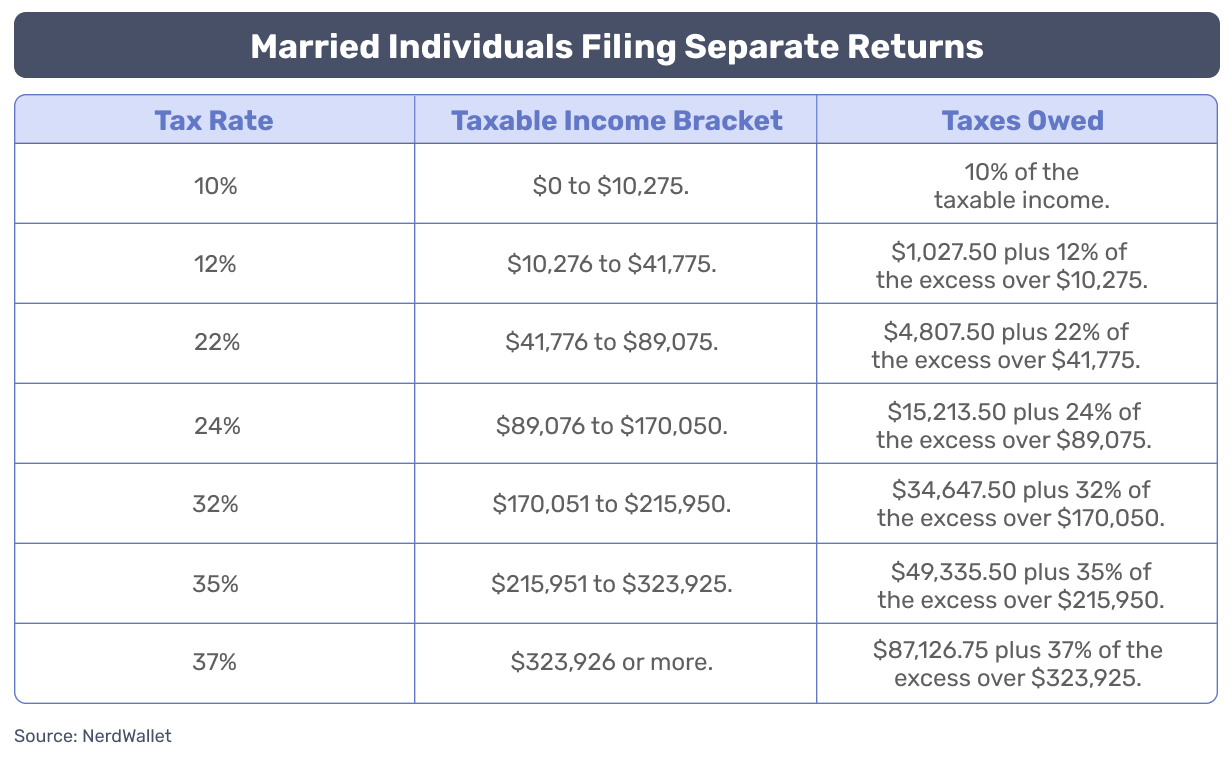

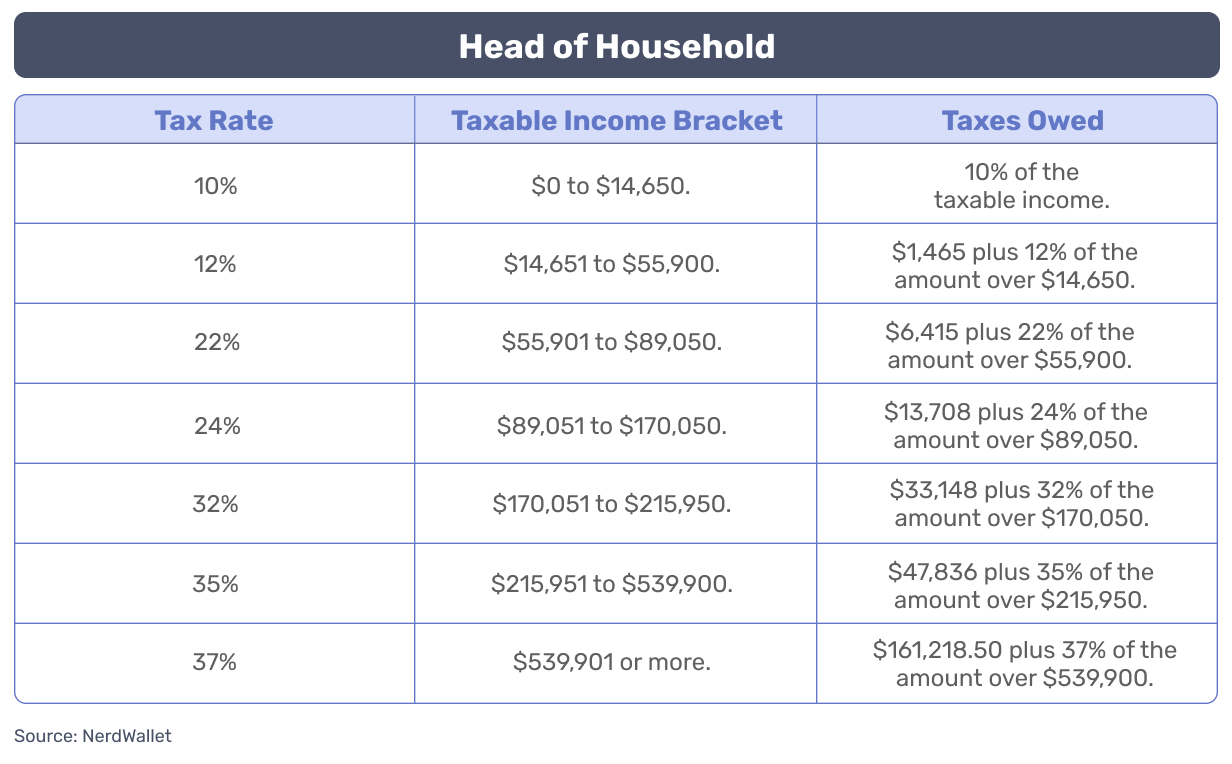

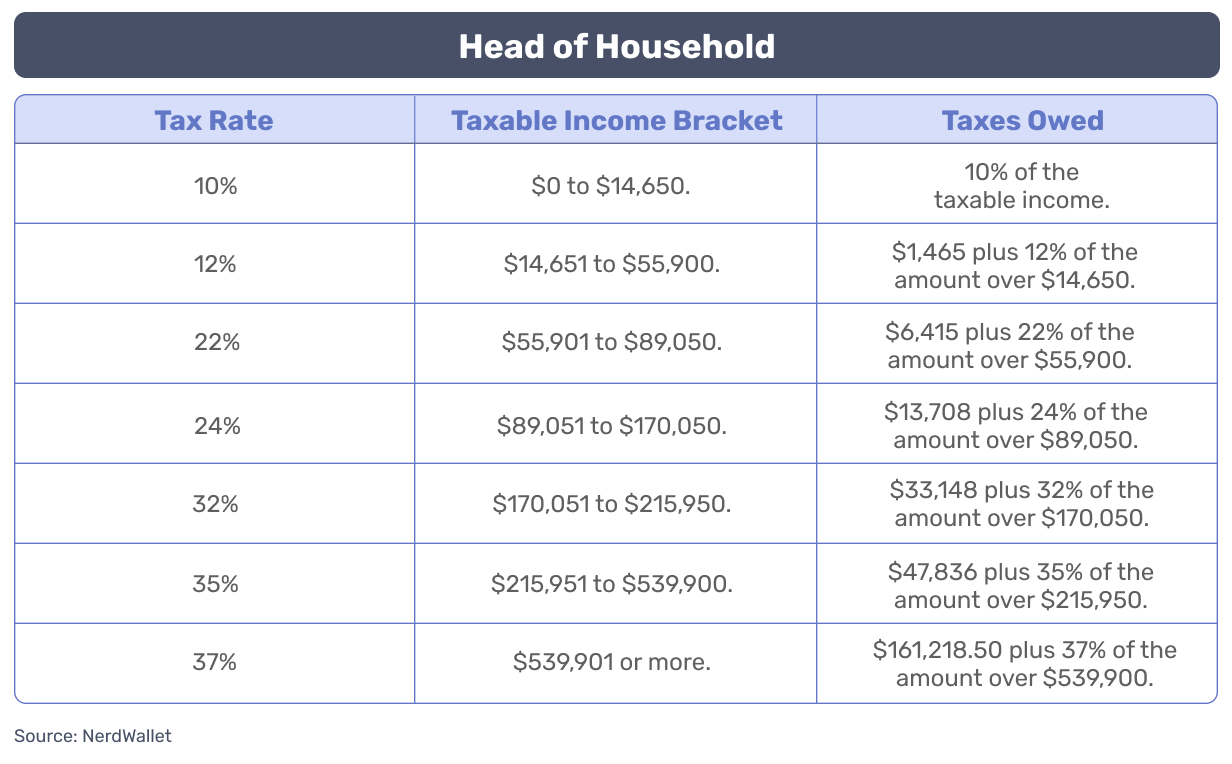

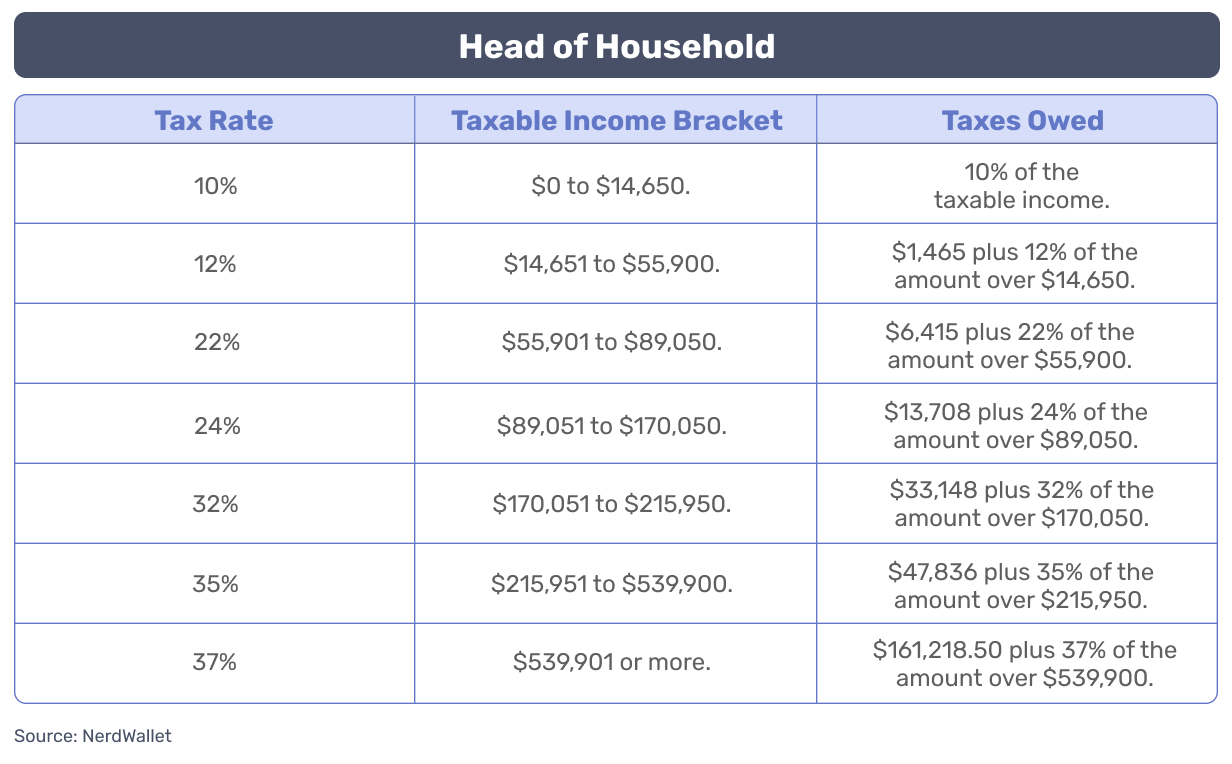

Your handicap in the tax world is the tax bracket you fall into. During a tournament or even while playing with a group of friends, your score varies based on your handicap. Similarly, the amount you pay in taxes depends on the tax bracket you fall into, which is determined by your taxable income and filing status.

1. Determine your filing status (single, married filing jointly, married filing separately, and head of household).

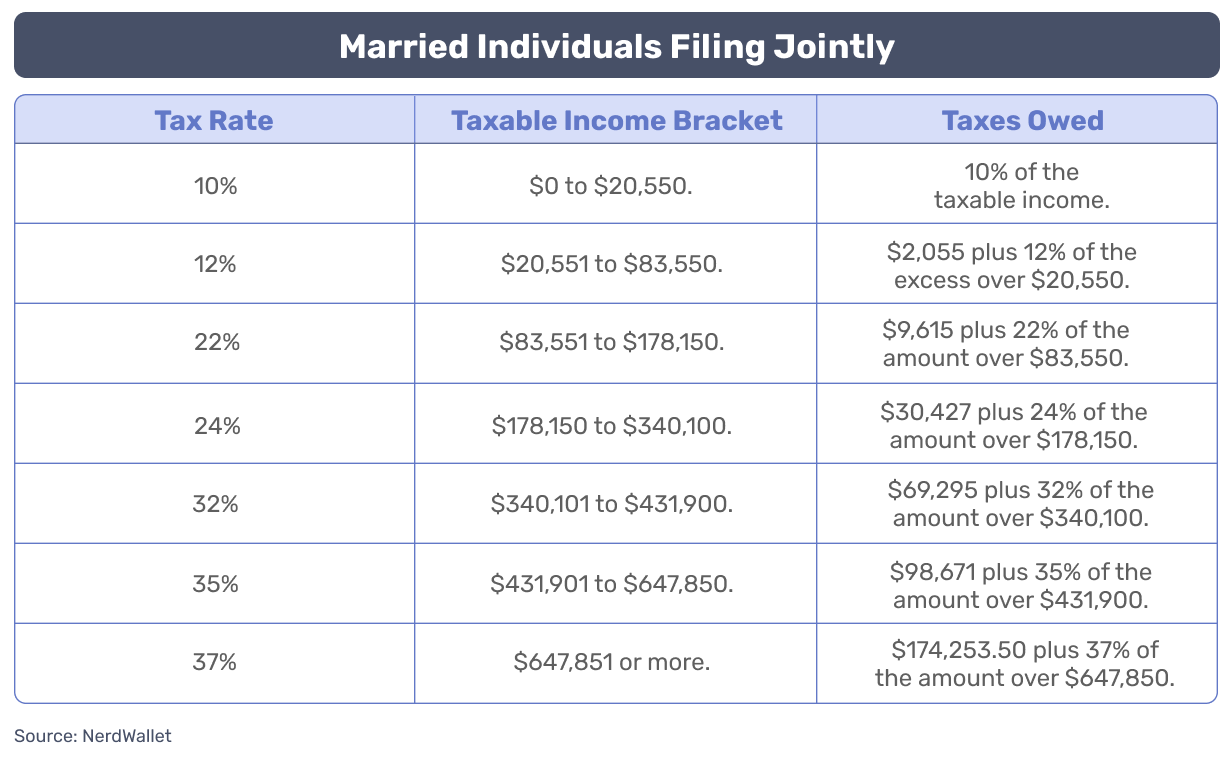

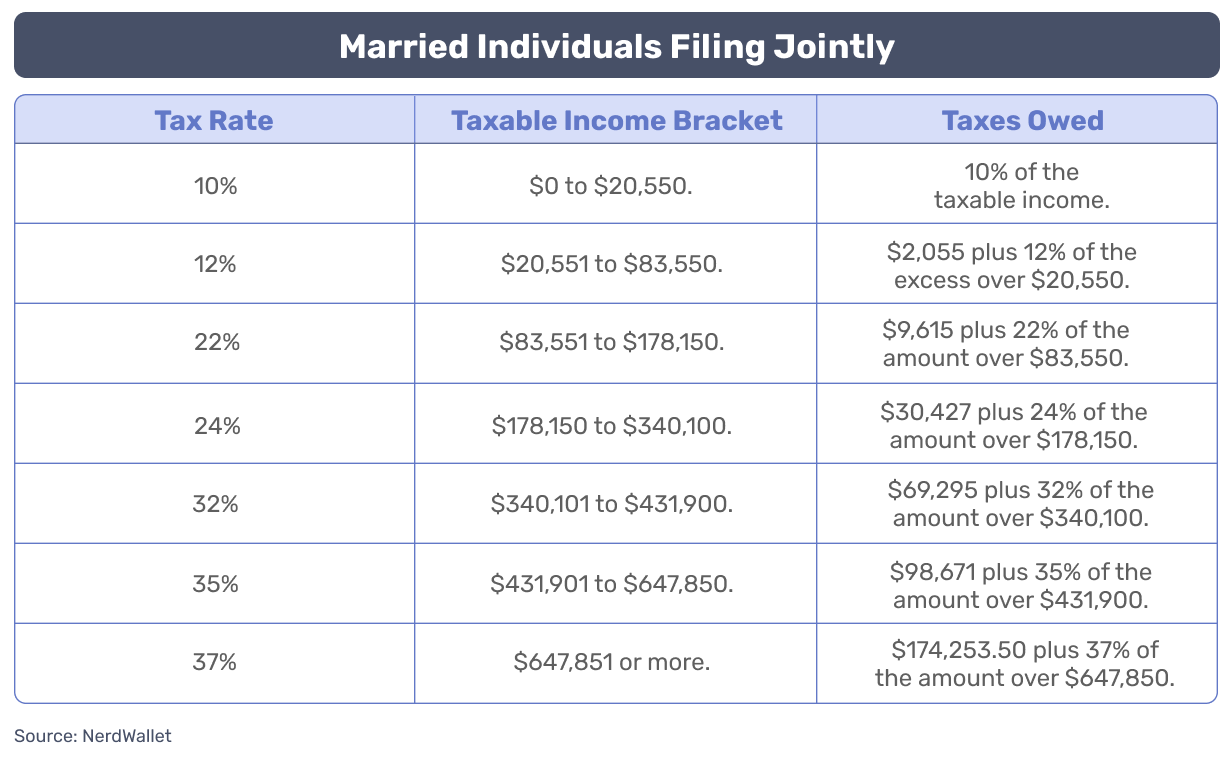

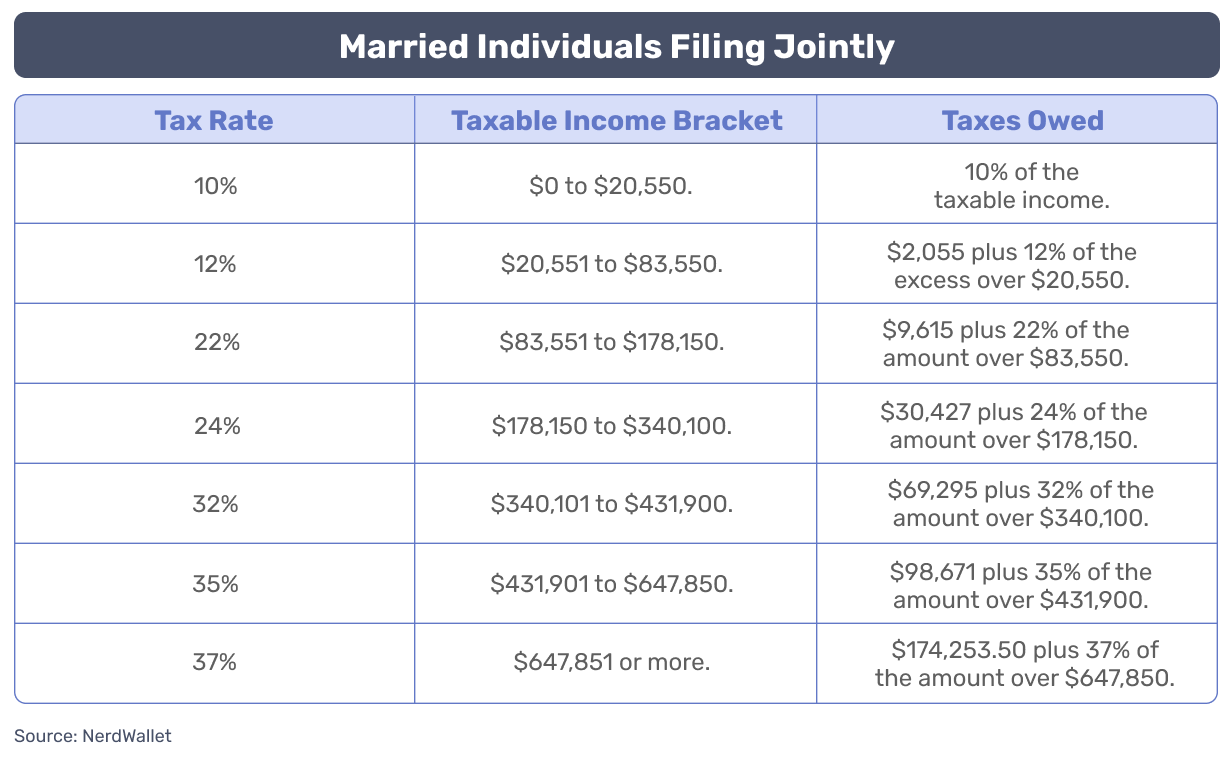

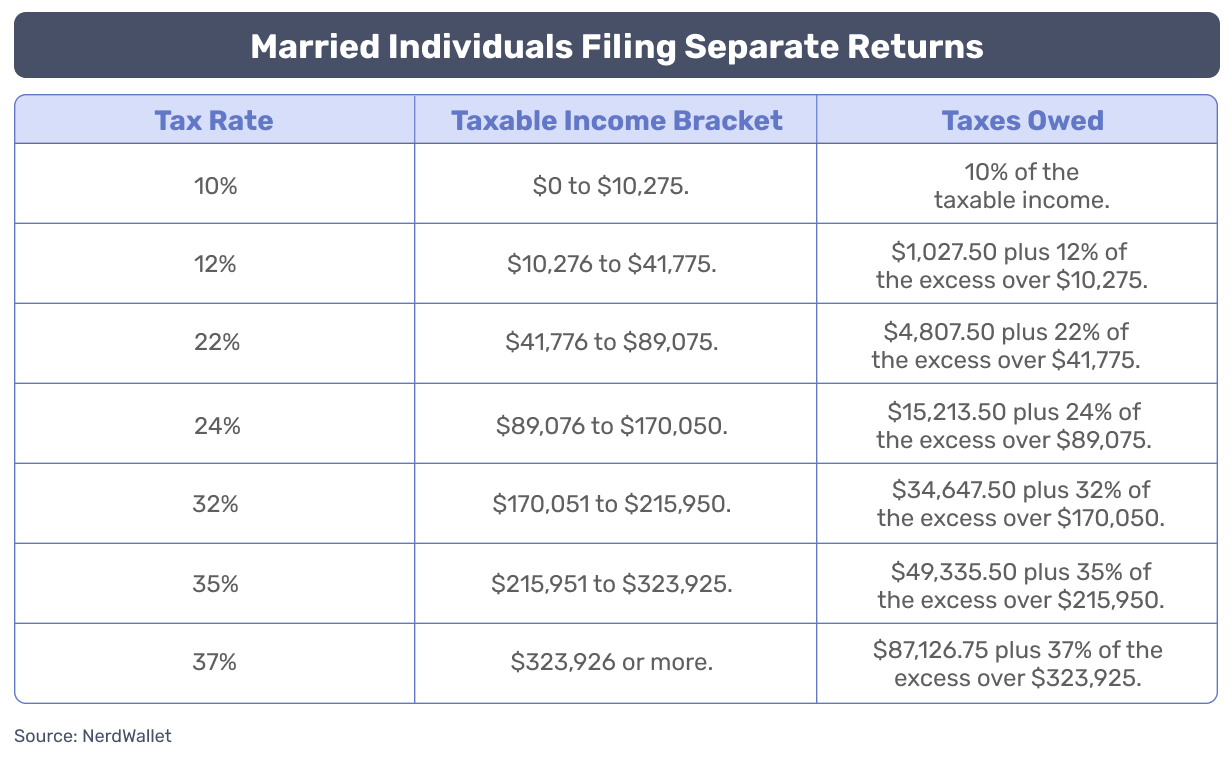

2. Understand what tax bracket you fall into based on your filing status:

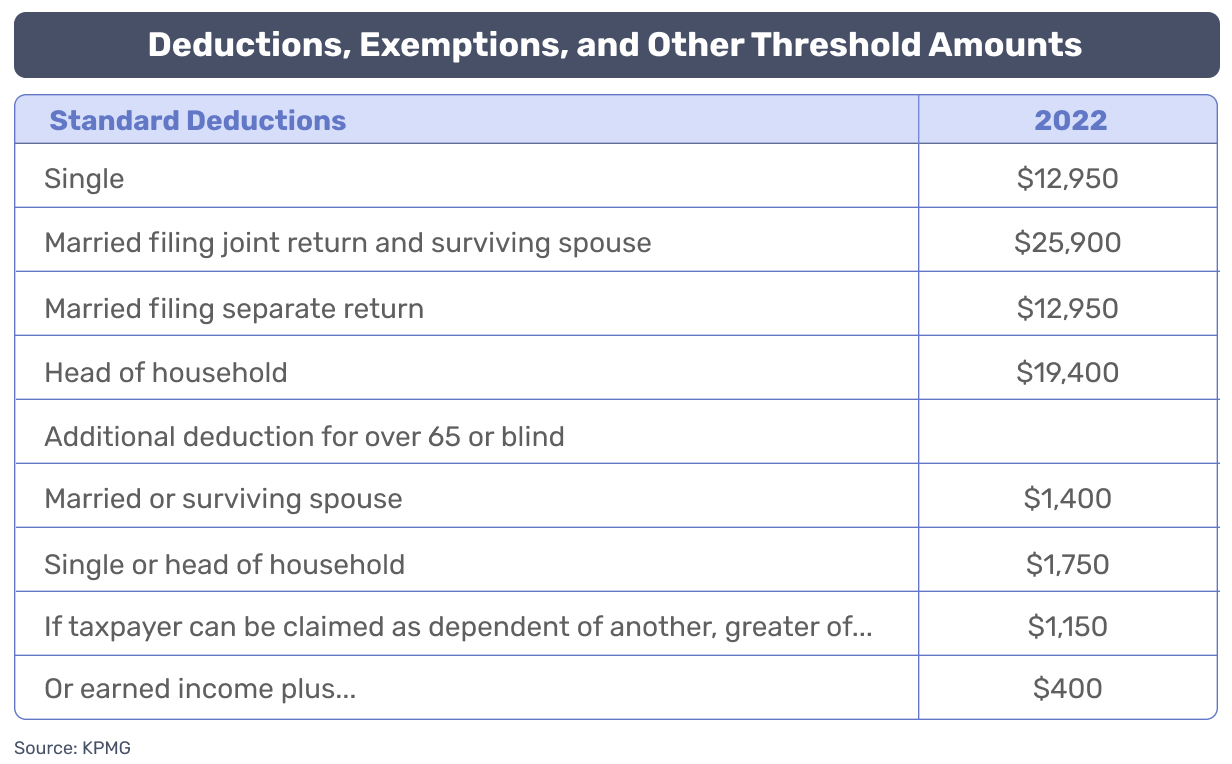

3. Consider the standard deduction that might be applied to your taxes:

4. Think about tax reduction strategies.

Maximizing Reductions

You’re trying to lower the times you hit the ball for every hole. Tax filing has a similar approach. The lower the amounts you pay in taxes, the more you earn. Deductions can be aggregated to emergency funds, college plans, and savings accounts that grow your wealth. Falling into a large income bracket makes these strategies even more relevant.

- Tax Drag: A tax drag is a reduction of income due to taxes. Ideal tax strategies aim to reduce the tax drag as much as possible to ensure your money has more power to grow.

- Charitable Giving: Donating appreciated stock can help avoid capital gains taxes and claim deductions.

- Retirement: If employed, you should save in your 401k or 403b. If you’re self-employed, you can set up a SEP IRA, SIMPLE IRA, OR A SOLO 401k.

- Healthcare: The most advantageous strategy is to use a Health Savings Account (HSA). HSAs have three strong advantages:

- Savings with pre-tax dollars.

- Growing tax deferral.

- Tax-free qualified distributions.

- Income Reduction: Your employer may offer a deferred compensation plan that allows you to postpone approximately 10% of your salary or a bonus. The benefit is that you still need to receive this income, meaning it isn’t taxable yet.

- Tax Credit: A tax credit is a value you can subtract from the taxes you owe rather than reducing your taxable income. You can qualify for many tax credits.

- Reduce Taxes on Capital Gains: If you make money from selling an investment, you must pay a tax from those gains, also referred to as the capital gains tax (CGT). Two ways to take advantage of these capital gains are 1) long-term capital gains, and 2) gain and loss offset.

Hole in One!

Paying taxes might differ from what you look forward to, but understanding how to take advantage of tax strategies might be exciting. Planning ahead and taking advantage of tax deductions can ease the sting of paying taxes and get a little money back to allocate toward your goals. Stay organized, know essential deadlines, and know what tax bracket you fall into to play these cards in your favor. If you need help understanding your unique tax situation or implementing strategic tax planning strategies, don’t hesitate to reach out, we are happy to contact you with a financial advisor that helps you feel peace of mind during this process.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners