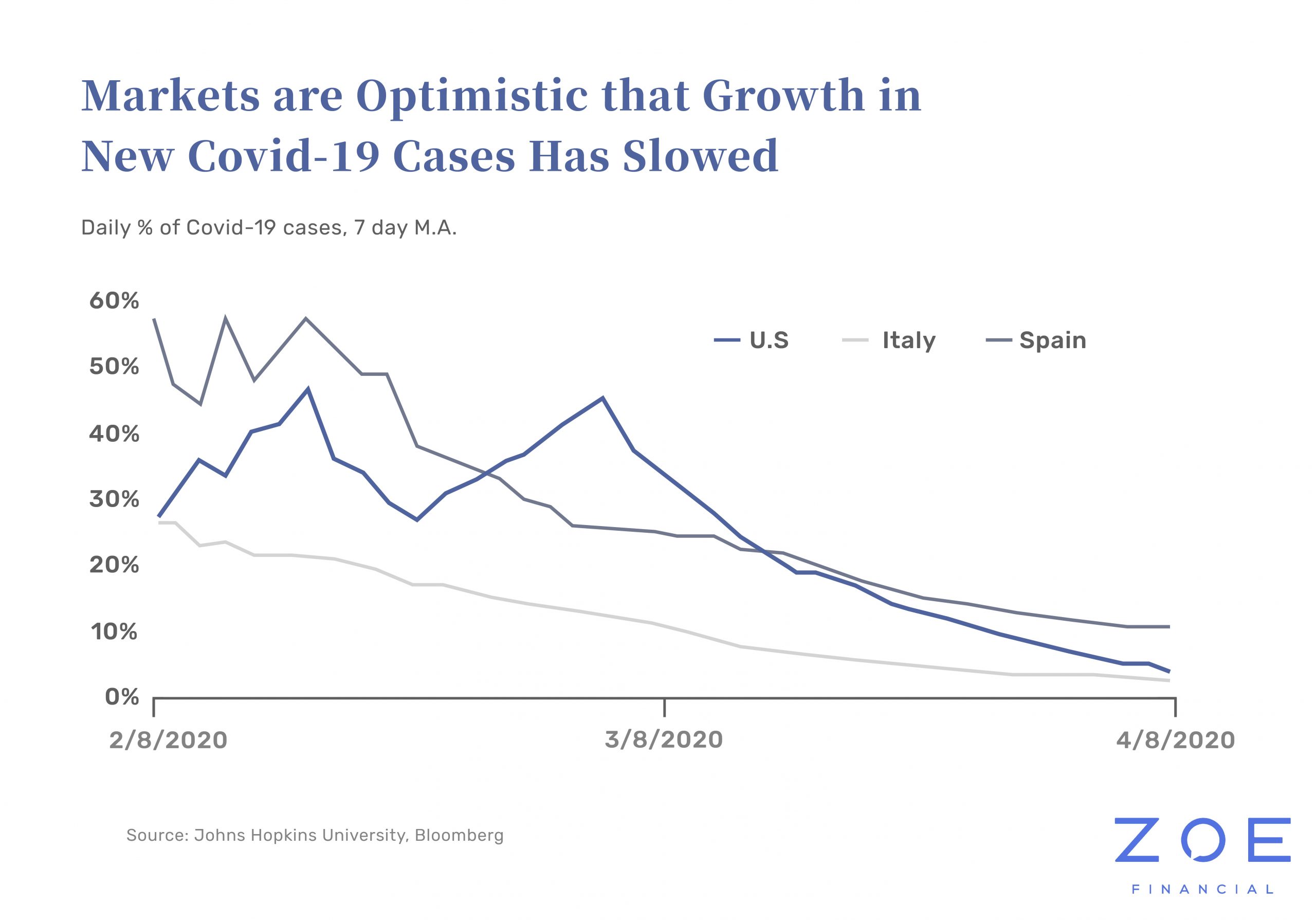

The news might seem a little incongruent recently, as stock markets recover while the number of coronavirus cases increases each day. Simply put, the market is currently aiming to price both how severe the shock is currently AND how strong the recovery will be. Stocks care about what will happen next rather than what’s already happened.

What Happened to U.S. Stocks?

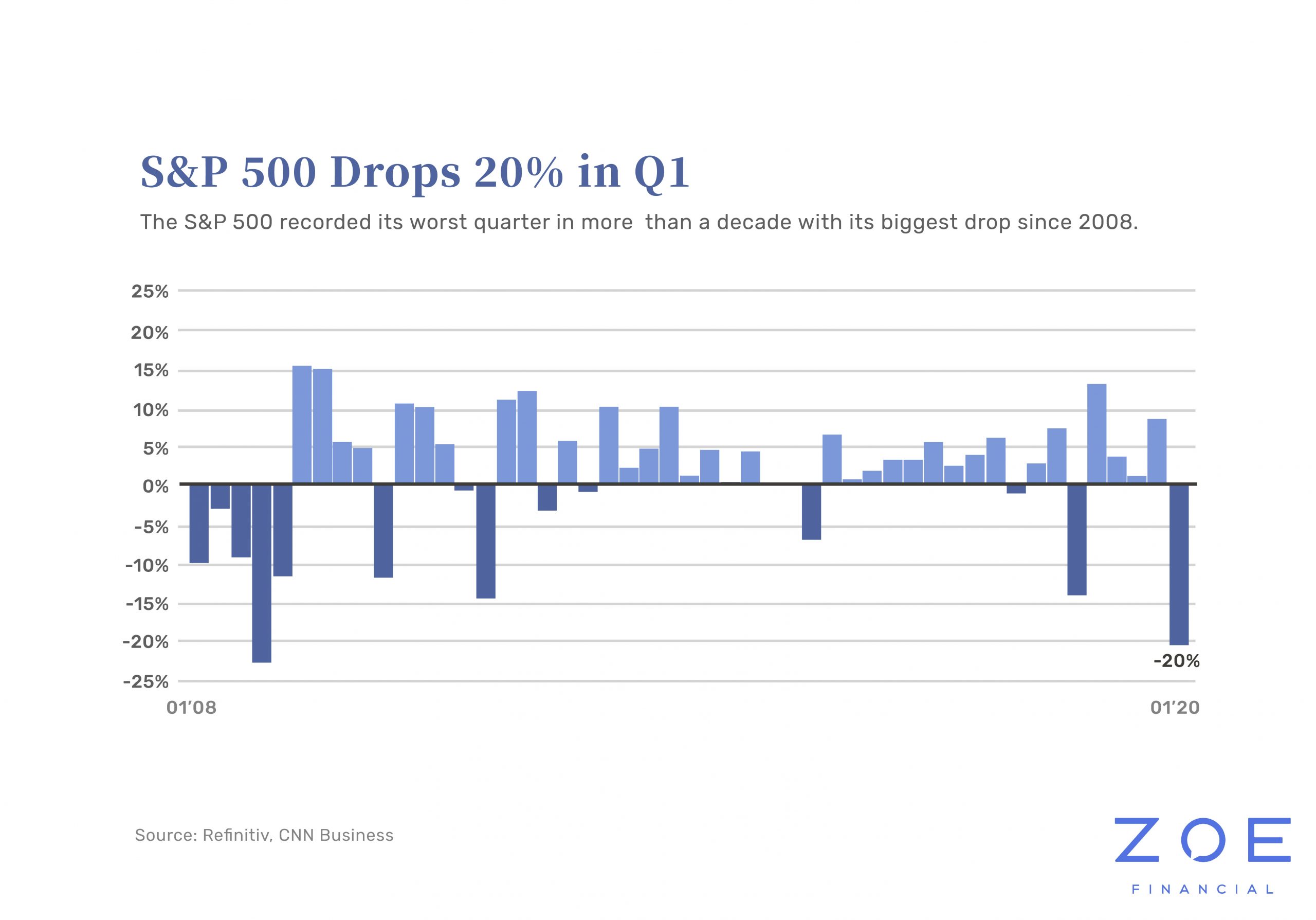

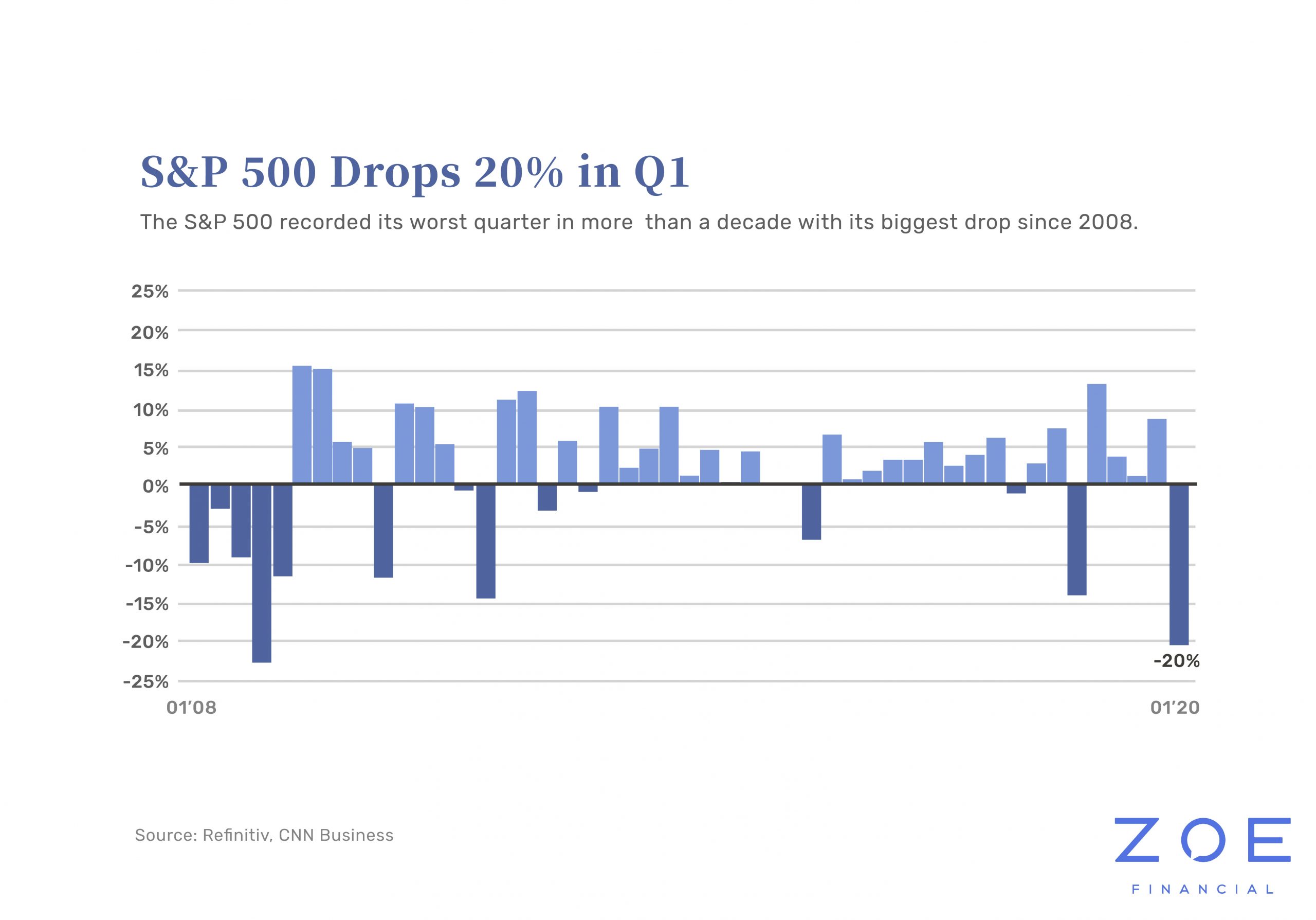

Let’s start from the top: U.S. Stocks had the worst quarter (Q1 2020) in well over a decade. Stocks fell -20% from January to the end of March, and at one point they fell -34% from the highs to the low. In other words, by the end of March, the stock market was pricing in a really bad case scenario for April.

Then, in April stocks roared back and as of mid-April 2020, are (only) down -18% from their all-time high seen on Feb 19, 2020.

So what are some of the potential drivers for the stock market recovery?

Government Response

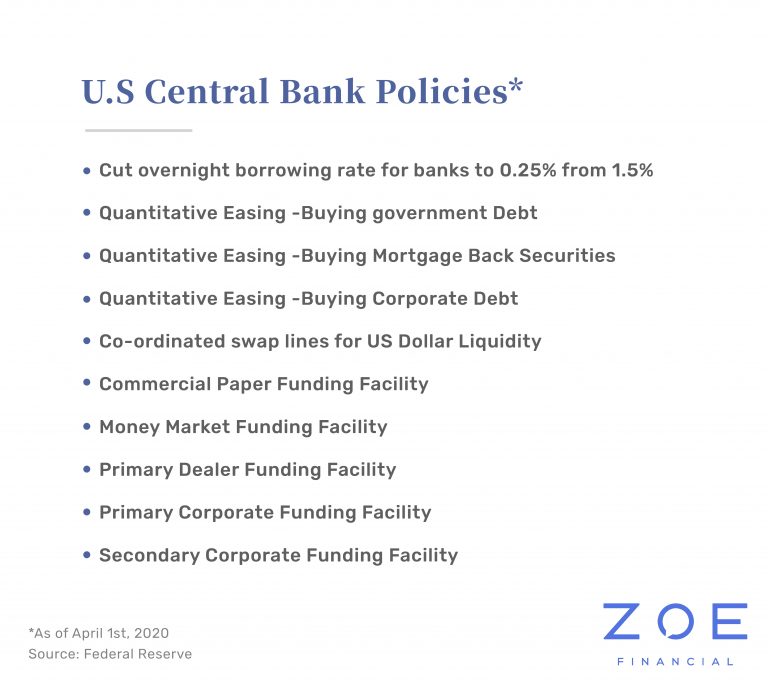

The Federal Reserve is taking unprecedented action to provide liquidity into the market.

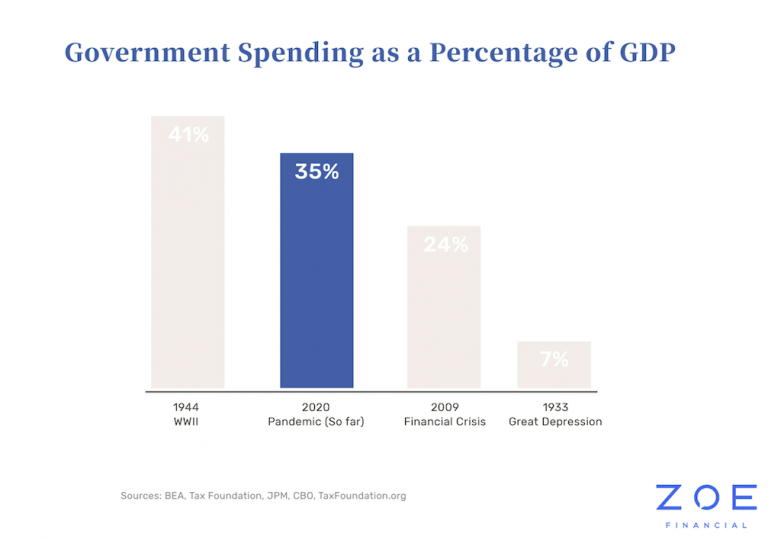

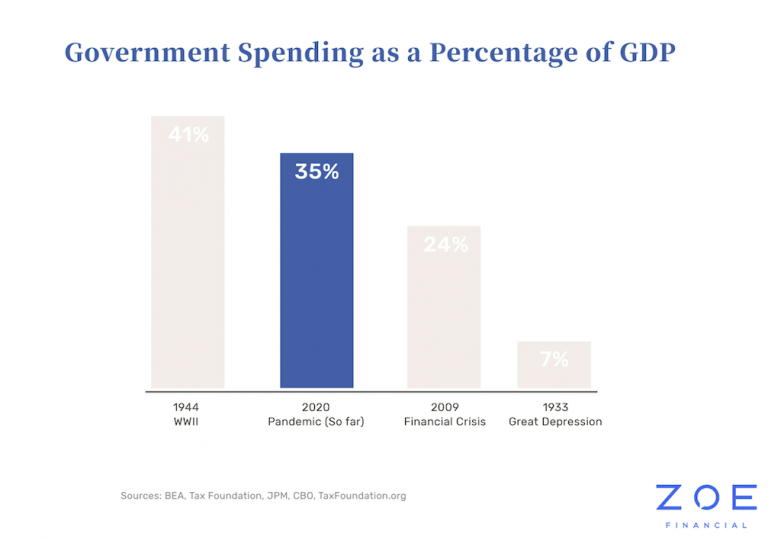

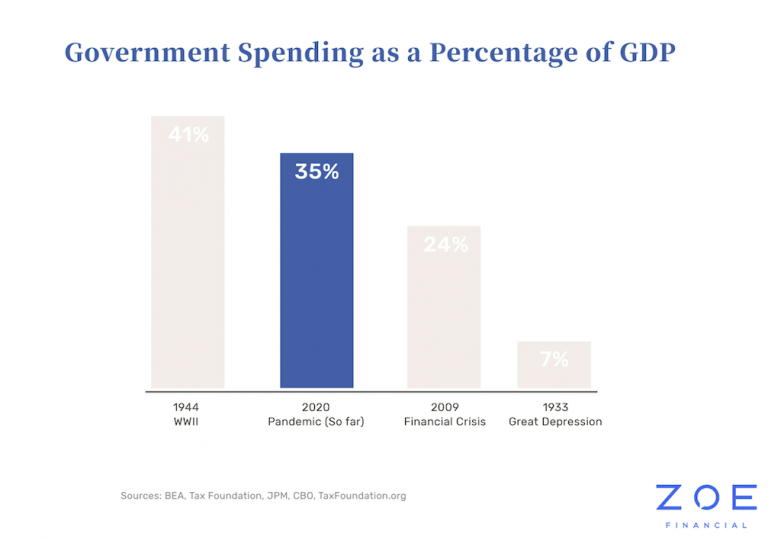

The $2.28 Trillion Fiscal emergency package is the largest government aid package since World War II.

Economic Composition Does Not Equal Market Composition

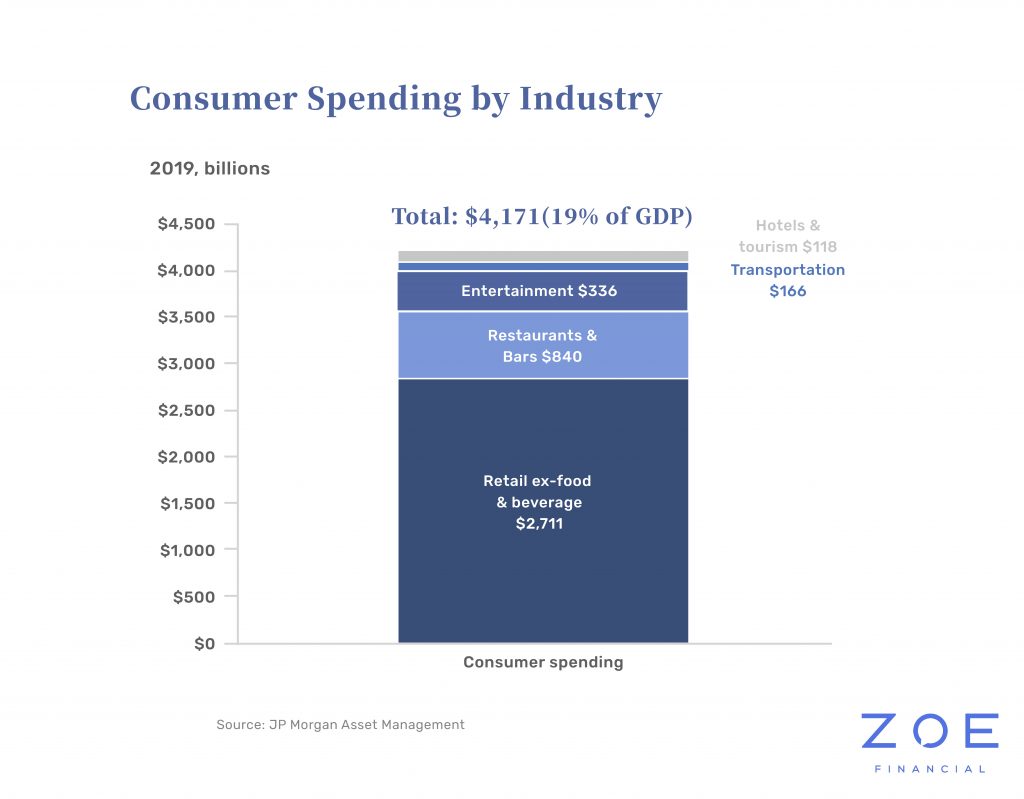

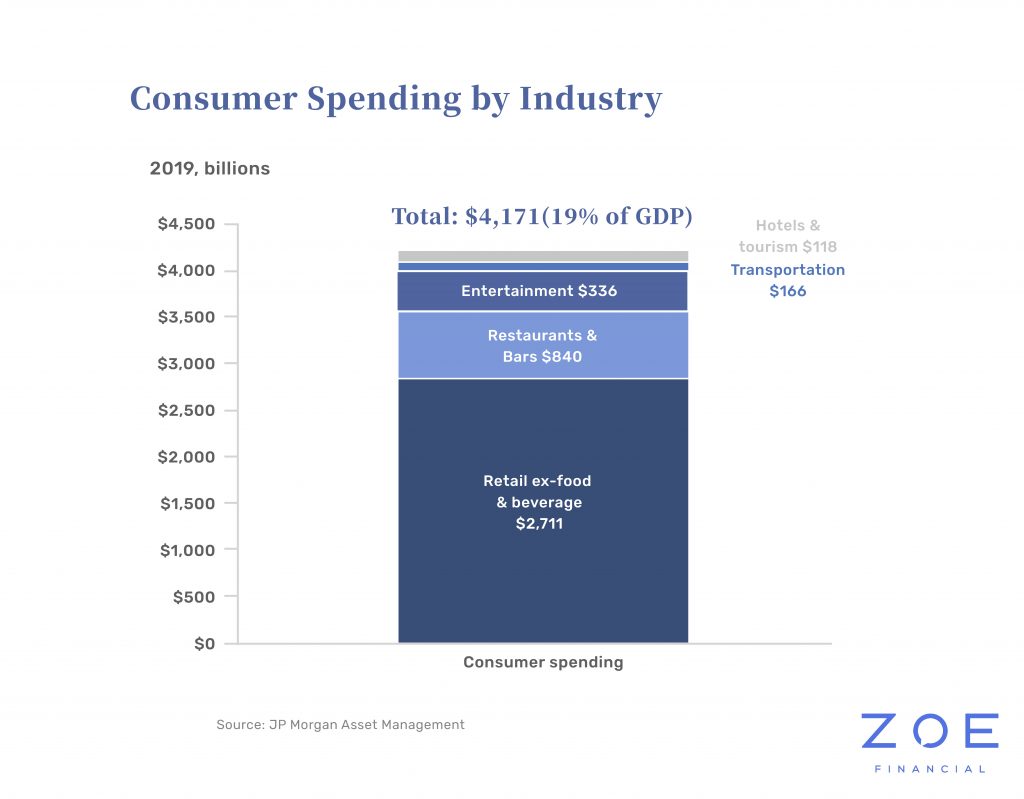

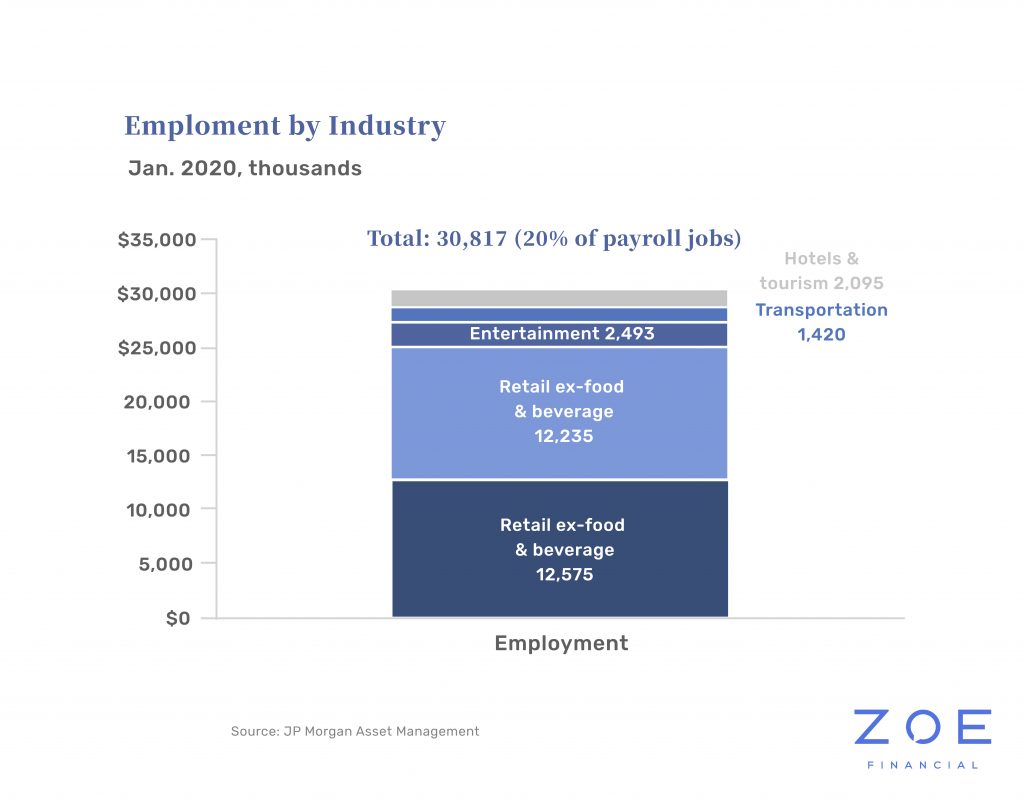

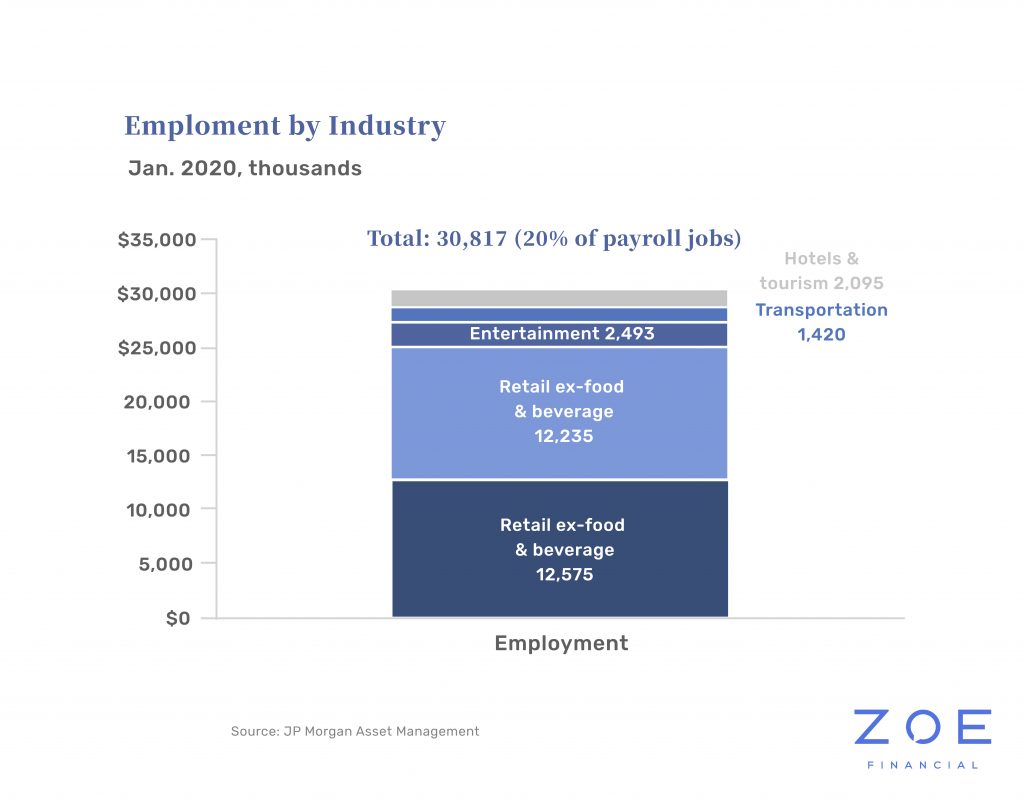

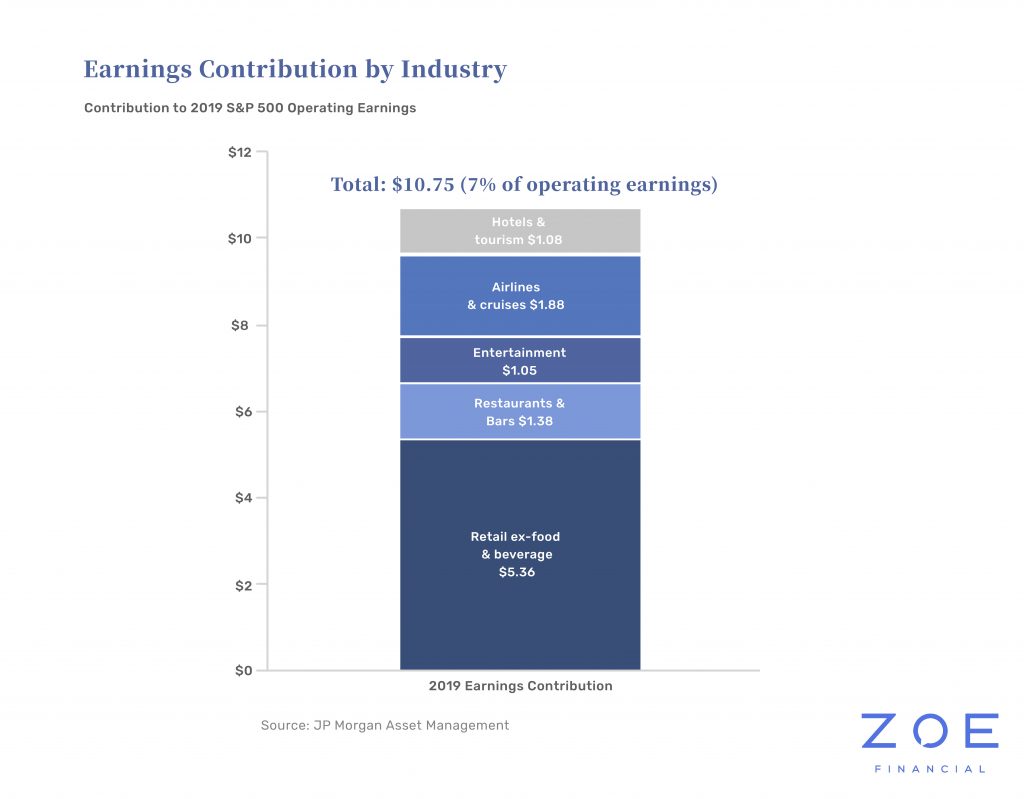

While the sectors most impacted by shelter-in-place initiatives are a huge part of the U.S. economy, they are less vital to the stock market. JP Morgan Asset Management research shows that the Retail, Restaurants/Bars, Entertainment and Hotel & Tourism account for 19% of GDP and 20% of Jobs.

Markets Attempt to Price Both the Shock AND the Recovery of Earnings

The single most important driver of stock returns is discounted future corporate earnings. As per the below analysis, the market seems to be priced somewhere between a “U shape” and a “V shape” recovery for earnings in the coming two years. If the market’s current assumption is wrong then stocks will likely sell-off. If it gets it right, it would explain why stocks are trading where they are currently.

TINA (There Is No Alternative)

With Central Banks buying government and corporate bonds in the open market at an unprecedented pace, treasury bond yields are at historically low levels. One can make the case there are few appealing alternatives to stocks that can generate returns above inflation.

Final Thoughts

It is impossible to predict how severe the shock will be to earnings nor how strong the recovery will be am not advocating that current market prices are “right” or “wrong.” As an institutional trader at Morgan Stanley and then an institutional investor at JP Morgan Asset Management prior to starting Zoe Financial, I learned that: trying to understand the short term moves of stocks is a losing proposition. It is the equivalent of predicting the exact location/speed/strength/direction a hurricane will hit when it is 200 miles out at sea. Actually… predicting the markets is even tougher than that, as a hurricane at least follows the laws of thermodynamics. In the short term, stocks are significantly affected by human behavior, which is inherently unpredictable.

We're Here to Help

Our vetted advisors & concierge team are available virtually to answer your financial inquiries.