Preparing for retirement can, for many, resemble an arduous game of chess played across multiple boards. Just like there is no truly wrong way to tackle preparing for retirement – as long as you’re saving- there is no “wrong” way to approach a challenging chess match.

Yet, after just three moves by a given player, there are more than 9 million possible next positions. After 4 moves – 288 billion positions can arise on a chess board! The complexity of making the “right” moves to ensure a winning retirement as a soon-to-be-retiree during a time when you might feel as though you’re playing in the dark can easily leave you doubting your game plan.

Retiring at Your“Target”Age

A successful retirement depends largely on how much you’ve saved during your working years leading up to the age you aspire to retire. As we mention in our Guide to Retirement Planning, saving for retirement is one of the biggest savings goals you will have in your lifetime. This is because it is a time in your life when you no longer have that working income you’ve grown accustomed to.

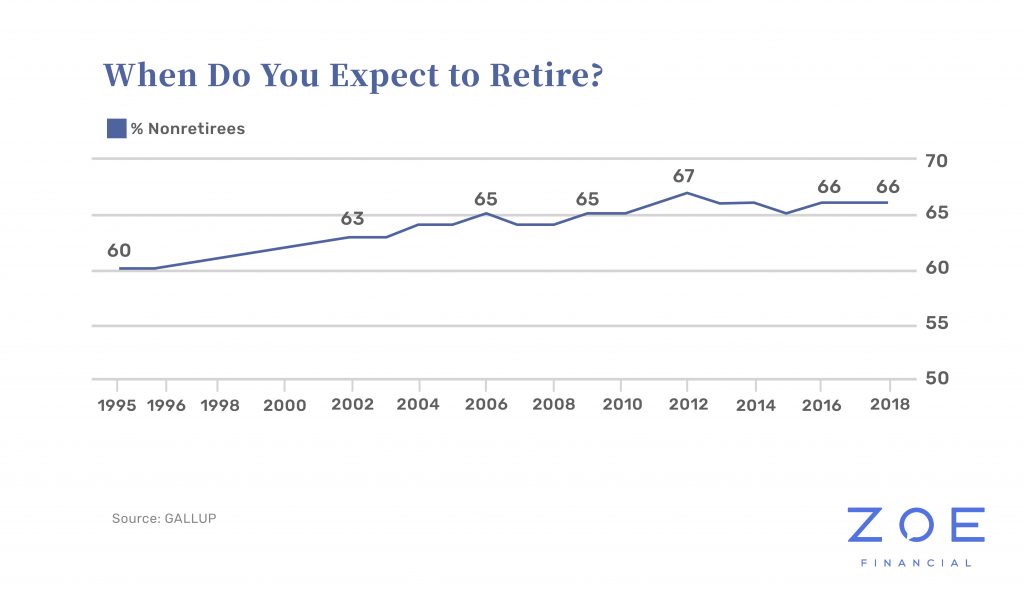

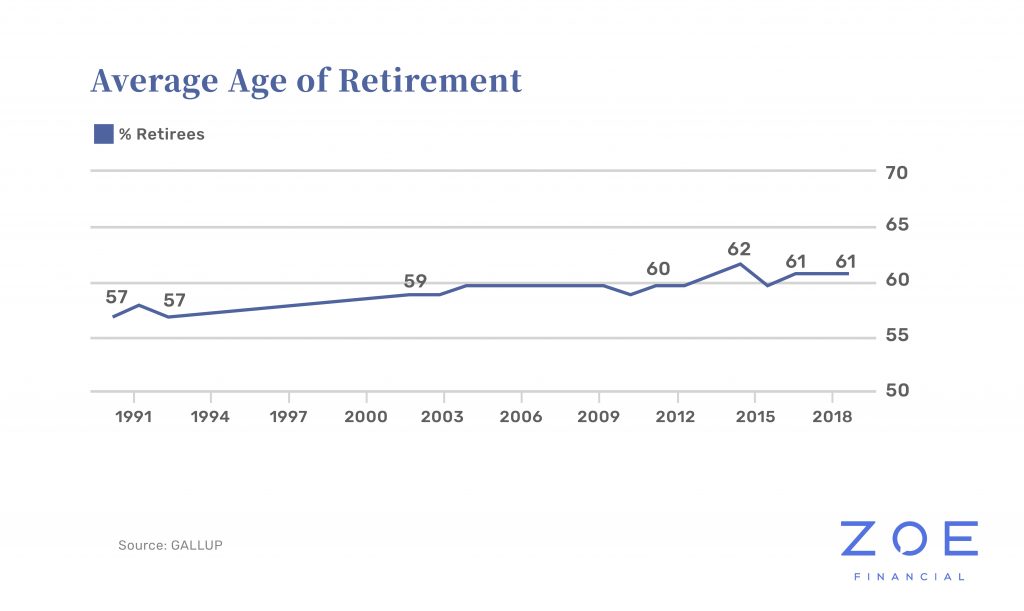

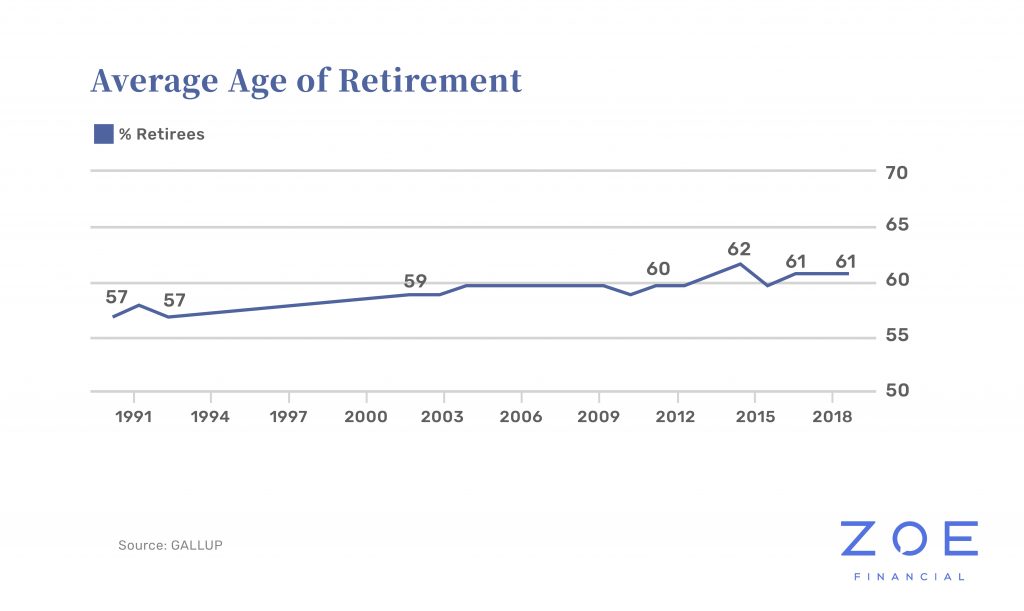

If you plan on retiring at age 65, that could mean 20 to 30 years of no working income. The average non-retired American expects to retire by the age of 66.

Schedule a Free Retirement Consult

View 3 Top Retirement Advisors Near You

However, according to Gallup Polls, Americans may end up leaving the workforce earlier than they anticipated, around the age of 61.

Tip 1: Evaluate Risk In Your Game Plan

Just as things can unexpectedly change around us, retirement may not always come at the exact age you planned nor within the economic context you expected. Thus, it’s critical to plan ahead. While that’s easier said than done when even the next day might feel uncertain, foreseeing potential risks to your retirement can help avoid headaches in the future. Evaluate your existing financial retirement plan and savings strategies, including the variety of potential outcomes for the investments within your portfolio.

Your retirement plan should include the detailed financial goals you expect to reach within your retirement, such that your plan is working towards an objective. Having a clear picture of how your funds may fluctuate can help you better evaluate whether the game plan you had in place is still feasible, or if it’s time to strategize over new moves. As the situation changes around us, note that there may be pieces you are unable to control and that’s alright!

Tip 2: It’s Normal To Feel Anxiety – Focus on Your Short & Long-Term Financial Goals

Soon-to-be retirees may feel increased anxiety due to market volatility because it creates “blind spots” despite years of diligent retirement planning. That said, a good retirement strategy gives a bit of leeway for the unexpected. It’s critical that you avoid allowing the anxiety around the unexpected to lead to impulsive behaviors. You might have considered “cutting your losses,” but you’re far better off staying the course regardless of how the market reacts. Even if you’re about to retire and feeling worried about doing so during a recession, being diligent with your established withdrawal plan can help you weather the storm.

Tip 3: Check Out Your Roadmap

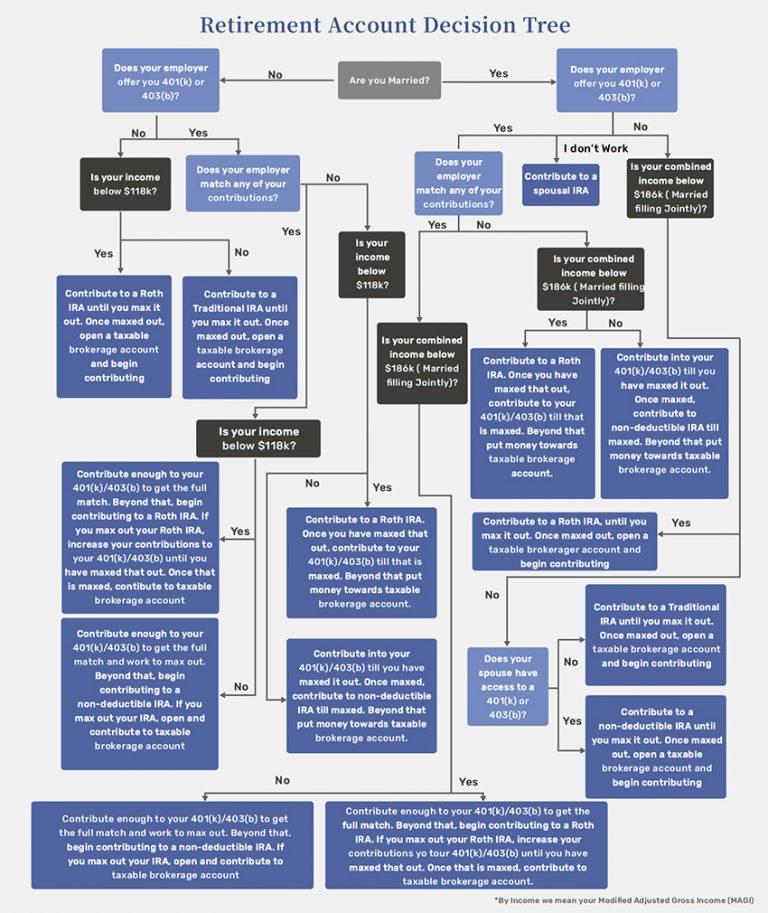

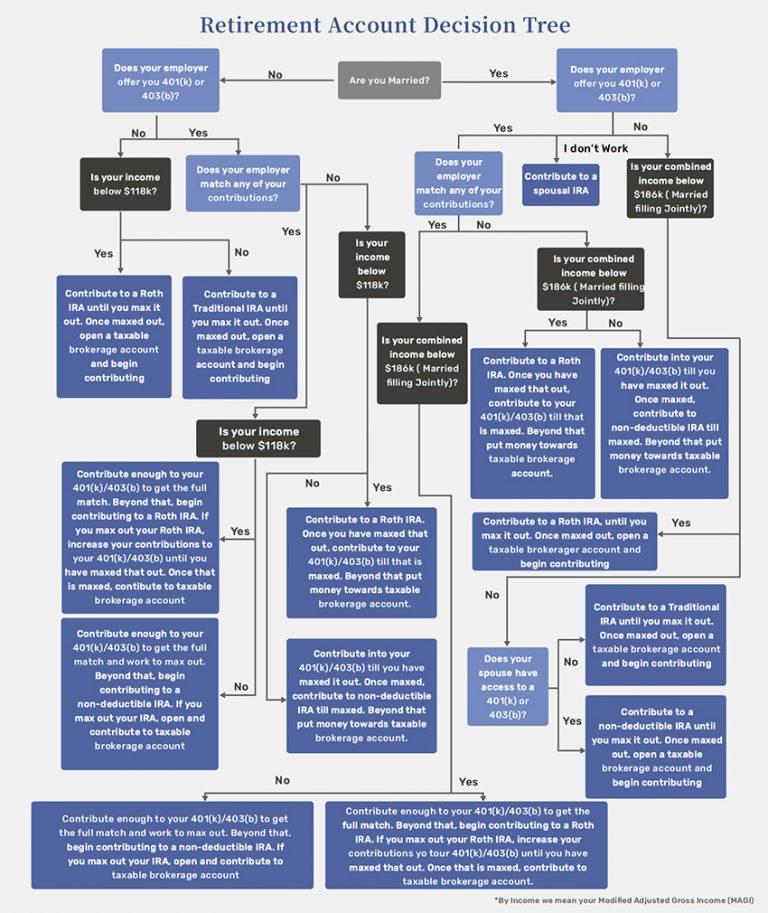

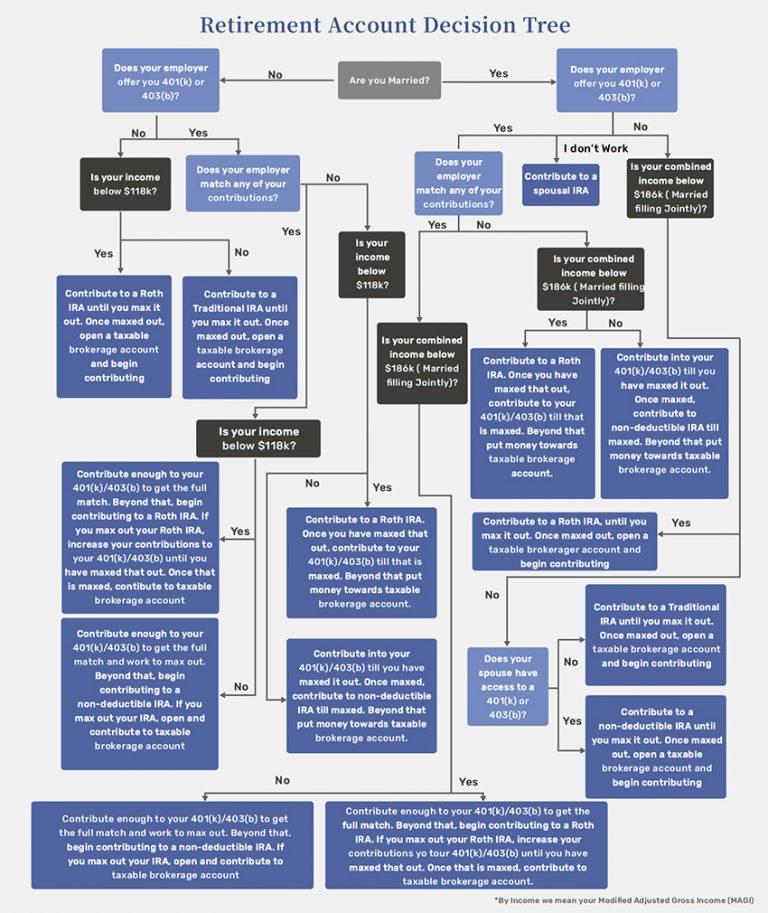

Consider reviewing our retirement account decision tree to evaluate if your existing plan follows or is similar to this roadmap. As we mentioned, retirement planning is not one size fits all and your pre-retirement steps are unique. If you’re still some time away from your “target age,” or if the current situation has shifted your target retirement age significantly, now is a good opportunity to review your next steps.

Tip 4: Focus on The Fundamentals of Investing

Even in a choppy or uncertain market, the fundamentals of investing are important. When you save for retirement based on a sound and comprehensive financial plan the risk of reactionary impulses based on fear is diminished and contributes to post-retirement well being. This helps you to stay invested in the market for the long term, through all of the years you expect to be in retirement, regardless of what’s on the news.

Tip 5: Review Your Game Plan with Your Financial Advisor

Transitioning to retirement, and potentially taking distributions as a retiree can be very confusing at this time. Working with a financial advisor who can guide you in those next steps, especially if your retirement plan includes saving or investing outside of IRAs and employer plans is key. An advisor can also help ensure that you’re invested in the appropriate investment strategies according to your short-and long-term goals and risk tolerance. Most importantly, an advisor can help you avoid knee-jerk reactions we discussed earlier, which are often based on fear.

Safeguarding your retirement during uncertainty as a soon-to-be retiree can be even more preoccupying if you were managing your own retirement planning without a financial planner or advisor. For this reason, we’d like to invite you to the Coronavirus & Retirement Virtual Panel on May 6th led by Zoe Founder & CEO Andres Garcia-Amaya. It will focus on providing actionable advice and answering your live questions regarding preparing to retire or retiring during the Coronavirus pandemic.