Rebalancing Your Portfolio

Just as your life constantly changes, so should your investment portfolio. When rebalancing your assets, keep these things in consideration.

Published Jul. 6, 2018

Reading Time: 3 minutes.

Your investment portfolio isn’t static. It changes as the value of your investments change, which means that you will eventually find that the proportions of different assets have shifted over time. Therefore, every so often you should consider rebalancing your portfolio.

Rebalancing is the process of buying and selling investments to return your portfolio to the original proportions of asset classes that it was before or that you want it to be at now.

Example Of A Shift In Proportions

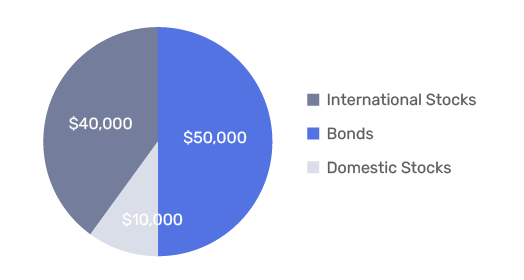

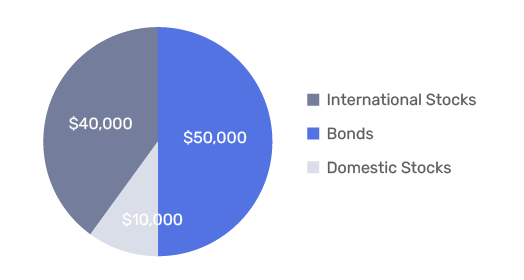

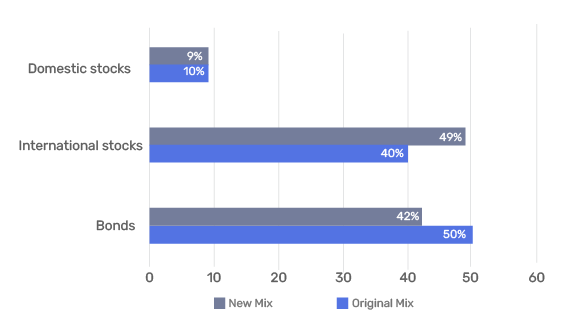

As an example of rebalancing, assume you have a portfolio distributed between 50% bonds, 40% international stocks, and 10% domestic stocks. If you had a portfolio of $100,000, it would look like the following:

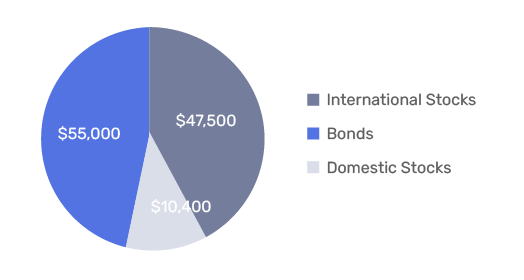

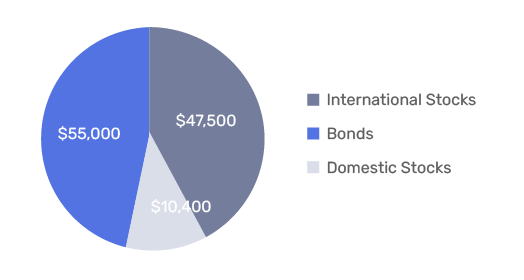

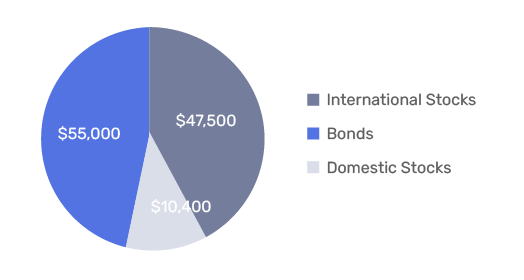

Now let’s fast-forward time several months. When you next check your stocks, you see that the international stocks do really well, rallying 37.5%, bonds have declined 5%, and domestic stocks have rallied only 4%. Now your investment portfolio looks like this:

With a total portfolio value of $112,900, the proportional distribution of assets is now 42% in bonds, 9% in domestic stocks, and 49% in international stocks.

Compared to your original 50-10-40 allocation, your investment allocation has shifted moderately. Over time, or after special events, allocations can change even more dramatically.

Consequences Of A Shift In Proportions – Why The Change Matters

What happens to each portfolio as we see the following shifts in the market over the next few months:

-Bonds increase by 5%

-International stocks decrease by 16%

-Domestic stocks increase by 12%

Affect On Original Portfolio:

Bond value increases from $50,000 to $52,500

Domestic stocks increase from $10,000 to $11,200

International stocks decrease from $40,000 to $33,600

Overall change: $100,000 becomes $97,300 = 2.7% loss

Affect On New Portfolio:

-$47,500 bonds

-$55,000 international stocks

-$10,400 domestic stocks

Bonds increase from $47,500 to $49,875

International stocks decrease from $55,000 to $46,200

Domestic stocks increase from $10,400 to $11,648

Overall change: $112,900 becomes $107,723 = 4.6% loss

The effect on the portfolio is almost twice as bad as it would have been on the original mix of assets. Although you may see the opposite happen when you find yourself on the right side of an ‘unbalanced’ portfolio, and see higher returns than you would have at your original mix, you will not have maintained your risk-return tolerance.

If you want to restore your original allocation, you would need to engage in rebalancing by selling some of the international stocks and using that money to buy some bonds and a significant amount of international stocks.

How To Rebalance – Practical Steps

Though an important investment activity, rebalancing faces several complicated factors that require attention and thought.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Types of Fees

The Most Common Type of Financial Advisor Fees are:

The first question to ask is, “how often should I rebalance my portfolio?”. The prices of stocks change every moment of the trading day, with the precise proportional allocations quickly deviating from their original levels. Remember that the goal of rebalancing is to keep your investment portfolio aligned with your strategy and needs. Rebalancing every year is generally considered an efficient and effective strategy.

Second, when rebalancing you also have to worry about commissions. Another reason why rebalancing often detracts from your portfolio’s strategy and trajectory is that commissions can quickly add up and dent your returns. You should, therefore, account for the impact of trading commissions and adjust your strategy accordingly.

Lastly, rebalancing brings up significant tax considerations. Depending on the type of account you are trading in, when you rebalance, you could be selling investments that suddenly expose you to captain gains taxes and therefore hurt your portfolio’s trajectory and gains.

Normally selling investments may also result in potential benefits from tax-loss harvesting, whereby investments that have been declined are sold to benefit from tax deductions for capital gains losses.

Conclusion

Rebalancing is an important financial tool to maintain your investment portfolio’s trajectory and asset allocation. Though a relatively straightforward concept, there are still a variety of considerations including timing, procedures, tax, and costs, to consider when determining your rebalancing strategy.

Ready to Get Started?

Real financial planning should pay off today. Not in 10 years time