Could War Affect My Investments?

Published February 25th, 2022

Reading Time: 4 minutes

For many, one of the biggest questions is: How will this situation affect my wallet and investments?

This week, we woke up to a world of uncertainty. Every news outlet is talking about Russia’s military assaults on Ukraine. Due to its complex geopolitical nature, the potentiality of war will have meaningful repercussions across political, social, cultural, and economic dynamics. With thousands of people world wide already affected, numerous financial concerns undoubtedly arise. For many, one of the biggest questions is: “How will this situation affect my wallet and investments?”

What Is The Crux Of The Matter?

“An undeniable effect of the global economy is that what happens on one side of the world has repercussions in other markets,” said Andres Garcia-Amaya, Zoe’s Founder & CEO.

With Russia being the third-largest global oil producer, this conflict has affected oil prices. After a steady rise throughout the start of 2022, the barrel of Brent crude was up 2.3% on Thursday, jumping to a price per barrel above $105 for the first time since 2014. Considering oil jumps, along with wheat and corn disruptions, an impact on inflation is inevitable.

The Russia-Ukraine conflict is generating a strong market pressure that is affecting the stock market across the globe. Increasing tension has caused an impact in the US market with the S&P 500 Index dropping 2.5% and the Nasdaq Composite tumbling 1.5%.

What Does History Tell Us?

The threat of a potential war understandably causes anxiety and tension, but historically we’ve seen that after a crisis, markets rebound. As a matter of fact, the effect on the Dow Jones from some of the greatest global crises shows that while it takes it on average 18 days to hit bottom, the recovery from the fall is faster.

Moreover, data shows that during periods of war, stock market volatility has historically been lower and returns have been higher than the index average including non-war years (11.4% vs 10%).

This news has been shaking the whole world, but it is not the first time that the Russia-Ukraine situation has been in crisis. In 2014, Russia invaded Ukraine after the pro-Russian President Viktor Yanukovych was deposed for rejecting a deal of integration with the EU. Back then, the S&P 500 and Nasdaq Composite dropped 0.7%. Despite this, after the crisis, the global market did what it does: recover.

What Should Investors Do?

The (almost natural) reaction of nervous investors is to dump their stocks. However, there are a few things you should keep in mind before impulsively rushing into making changes to your portfolio due to a geopolitical conflict.

1. Remind Yourself That Market Volatility Is Normal

Market volatility is not only normal, it also should be expected. The stock market is a rollercoaster with ups and downs. While the market fluctuates, a good approach to maintain your peace of mind is to remind yourself how normal it is and to avoid making emotion-driven investment decisions.

2. Stay The Course

While it’s easy to let market pressures spook you, a good way to unwind about it is remembering why you’re doing this and whether your focus as an investor is “market timing” or “time in the market.”

In the long run, “beating the market” might not be the best way to go. It’s impossible to know in advance how the market will act, which could increase the risk of buying high and selling low. Unless you have a crystal ball, the right way to go about it is to let the market do its thing, while you stay the course. Historically, this approach has provided greater returns than jumping in and out of the market at what you believe are the lows and highs.

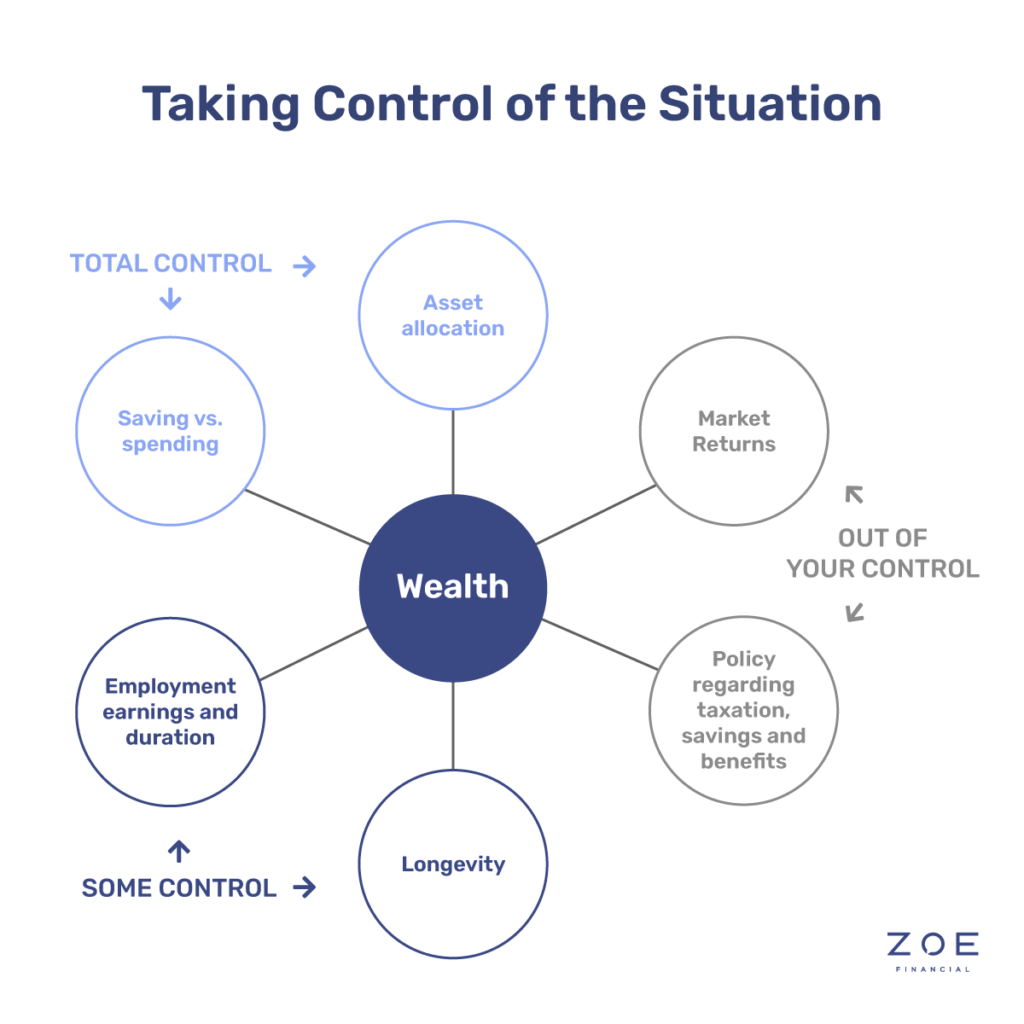

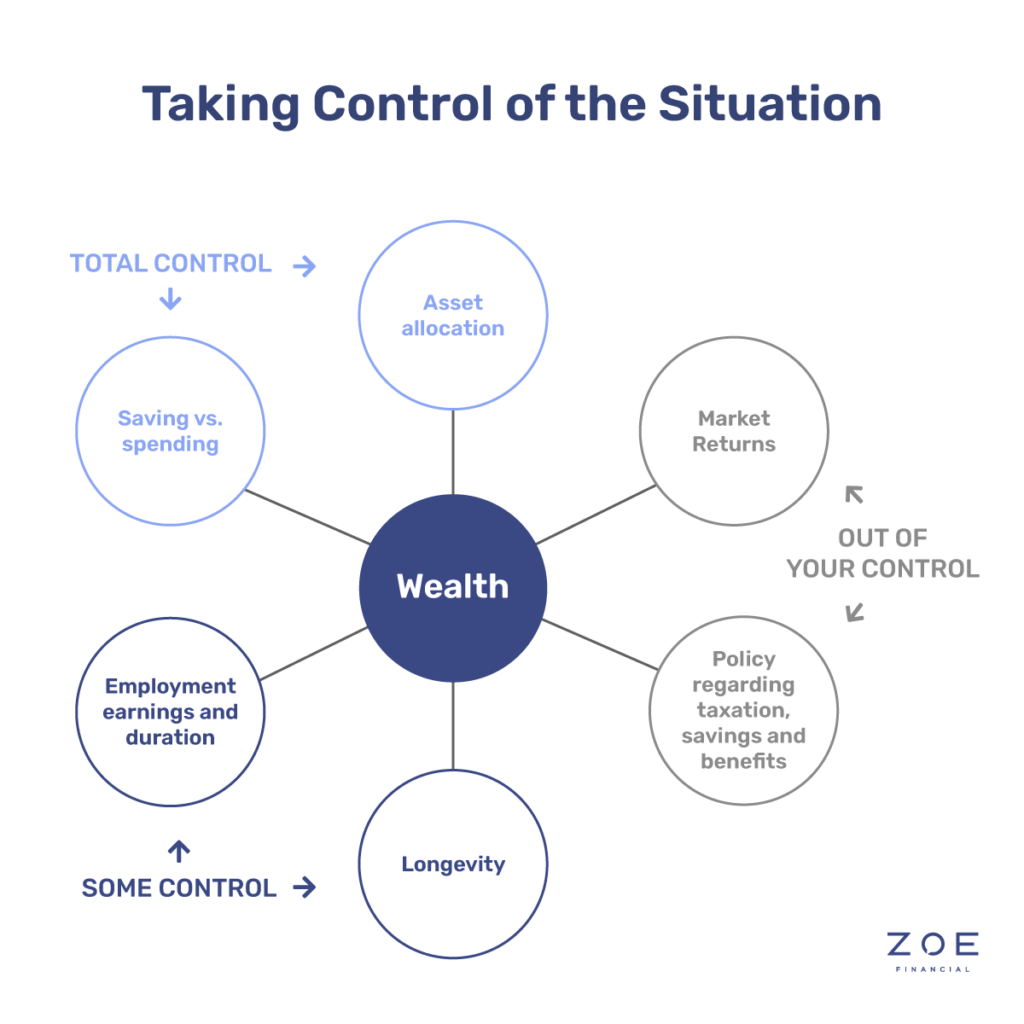

3. Focus On What You CAN Control

A great starting point is ensuring that you are spending less than what you are making, which will keep you from having to withdraw from your investments in times like this. Another factor you can control is seeking guidance from the right wealth advisor for you.

If you already have that covered, you can work with them to review your emergency fund and current portfolio holdings. It might also be a good time to have a conversation with your advisor about assessing your risk tolerance.

Finding Calm In Unsteady Times

“Feeling nervous about the potential effects of the Russia-Ukraine conflict is only human. After all, there’s a lot of complexity and uncertainty behind how the stock market could react to geopolitical events such as this,” said Garcia-Amaya.

When it comes to your investments, it all comes down to the impact the crisis could have on the earnings of the companies you own stock from. It depends on many factors like scale, which are still hard to measure. However, how you approach it and what you do about it might determine the outcome of your investments (and your peace of mind).

Stressing about it and rushing into making decisions cannot solve much for you now, so the best approach is to take a step back from impulsive actions and think about the long-term view.

Disclosure: This blog is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. The observations of industry trends should not be read as recommendations for stocks or sectors.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners