Overhauls to the tax code are few and far between. On Friday, Congress released the final version of their tax overhaul plan which will take effect on January 1st, 2018. Because of the date they chose, most people won’t see the effect until they do their taxes in 2019. The new tax bill looks to lower both corporate and individual tax rates whilst also making some changes to some important tax deductions. Compared to the current law, only 5% of taxpayers will pay more tax in 2018, and 9% in 2025.

To help you understand what the changes are and how they affect you, below is a breakdown of some of the more important changes and a calculator to show you how it will impact your personal income tax.

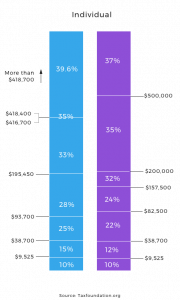

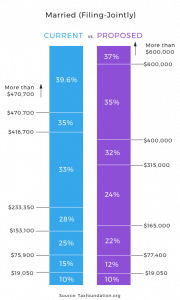

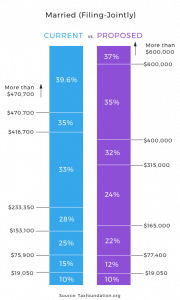

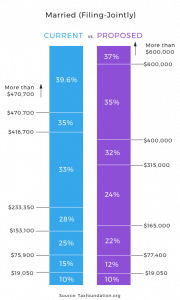

One of the biggest changes to take place is the overall lowering of personal income taxes. Although 7 different tax brackets remain, the rates of each bracket are decreased by a few percentages with the top rate falling from 39.6% to 37%.

Additional changes include the increase of the standard deduction from $6,500 to $12,000 for single filers, and from $13,000 to $24,000 for married joint filers*. The new plan looks to remove any personal exemptions ($4,150 for each qualifying exemption)*.

Other individual tax changes include:

- Capping of state and local tax deductions to $10,000*

- Increase in the child tax credit to $2,000 per child ($1,400 being refundable)*

- An increase in Alternative Minimum Tax (AMT) phase out* which would cut the number of AMT taxpayers in ’18 from 5.2 million to 2.3 million people

- Ability to use 529 Plans for grades K-12

- Doubling of the estate tax exemption*

Businesses will also see a change in their tax rates with the corporate rate changing from multiple brackets (highest bracket of 35%) down to a single 21% rate. Pass through income will still be taxed at income rates, but will get a 20% deduction on all qualified income.

To help you understand how the changes in the tax overhaul will impact you, we’ve put together an excel calculator to reflect the old tax laws and the new tax laws. Enter your information to review how the changes will impact your situation.

*These changes will sunset (expire) after 2025.

If you enjoyed this post, check out Game, Set, Tax!